This unit being a theory concept introduction will also give out some practise sessions, but these practise sessions are just for understanding and don't consider them as configuration tutorial on our 'GEM' company.

Payroll Accounting:

Similar to the Material Management we discussed above, Payroll accounting is also done using Cost centres. Payroll Accounting starts by calculating wages and salaries of various employees in HCM module(Human Capital Management) and then relevant document is generated. Salaries are expenses and so in FI module, document is generated as an expense(costs) to a cost centre to which Employees are assigned. In HCM module, Employee Master data is assigned to concept called as infotypes. Infotype determines the 'company code', 'personnel area' and 'personnel Subarea' of the assigned employee.

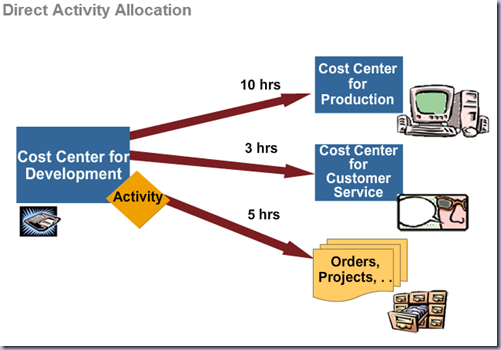

Direct Activity Allocation:

Direct Activity allocation is a part of cost-centre accounting . It gives ability to allow a particular cost centre to charge a cost autonomously. This cost is charged as cost object by Cost centre for any services or activities undergoing under it. Charges/ costs are calculated at planned activity rate. So, Direct Activity Allocation takes care of measurement of costs, posting and allocations of an organizational activity.

Ex: let us consider an engineering department

In any Scenario cost centres will be in a hierarchy to know/control the flow of costs. Engineering Cost center on the left side in picture above charges engineering hours to other receiving cost objects like production cost center, customer service cost center etc.. This is the cost allocation decided by the management to know the hourly costs of production, customer service etcc. This Direct Memory Allocation will not affect GL as it’s a study on costs and not real postings.

So, When doing a configuration for Direct Memory Allocation there are some factors that must be considered like Activity Type. To allocate an Activity to a cost center, Activity type must be defined first. Then only Activity can be allocated to cost center.

To utilise Direct Activity Allocation, Cost center in which Actiivity is assigned (or) Sender Cost center, Activity Receiving Cost object like Production (or) customer service etc, Activity type and quantity are to be configured.

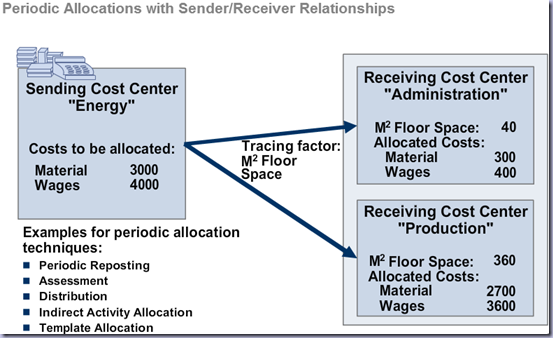

Periodic Allocations with Sender/Receiver Relationships:

As we know from above that Management decides the allocation of costs, but what are the cycles in which there will be re-allocations. This cycle of allocations is an important factor for smooth functioning of various activities in the company or else their might be delay or under-utilisation of machinery /human-resources. The Allocation cycle is made up of many segments like cost sender, cost elements to be allocated, the receivers, and also weighing factors. The weighing factors are 'tracing factors' and 'tracing factor rules'. At month end, all the segments are executed as a back-job in SAP system to re-access and relocate the costs to cost centers.

Segments in a cycle are processed based on system determination and so, might not be necessarily processed in numerical order. This system selection in ad-hoc manner will create problems for Allocations with dependencies, these must be allocated in separate cycles to overcome dependency problems.

I know this might not be understandable easily. So, lets consider the following example. Each Department in company will have expenses and there will be administrative expenses. If there is a cafeteria in our company then how to allocate costs, can this expense be used as administrative expense?? Obviously No, Accounting concepts consider Cafeteria expense as additional dependency. Here we need to create 2 cycles

- First, allocate corporate administration expenses

- Next, cafeteria expense

Simply, 2 cycles are needed. If there is another expense like GYM this can be allocated to second cycle along with Cafeteria. But, a new IT department is added into the company then in which cycle this expense must be added to? First cycle as it is an important corporate expense and must be treated equally with other departments.

If we look at sender and receiver relationship in an allocation cycle,

Here, A sending cost center allocate costs to receiving cost centers using tracing factors. This company in the picture given considered different tracing factors for different receiving cost centers. This cycle of allocating costs will be repeated monthly using the tracing factor called M2 (floor space). In above picture, Using tracing factor it calculates wages costs too. This periodic allocation techniques can be using to

- Periodic Reposting

- Assessment

- Distribution of costs

- Indirect Activity Allocation

- Template Allocation (Template, as commonly used cycle of allocation)

Let us practise the Direct Activity Allocation:

Got t-code: KB21N or by path: SAP easy access menu -> Accounting -> controlling -> Cost center accounting -> Actual Postings -> Activity Allocation -> Enter

Here, know the fields as shown below!

-

Send. CCtr - Sending Cost Center

-

SAtyT - Sending Activity type

-

Rec. CCtr - Receiving Cost center

-

Total quantity - Quantity of costs to be allocated

Save the document as posting from sending cost center to receiving cost center.

We, can use version to upgrade the cost allocation manually later as a new version.

Periodic Allocation: Assessment (Example)

Assessment must be done to continue the cycle of costs allocation periodically. Assessing periodically is needed because, there might be a change in number of employee/ machinery or products/ service etc.. Anything new added in later cycle of activity must be assessed to allocate new costs appropriately.

First aim of assessment is to allocate primary and secondary costs from a sender cost center to a receiving controlling objects (ex: Cost objects). This has to cover the main costs/secondary costs which receiving cost objects will be facing periodically. Only Cost centers or Business processes can be senders while receivers can be cost centers, WBS elements, Internal orders, Cost-objects or Business Processes. And if needed the types of receivers can be restricted in configuration. As per rules defined in the Assessment cycle, primary and secondary costs will be allocated.

