Before going into any bit furthur, I would like to show some important macro-financial slide, which describes more than anything that could be discussed here.. Just try to understand what is being done with what components and even if somethings are new here at this stage of tutorials just know about the whole thing described in this slide by Google searching.

This unit in this course includes understanding CO module and how it fits a business orientation and How it takes the features of SAP ERP into an enterprise. This module gives out a clear understanding on the management accounting activities like overhead cost accounting, profit centre accounting, profitability analysis of market segments and other.

OBJECTIVES:

- To create internal Order, post documents to an internal order and get a detailed information on commitment management and settling the costs for a cost centre

- List all the components of CO-PC(product-cost controlling), detail out the product cost planning and how to estimate standard cost.

- Display profit centre, assigning profit centres, how to use profit centres as internal integrated planning component, flow of data to EC-PCA(Profit Centre Accounting) along with understanding its master data, understand the flow of data into CO-PA (Profitability Analysis) and process a CO-PA drilldown report

CONTENT:

Obviously from the objectives you can get the content list

- Management Accounting/CO and Master data in SAP ERP

- Organizational levels

- Cost centre accounting

- Internal order

- Product cost accounting

- Profitability analysis

So, where is profit centre accounting?? And what about cost-of-sales accounting?? Why no one talks about SAP configuration by cost-of-sales accounting??

Businesses can use the modules needed only by them rather than installing all the modules as part of software. In SAP ERP there are many modules which completely divide and maintain the individual departments along with some exceptional case modules like corporate services which takes the accounts of Travel management, Environment management etc.

Enterprise structure is mapped into SAP applications using organizational units Which in turn represent enterprise structure as a legal entity. Company code can have its own reporting capabilities either internal reporting or external reporting depending on the client. Client is the highest level of the company which represents the headquarters of a group or the company itself.

Master Data:

There are 3 Master data in most of the SAP configurations,

- Customer Master data

- Vendor Master data

- Material Master data

For example, Customer master data will contain all the business info on the customer and their details as shown in the pic above, the issue is with the authority to view this data. Sometimes whole data of customer will not be shown and it depends on the authority of the person who is about to view customer master data. There are 2 types of views for each type of information in Customer master data. Like, Payment parameters/ Dunning procedure might be visible only for Accounting head while only company code is visible for Accounting clerks.

Difference in FI Accounting and CO Accounting:

Financial Accounting or FI module accounting in SAP is mostly external. As it is external I mean, the report it generates must comply with the Accounting standards like GAAP or IFRS and Taxation and other similar subjects will start from FI module. While, CO Accounting is purely internal accounting which means it is managerial accounting which is solely used for internal decision making. Like Profit Centre Accounting which is used for understanding the profits from each profit centre and maintain the costs in prescribed/predefined decisions. There are many tools in CO but most of them are used for management understanding and decision-making regarding their operations.

Architecture of Management Accounting/Controlling/CO module:

Lets say Management is trying to reduce the costs of the operations in the company and they can find the following applications provided by SAP to make their decisions.

Cost-Centre Accounting gives out a clear picture on what is the costs being incurred in each particular assigned cost-centre. But, what if there is a project/process/product which involves many cost-centres or departments in the company, in this case of cross-functional costing, Activity-based costing is normally used to view the costs incurred by a particular process/product/project. This is very important as managers cannot make a conclusive limit to costs before funding departments in the company without predicting the costs.

In turn, these costing solutions gives a clear picture on product costing and efficiency of each business area in the company. By the picture, it is clear that what sort of costing or analysis methodology must be used for any specific answer.

We can use Profitability Analysis for how profitable can a new product be in the present market.

We can use profit centre Accounting to get the financial statements of a particular point of operations in company. Like, profit centre can be assigned to a product, group of products, a company, group of company or group of departments. So, Profit centre accounting emerged as a viable way