In the above picture an example in shown on the cafeteria assessment cycle. Here, Assessment cycle takes a key (no of Employees) as statistical key to evaluate the costs of the receiver. As shown in the figure, there are different cost centers as per the bills the receiver is paying like Labor Costs, Electricity, Maintainence etc..

Real-Time Integration of Management Accounting and Financial Accounting:

Advantages of FI-CO Integration:

Let us consider that there are Functional areas too defined for our company in SAP Configuration along with cost centers.

When a document is posted for wages/salaries in FI as shwon in above pic, the relevant functional area and cost-center(1000) are assigned in the posting. Remember, Functional areas are configured as an organizational area which has its own cost-center(4100) and profit center. As cost-centers are part of CO module, the gap between FI and CO is connected. But, there will be a problems as Cost-center(4100) in Functional area don't yet know this transaction, we need to make another reposting from cost-center 1000 to cost-center 4100 to ensure that Functional area knows the transaction. Here, Users can access the FI document from the CO document and vice-versa. So, both the CO and FI document of a same transaction can be longed and traced out for analysis later.

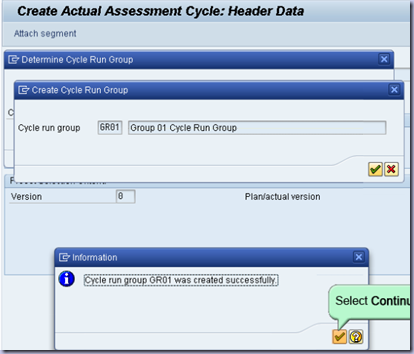

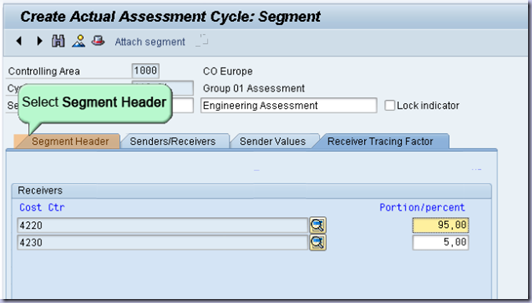

Practice: Create an Assessment Cycle:

Goto SAP EASY ACCESS MENU -> Accounting -> Controlling -> Cost center accounting -> Period End Closing -> Single Functions -> Allocations -> Assessment

Here, first a cycle must be created. So, click Extras->Cycles->create in top row-options to create a cycle

After entering the Cycle and Start Date, the info about the cycle will appear on the screen as Header Data. Here click Goto -> CYCLE RUN GROUP

Here, select CREATE, to create a new cycle group and once cycle is created , click CONTINUE as shown below.

Now clickon Attach Segment

Once you attach the group Cycle, then the actual screen opens to give a clear info about the sender/receivers, % of amounts to be posted to receivers if there are more than one, statistical key etc.. As shown below

In Above screen, it clearly shows the portion of percentage receivers are supposed to receive from senders. See the Tabs in the above screen which clearly asks sender/receivers, sender values etcc. After, filling the whole needed info you can press SAVE to create the cycle.

THIS IS THE END OF COST CENTER ACCOUNTING CONCEPTS IN THIS UNIT, WE WILL DISCUSS MORE ABOUT THEM IN CONFIGURATION UNITS

INTERNAL ORDERS:

Internal Orders are the best flexible Controlling tool which can be used for

- Track costs

- Revenues

Internal Orders provide a basic capabilities of planning, monitoring and allocation of costs in the company.

(Prof. Segment -> Profitability Segment)

There are 4 types of Internal orders generally, which can be used depending on the type of transaction. In the above pic, you can see what units are needed for each type of order,

- Overhead Cost Orders.

- Investment Orders.

- Accrual Orders

- Revenue Orders

- Internal Orders for Costs can function for any receiver

To go into more deep into any CO components, we need to know and learn what is SETTLEMENT in SAP?

SETTLEMENT is something like accepting/negotiating to reduce the present-cost which is more than pre-planned cost and which is above the pre-defined limit. Limit can be a percentage of the cost or a specific amount or some other factor. Let us say our company has an ASSET UNDER CONSTRUCTION or AUC (I kept AUC in bold because, it an important topic in Asset Accounting which is a part of CO) and so this AUC is a cost for the company until AUC becomes a complete Asset giving out some profits for its usage. But now being under construction, there will be costs like labour costs, material costs for construction, service costs by engineers etc.. Our Company's Senior Management decided to dispense a particular amount of cash periodically/each month to AUC account. Obviously, an APP (Automatic Payment program for this AUC in SAP was created and amount is determined by an Internal Order( or Assessment Cycle) with a settlement Rule. Settlement Rule for this AUC is needed because If the construction company asks more money than a pre-defined limit, how come the Senior management know that they asked more??? Here, During SAP configuration for Settlement rule we can specify that for each period costs should not cross a particular amount and If the construction company asked more than this particular amount then, dispense the asked amount if it is in a particular % of range, or else wait for approval. (This is just a scenario in which senior management can finish the AUC in planned costs and if costs raise, they will know why and what for?). When the construction company asks more amount than the percentage range limit, then Senior management must settle by negotiating with the construction company on What and why the cost is raised for etc.. So, SETTLEMENT is like a negotiating factor when costs are above the planned ones.

The SETLEMENT description and example I gave above is for when a similar situation arises. But In SAP most cost objects - other than cost centers - must be "settled" at period end so that there will be no problems with transactions later. By means of the settlement the costs incurred for the cost object (project, internal order, ...) are debited to other cost objects and/or G/L accounts. The settlement rule, a table maintained in the cost object master data, describes to SAP how the costs will be settled: receivers, percentages, full/partial, etc.. Cost are settled when the user starts the settlement procedure at period end. Settlement is used in most of important areas of SAP where there is a need to tolerate cash differences like,

- Settlement in Customer Service (CS)

- Settlement in Production Orders (PP-SFC)

- Settlement in Asset Under Construction (AUC)

- Settlement in Internal Orders (FICO)

And there are lot more SETTLEMENT types in other modules like SD, PP, PS, etc depending on the need.

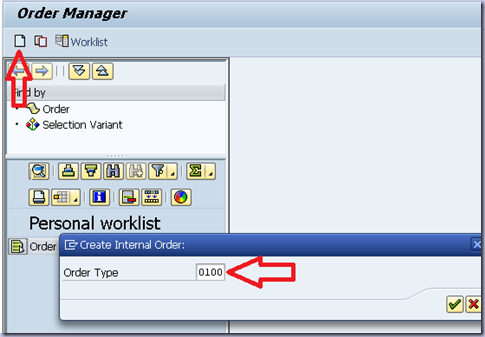

Now, let us see how to create an Internal Order

Goto SAP Easy Access -> Accounting -> Controlling -> Internal Orders -> Master Data -> Order Manager

Here, click CREATE to create a new order and give the relevant name for order-type

In the next screen, Details of the Order can be entered. In ASSIGNMENT tab details like the Profit Center, Cost Center, Business Area and other relevant field concerned with this order must be entered and then we need to release this order so that our company can use it. To release this order goto CONTROL DATA tab and click RELEASE button, which after the Order is released the text on the button will change to TECH COMPLETE as shown below. In Status Bar, update will be given whether Order is saved or not as Given in below pic.

Here, in the same screen there is a SETTLEMENT RULE button under the screen tile as shown below,

Here, Settlement Rules can be specified for this order once the SETTLEMENT RULE Button is clicked where we will land in the below screen which asks for receiver, types of settlement, and other important information for a settlement.

PLANNING / CALCULATING INTERNAL ORDERS:

Costs are planned for orders that normally have long life-cycle. These costs are planned because they are important costs the company must meet in order to function smoothly.

Internal Orders are complex in nature, but complexity changes depending on the situation and the company. Though Internal Orders are all same, the amount of information given to create an Internal Order changes along with the complexity of the information and simplicity to control the individual organisational units . In the above picture, From Left the complexity increases to create the internal order but the simplicity in controlling deep organisational units/methods can be attained.

- Overall Planning: It is the simplex form of creating an Internal Order irrespective of cost elements.

- Primary/Secondary Costs and Revenue Planning: These type of Internal Orders can be created if the user has a detailed info on the Internal Order. For Manual creation of primary/ secondary costs and revenue planning requires information on the primary costs, activity planning and Revenues being generated. In the same way, Automatic Internal Orders can be created as shown in the picture above.

- UNIT Costing: Unit Costing gives out more detailed control on the cost elements than the previous types of internal orders.

POSTING TO AN INTERNAL ORDER:

Internal Orders being a type of cost-object can receive postings from other applications like FI, MM and Management Accounting. Internal Order allows better view of costs which is not possible in a common cost-center.

We know that Internal Orders can be REAL or STATISTICAL. SO, how to make/find a difference between the real and statistical internal order?

The difference is in Statistical Internal Order, the Cost-object that the internal order is attached to will receive the real posting when the internal order is just used for statistical purpose.

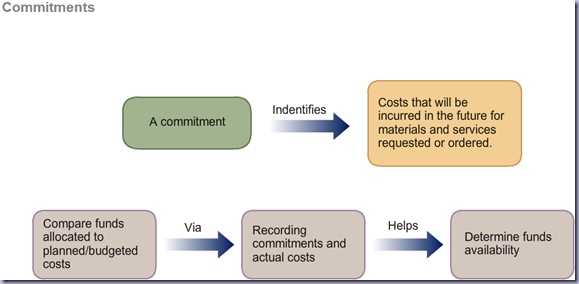

COMMITMENTS:

There is a concept called as COMMITMENT MANAGEMENT in CO module which must be activated. A commitment identifies the costs which the company must and should meet in the near future as part of its business. Commitment covers mostly the costs incurred for the goods and services requested / ordered. It can be considered as overdue for a purchase order and this costs must be paid asap. Normally, the management will cover all the costs and will list out all the commitments in the company for a particular time-period.

When the commitments are being met, realistic comparison is done between the allocated planned/budgeted costs to actual costs. Funds availability and Funds management is available to senior managers with this COMMITMENTS in CO module.

For Example, In MM components a commitment can be used to purchase materials needed in future by creating purchasing function. When an overhead-order for purchase requisition or when a purchase order line item is created, a commitment is recorded automatically. This commitment is the desire of the company to get the product and this commitment can only be reduced to zero when a 'Goods Receipt' is posted against the purchase order created before. Here, The 'Goods Receipt' and 'Purchase Orders' are all part of MM module. You can see the picture below for clear methods of Commitment Activity.

This 'Goods Receipt' will reduce the commitment to zero. And then along with posting 'Goods Receipt' an Internal Order can be generated with actual costs of the transaction in FICO modules. Internal Order will show the transaction to Finance team in the company. This process of reducing commitment will be used until the COMMITMENT is reduced to zero.

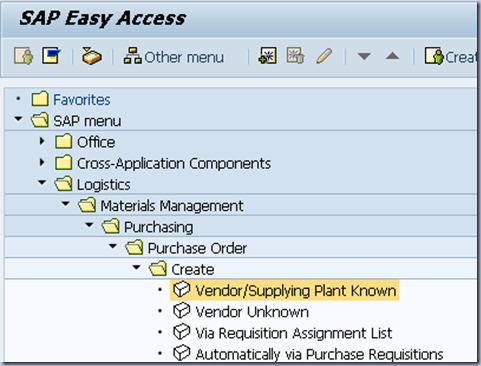

CREATING PURCHASE ORDER COMMITMENT:

Goto SAP Easy Access Screen -> Logistics -> Material Management -> Purchasing -> Purchase Order -> Create -> Vendor/Supplying Plant Known

as shown below

We will create a Purchase Order, See the COMMITMENT amount after the purchase order is created. Then we will create a 'Goods Receipt' and then we will see the COMMITMENT amount. Here, after Goods receipt, the commitment amount must be zero and the same amount should goto ACTUAL POSTING.

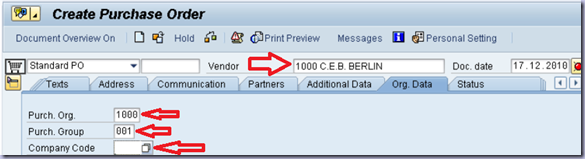

In CREATE PURCHASE ORDER Screen, give the vendor details as shown in the below pic. Along with that, Click on HEADER and click on ORG.DATA tab to give information regarding the Purchase Organisation( Purchase Organisation is created in MM module by SAP consultant in MM), In Org.Data tab, give the details of Purchase Organisation Group and Company code as shown below.

Then Click on ITEM OVERVIEW, to give details about the item/product to be purchased.

In ITEM OVERVIEW, give details like Material, Quantity, Delivery date, Net Price, Plant , etc. as shown above. After you Enter the details in ITEM OVERVIEW, press ENTER to get into PURCHASE ORDER Screen.

Here, Enter the Order number of choice in Account Assignment Tab

Now, click ENTER to see the Purchase Order screen. Click Save to get the purchase order number as shown below

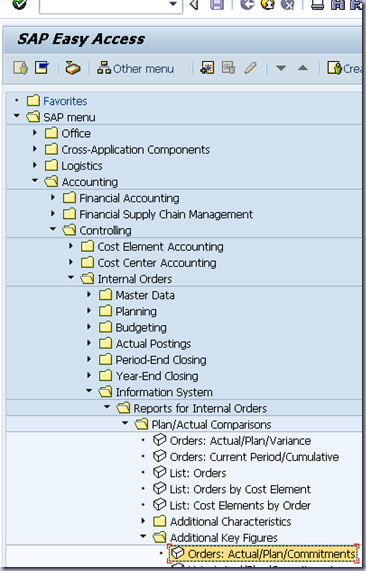

Now, to see the commitment in Internal Orders, goto

SAP EASY Access ->Accounting -> Controlling -> Internal Orders -> Informations Systems -> Reports for Internal Orders -> Plan/Actual Comparisons -> Additional Key Figures -> Orders: Actual/Plan/Commitments

In the Next Screen, enter the details being asked. Don’t forget to enter the Order number which was entered in ACCOUNT ASSIGNMENT TAB in PURCHASE ORDER. Then click execute.

Once EXECUTE button above is clicked a new screen will appear giving out the details of COMITMENTS as shown below.

Now, let us create a GOODS RECEIPT to shift the COMMITMENT amount in above screen to ACTUAL AMOUNT.

Goto SAP EASY Access menu -> Logistics -> Material Management -> Inventory Management -> Goods Receipt -> For Purchase Order -> PO Number Known

As shown below,

In the GOODS RECEIPT PURCHASE ORDER Screen, select the relevant fields and also give the Purchase Order Number and click EXECUTE.

In the GOODS RECEIVED PURCHASE ORDER Screen, select ITEM OK in MATERIAL tab and this is compulsory..Then click SAVE

And when you save the GOODS RECEIPT, a material Document will be generated as shown below.

Now, we must check he COMMITMENTS as the transaction must be a real and Actual posting.

So goto

SAP EASY Access ->Accounting -> Controlling -> Internal Orders -> Information Systems -> Reports for Internal Orders -> Plan/Actual Comparisons -> Additional Key Figures -> Orders: Actual/Plan/Commitments

Here, enter the details asked and click EXECUTE which will give us the COMMITMENTS page and here, there will be no amount under COMMITMENTS(but, screen differs from the pic I gave you below and I just gave it to show you a similar screen but amount will change)

Amount unlike what we saw above and the amount will be under ACTUAL Column which means the transaction is completed as per planned.

ORDER SETTLEMENTS:

As we had read all about SETTLEMENTS above, we just need to know about the connection between SETTLEMENTS and INTERNAL ORDERS. Internal Orders can be used to inherent collector of costs and aid in planning, monitoring and reporting purposes. As looked above materials example, costs will be transferred to their Final Destination such as PLANT, COST CENTER, FIXED ASSETS, Profitability Segment and so on. This process of is making costs reach their final destination is called SETTLEMENT. Settlement is also another form of Periodic allocation of costs. So, Settlements occur almost at end of the period or at the end of Order life depending on the business purpose of the order. A receiver(different types of organisational units) can get settlement unless it has been configured to receive a settlement validly by the consultant. A settlement can have multiple receivers depending on the business purpose and process of the order. There will be many options given for a SETTLEMENT.

PERFORM ORDER SETTLEMENT:

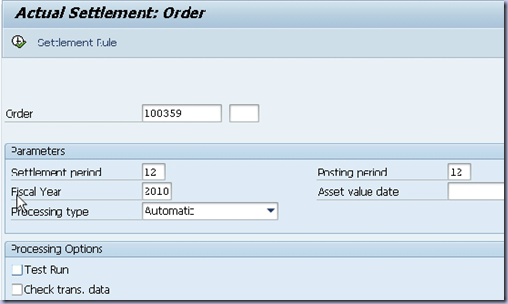

Goto SAP EASY Access menu -> Accounting -> Controlling -> Internal Orders -> Period-End Closing-> Single Functions ->Settlement -> Individual Processing

In the next screen as shown below, enter the details of the order number, Fiscal year, posting period and de-select the TEST RUN as shown in the pic. Then Click EXECUTE

After, clicking EXECUTE in the above screen, a new screen opens giving out all the details of the order number given (100359) as below

Here, see the Status bar that says ' Processing Completed with no errors'. Here, click DETAILS to see the

If you click on RECEIVERS, you will be able to see more clear view of transaction from the point of the receiver.

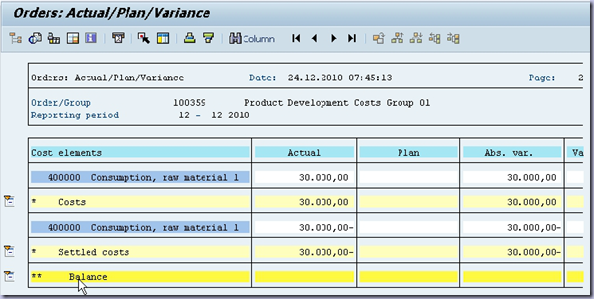

Now goto SAP EASY ACCESS screen -> Accounting -> controlling -> Internal Orders -> Information System -> Reports for Internal Orders -> Plan/Actual Comparisons -> Oders: Actaul/Plan/Variance

Here, enter the order details along with the controlling area details asked and then click EXECUTE to know the variance of costs in the order as shown below.

Note that in the above screen , the balance is ZERO as costs and settled costs negate each other to zero.

This is it for Internal Order in this UNIT

PRODUCT COST ACCOUNTING (CO-PC):

Product Cost Accounting deals with all the aspects of the products from planning, costing and services which must be given as part of product. In the same way it tracks and analyses the actual costs of the products. PRODUCT COST ACCOUNTING consists of 3 components,

- PRODUCT COST PLANNING: Here the costs are estimated to product goods / services.

- COST OBJECT CONTROLLING: Here, costs in production are tracked as orders will have cost-objects(like production Orders) assigned to them. Using these cost-objects, COST OBJECT CONTROLLING tracks the costs. Production might be for Product/ service.

- ACTUAL COSTING/ MATERIAL LEDGER: Here, this Material Ledger deals with actual costs of the product.

Let us go into each component in detail;

Product Cost Planning helps in estimating the costs when they are produced/ manufactured. System can make the Cost estimates (Standard costs) using Quantity Structure data available in Manufacturing Master Data. Here, SAP system looks for BOM (Bill of Materials) and ROUTING in the Manufacturing Master data. If the data is not available in the Manufacturing Master Data, then User can enter the data manually using UNIT COSTING tool, or user can transfer the relevant data automatically from non-SAP system to the present SAP-System using batch input. After all the estimates, the Cost Objects will be used to store all the costs incurred during production. Most of the Cost-objects will be Production Orders. Here, Production Orders keep track of Material Prices, Activity Prices, Process Prices, Overhead costs etc.. As these are main costs needed for the management and Production teams for analysing and to create value to the product.

Cost Object Controlling comes into focus when production teams use simultaneous costing and period-end closing to make a decision on final costs incurred. After production of an item the real costs can be decided using raw-materials consumed / utilised for production and simultaneous costs(same costs copied and used just for analyzing). Once, the raw-material costs are decided, then a clear amount can be decided on any phase of production for planned vs actual costs. Sometimes, in production there might be minor problems(like machinery problems) which could hinder the production flow and here, production teams must be aware of the costs and should try to reduce the maximum damage and loss for the company. So, they should have planned costs vs actual costs information readily available to reduce the over-buy of raw-material here but should keep on testing the production flow until the production problem is solved. Period-End Closing is an important topic in FICO as there are many steps to be done for each period-end in SAP system. In Cost-object Controlling, Period-end closing deals to find out the actual amount of goods/ products the company produced in a particular period and tries to find out the Actual Cost of the goods produced. Here, in Period-end closing the goods in production are also considered as finished goods. If the production process of the product is too complex to consider goods-in-production as finished goods then it can be changed in the configuration. Scrap is an important concept to study in Production planning as it has various amount of perceptions. Sometimes scrap can be sold to other companies while in other situations it is completely a lay-off thing which doesn't gives any value. Along with these, environmental ethics must be looked into when considering scrap in production process. When there is a variance(difference) in planned costs vs Actual costs, Cost-Object Controlling must be able to settle them in the other components such as Profitability Analysis & Financial Accounting in the company so that variance must be nullified and in some cases planned costs should be re-written by the actual costs which caused the variance(Of course, if depends on the production planning too).

Cost Object Controlling supplies basic information for the following business functions:

- Price setting and general price policy

- Inventory valuation

- Cost of goods manufactured

- Profitability analysis

- Profit Center Accounting

Implementation Considerations

Here are some of the ways you can utilize the Cost Object Controlling component:

- To determine whether the actual cost of an order matched or exceeded the planned cost

- To determine the production variances between actual costs and target costs, and why these occurred

- To decide whether to accept a particular sales order (whether the sales order will be profitable or not)

- To determine where your company has particularly low costs and therefore which cost objects it should concentrate on

- To decide whether it would be more profitable to manufacture a cost object in-house or to outsource it

- To determine whether and how the cost of goods manufactured can be optimized

Cost Object Controlling also can provide special information on:

- The cost of unplanned scrap

- Cost savings resulting from new production methods

- Cost behavior during capacity bottlenecks

The cost of goods manufactured for finished products and the work in process calculated for orders can be used to capitalize the inventories in your balance sheet.

From <http://help.sap.com/saphelp_46c/helpdata/en/90/ba60bc446711d189420000e829fbbd/content.htm>

For more info on cost-object controlling I would recommend to read whole SAP live demo here,

http://help.sap.com/saphelp_470/helpdata/en/22/ed1577765611d3a6ef00104b55d538/content.htm

ACTUAL COSTING / MATERIAL LEDGER will have the Actual-costs of each material at the end of the period. Each material will have a Standard Price(S) defined in Material Ledger. For any particular period all the transactions for materials to the company will be recorded and the difference in actual-price and Standard price(s) defined in Material Ledger will be calculated for each material as a variance for each transaction. At the period-end these variances will be calculated and sufficient changes will be brought to Profitability Analysis and Financial Accounting. At period-end these variances can give out the actual-price of the material.

In real Scenario, no one can exactly estimate the Standard price(S) of any material, and in this macro-economic world with basic concept of economies-of-scale, quantity is an important factor too on the material pricing. To avoid this confusion, first the standard-price(S) of any material itself will have a range in itself (Example: $10 - $12) depending on the quantity size and many other factors like seasons, market-changes etc... If you see the below pic, in the particular section called ITEMIZATION, there are number of factors written. Let us discuss itemization.

Let us suppose, we have all the materials and processes to make a new product for our company. To ITEMIZE a new product we needs certain

- materials as given in the pic above, we will list all the materials needed and their cost depending on the quantity

- We need to do some activities like, we must change some materials before they can go into our production systems, so the cost of changing materials and other activities involved like testing of pre-final product etc..

- There will be some processes involved with production like management involvement, Quality Control, risk-management, packaging, marketing, etc.. These costs will be listed

- Overhead costs include the cost when there is a fault in the production machine, when materials are bought from costly vendor due to wrong quantity estimation, etc..

All these costs, will give out the itemized product along with the total valuated Price for a unit quantity of product produced.

Now we can estimate the cost of the product using ITEMIZATION / COST ELEMENTS ITEMIZATION / COST COMPONENTS SPLIT(as shown in above pic).

- Cost elements itemization is nothing but all the costs like materials, process, activities etc. which we discussed above are assigned to cost-objects and together they can give the costs incurred during itemization.

- Cost Components split is a singular table which has the costs of Materials, Labour, Overhead Costs, Process, activities etcc. in each field. Each field gets updated as each department of the company give out their costs to itemize the product.

All these itemization will affect the costs the company pays in turn affecting the pricing, valuation, profitability analysis and cost-object controlling. Itemization affects cost-object controlling because for each period Standard-price(S) of a Material cannot be the same.

How to update the Standard-price(S) of a Material?

Remember: STANDARD PRICE OF A MATERAL CAN BE UPDATED/CHANGED ONLY ONCE PER PERIOD, AND THIS IS WHY IT MUST BE LEARNED CAREFULLY.

In Material Master Record, a material price can be changed by marking it and then releasing the standard cost estimate(S). Once a standard-cost estimate is marked along with its future referenced value, after release, the future-referenced value becomes the current cost. This whole process must be done without any errors as the limitations on the number of times to change the Material data.

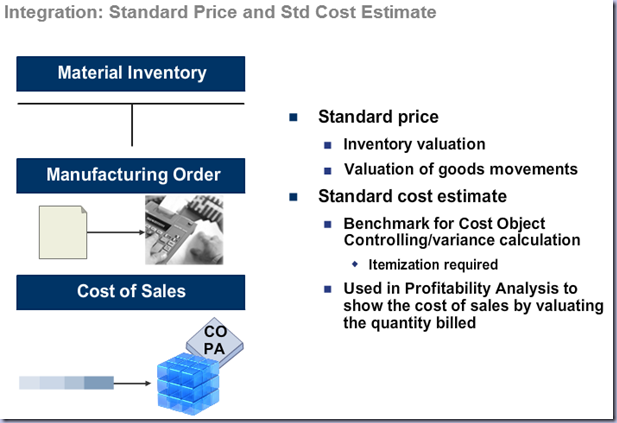

PRICE CONTROLLING AND COST ESTIMATION:

Price control plays an important role in valuation of the materials. If the price-control is set to standard-price then two things are affected,

- Inventory Valuation is changed according to the standard-price and

- Goods movement is also valued according to the price-control indicator

If this standard-price is updated regularly by standard-cost estimate of the material, then standard-cost estimate can be used in cost-object controlling. This gives back the variances in the actual and planned/target costs. This standard-cost estimates give out the differences in the price vs quantity of the item(or simple, variances) to different components in controlling. When the materials are Itemized, real-time variance calculations evolve in the production process. These variance calculations can be used in profitability analysis for exact cost-of-sales amount in the management report. This cost-of-sales amount can be calculated not for this period but also for the next periods depending on the standard-cost estimates and production estimates. This cost-of-sales estimation for the next periods gives out the basic profitability(or losses) of sales. Forecasting is an important thing Management must be able to do every time, even a small disturbance in/out of company's materials can change the forecasts.

PRACTICE: LET US CREATE A MATERIAL COST ESTIMATE:

Goto SAP Easy Access menu ->Accounting ->Controlling -> product Cost Controlling -> Material Costing -> Cost Estimate with Quantity Structure -> Create

In the Create Material page, Enter the material details as given in picture below and click the tick button as shown in red-box

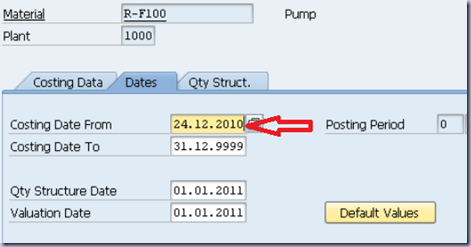

And after clicking on the Tick button, goto Dates tab in the same screen and enter the relevant dates on which the cost-estimate on this material is going to be used/valid.

And after entering the Dates, click save and then a new screen appears giving out all the details(below pic) on the Material data available as per the COSTING VARIANT given during its creation.

In the material's detail screen, check the details in the left-side under PUMP and then click save which is red-boxed in the above pic. After clicking Save a new pop-up appears as shown above with tile Update Parameters. Here, select both the fields Itemization and Log and then click Tick in the pop-up screen. By this step, Material costs estimate is saved in the Material Master data.

Now, let us see the Mark and Release cost update on this new Material which we entered above.

REMEMBER: ONLY ONCE A MATERIAL CAN BE UPDATED PER PERIOD.

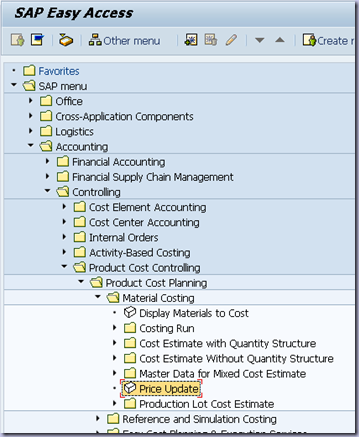

Goto SAP Easy Access menu -> Accounting -> Controlling -> Product cost Controlling -> Product Cost Planning -> Price Update.

Here, a screen appears which asks the details of the company and the Material as shown below. After entering the details, in Processing Options de-select the Test Run, click Execute(red-Box) to land in next screen

After clicking Execute a Price Update appears with status bar successfully updated info(below pic).

Now, click Back where a list appears with all the Materials updated , click on the material we had updated before (Red-Box).

And when the Material is clicked(red-box), whole Material information will be displayed as shown below.

In this Screen to update a price, first goto COSTING 2 tab as shown below

In this Costing 2 tab, Cost-Estimates are clearly visible and note the FUTURE cost. Now click Back 2 times to land in starting Price Update Screen . Here, enter the details on the screen again and click RELEASE as shown below

Once, you click RELEASE the whole tab will change as shown below and Marking button will replace the Release button, then click Execute

So, now the material is ready for price-updating to FUTURE Amount. And after clicking Execute in above screen, the price update is posted as a document(PRICE Change Document) as shown below

Now, let us see the CURRENT price of the material in its display. For that go Back, click on our Material on the List again which will display all the parameters of the Material. Here, goto Costing 2 tab and check the CURRENT cost. Below, I posted the previous pic where FUTURE cost estimate was 624 EUR.. So, after Price-Update, CURRENT cost -estimate column will have 624 EUR under it.

-----------------END OF PRODUCT COST CONTROLLING---------------

PROFIT CENTER ACCOUNTING (EC-PCA):

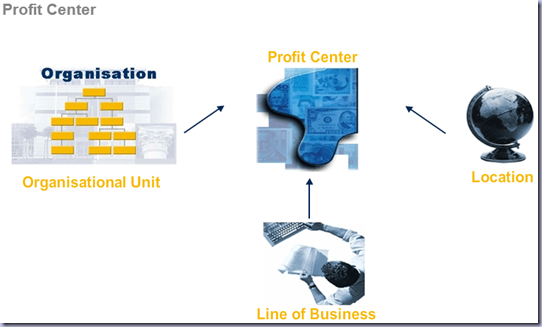

PROFIT CENTER is an organizational unit which exactly tries to reflect the management-orientation in the company either by its structure or functionality.

A Profit Center can represent any part of organisation depending on the Business area, product, geographical location etc..

The main responsibility of a Profit-Center is to analyse the revenues coming to the company from various methods as shown above and for smooth internal-controlling purposes. Cost center accounting is all about costs while profit center accounting is all about the profitability of the company. Both are needed for a short-term and long-term planning, controlling and executing of the senior management.

REMEMBER: Each cost center should have profit center but not the other way around. So, Configuration for a client/company should be done carefully by dividing its organisational units as per the costs and profits.

Whenever there is a transaction to/from revenue and cost accounts the corresponding cost-elements are updated. These cost-elements are assigned to CO area with a cost-object assigned. This way all the FI transactions to be tracked will have a reference by the assigned cost-objects. These Cost-elements might be assigned to Cost-objects, Cost-centers, Internal Orders, Production orders etc.. as shown in the pic above. The Master record of Controlling Objects will contain a profit center field and when Profit center Accounting is activated, various CO objects will be assigned to this profit center. This will create a statistical posting in EC-PCA whenever there is a debit/credit from the profit center( or whenever there is a debit/credit for he CO objects).

In configuration, most of the times cost-objects will be assigned to profit-centers and this will keep track of the profits. If the cost-objects are planned then the profit-centers concerned with these cost-objects will also be planned. This automatic planning will enable to post statistical postings to the profit centers too.

But, there will be lot of questions on using profit centers as organizational units as shown in the pic below.

Enterprise Structure of any client must be able to answer these questions, and it must have an alternative solution if client wants to implement a new Structure as client's organization changes. So, the data flow to profit center must be looked when creating a profit-center as data flow can be from any FI component such as internal orders, cost centers (or) data flow can be from cost and revenue elements (or) data flow can be specifically from cost objects from product cost controlling etc.. So, SAP Consultant must analyze the data flow in the client's company for profit center accounting.

What can these profit Centers do for Internal reporting?

All the profit centers in the client's company must be able to give internal reporting needed by the Client's operation teams. Profit Centers must be able to analyze the profits, and other key financial figures. Dimensions of reporting must include operating profit, capital costs and ROI as basic reporting capability. These three are very important corporate Finance concepts which must be on hand by operating and finance teams. For more info on the dimensions of reporting by profit center view the below slide

PRACTICE::

As we know cost-center must be assigned to profit center, let us do the assignment work and see how to create a profit center report.

Goto Sap easy access Menu -> Accounting -> Controlling -> Profit Center Accounting -> Master Data -> Assignment Monitor

In the next Screen, goto Assignment Monitor -> Cost Centers -> Nonassigned

But, here the System will ask for the details about the controlling area and the data to give the whole list of available cost-centers in a controlling area

Click Execute after entering the details which will give all the cost centers not assigned to profit centers similar to the below pic

Now, click Cancel(F12) and go back to SAP easy Access Screen to see How to generate Profit Center Reports.

Goto SAP easy Access menu -> Accounting -> Controlling -> Profit Center Accounting -> Information Systems -> Reports for Profit Center Accounting -> profit Center List: Plan/Actual

In the next screen as shown below, enter the relevant details and press Execute

In the next scree, you can see the complete list of profit centers and Select any profit center by double-clicking it. A pop-up opens which asks Quarterly report/Annual report or Semi-Annual report. For now, double-click Quarterly Report which gives out the complete report of the Profit Center for 3 months as shown below.

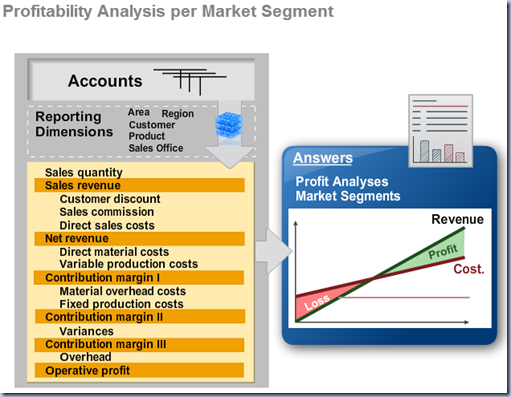

PROFITABILITY ANALYSIS::

Profitability Analysis is just an application for Management Accounting(CO) which works in the hands of Management only. There are 2 versions of available for profitability reporting,

- Costing based and

- Account based.

Difference in both can be seen in the below pic,

A Consultant must justify the usage of Profitability Analysis during implementation in such a way that it aids the senior management in forecasting the market movements and changes in customer preferences. Also, it must give out the brief losses occurring in the company even if these losses in a particular department/ product are being tried to averted with heavy focus from senior management. SAP CRM deals with more emphases on changes in Customer Preferences towards the product which can be analysed even with SAP BI.

The market requirement might be completely different to what the product is offering and this gives a chilling LOSS result later. The market requirement must be studied and customer preferences must be carefully observed to find the GAP between the company's product and the consumer preferences and it should be reduced(here SAP BI comes handy). The characteristics of the product must be mapped along the expectations of the consumer in such a way that it builds the exact value being asked(SAP CRM comes handy here) from the market and it must be inimitable for the competitors in the market. Sometimes, even if the product is not the best in the market it generates much more profits than the best product in the market. This might be due to various factors like lesser initial investment, alternative consumer preferences etc compared with best product in the market. For any Scenario, PROFITS are the more important part to be stressed first and then the market share and brand value must be seen. Because without PROFITS for a particular period, company cannot exist and will be forced to sell its assets to compensate the LOSSES.

A company must be able to meet the profit margins which are being forecasted. This task of meeting its margins gives out a clear understanding that company is performing as per its plan. So, Senior Managers must look out the forecasts of profitability analysis and try to make KPIs more profitable. KPIs are nothing but Key Performance Indicators which are used as part of Financial Analysis. KPIs can be anything on financial reports, it can be a ratio, a turnover or a margin or anything which is commonly calculated as part of Accounting reporting practice. During the start of a fiscal year, a company will make a vision, mission and select the KPIs to assist itself reach its vision with a mission. These KPIs will be mapped internally as real-time and when senior managers see that they are unable to reach the target as per their KPIs they should find the exact answer on why they failed to meet. And normally any big company will give out these answers in the next fiscal year report specifying what went wrong like uncertain economic downfall which aided on less consumer spending etc.. As part of Profitability Analysis, most of the important turnovers, profits etc will be decided for the next fiscal year and company functions to meet that targets. Profitability Analysis will also give out forecasts like which costs could reduce profits in near future. This gives more time for senior management for any critical decision-making needed to reduce such costs.

PRACTICE:

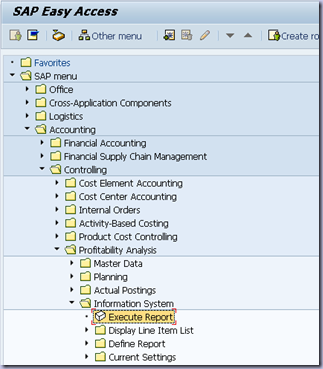

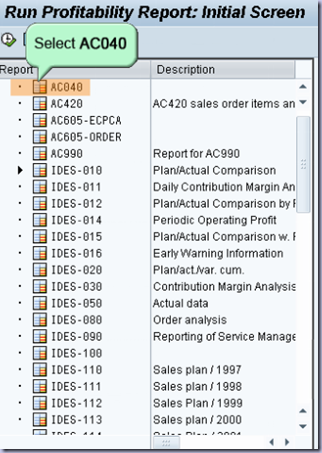

Let us see how to run profitability report!!?

Goto SAP Easy Access menu -> Accounting -> Controlling -> Profitability Analysis -> Information Systems -> Execute Project

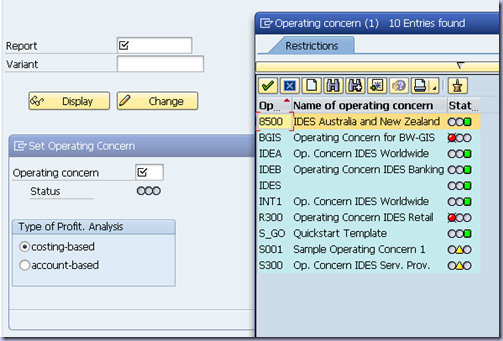

In next screen, the whole list of reports must be displayed. But, in my SAP server I got different screen asking for OPERATING CONCERN.

What is OPERATING CONCERN??

operating concern represents an organizational unit in your company for which the sales market has a uniform structure. It is the valuation level for Profitability Analysis (CO-PA).

Structure

You structure an operating concern by selecting

You should ask yourself at what level your analyses should be performed, such as the sales organization, region, product, or customer level.

- and value fields (only in costing-based Profitability Analysis)

You should ask yourself which values and key figures should be analyzed, such as revenues, sales deductions, costs, or quantities.

- as well as G/L accounts (only in account-based Profitability Analysis)

This structure may vary greatly from one company to the next. For example, the structure of total production costs in a manufacturing company differs from that in a wholesale or retail company. Consequently, you need to "model" CO-PA in Customizing by defining the characteristics and value fields that you want to analyze.

The system then generates the necessary

database tables for CO-PA transaction data and access programs based on how you defined your operating concern.

From <https://help.sap.com/saphelp_46c/helpdata/en/7a/4c38814a0111d1894c0000e829fbbd/content.htm>

So, If you have Profitability Analysis configured as part of your company then OPERATING CONCERN will be there. After, you double-click on Execute Report in SAP Easy Access menu, a list of all the reports will appear as shown below

Select a REPORT(for now as we didn't create any report as part of OPERATING CONCERN) and click on Execute. Some more details regarding periods and year will be asked by the system in next screen

Enter the details and click Execute to get the actual report which we are trying for as below.

I drilled down the report by selecting PLANT and DIVISION in the Navigation menu provided.

--------END OF UNIT - 4-------

This unit is complete.

You should now be able to identify where SAP Management Accounting/CO fits both in the SAP ERP solution and in the organizational structure that is used to map SAP ERP to an enterprise; explain the function of master data in an enterprise’s SAP ERP system with an example; describe how SAP ERP supports an organization’s management accounting activities including overhead cost controlling, product cost accounting, profit center accounting, and profitability analysis of market segments; identify the components of management accounting, organizational level and master data used in Management Accounting, data flows into and within Management Accounting, period-end activities and reporting tools in Management Accounting.

![clip_image031[1] clip_image031[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgNeA1Ns25cBvtgWHb2w8avA9FDG0Y10aRUxib-QAyjx_8AUHF_IZEQhEEc9SVNrmg-bfagqVnuqDmppa2v2lif4ueOD1ttTcuR56MHZrLHEJMldoQZBMAhl2h9OvAYg4ZO-OuGpowR_ms/?imgmax=800)

![clip_image057[1] clip_image057[1]](http://lh4.ggpht.com/-lAmTV8RlvSM/U2w7zXHOizI/AAAAAAAAD-Q/v6VanshamsU/clip_image0571_thumb1.png?imgmax=800)

Nice aticle.

ReplyDeletePayroll processing services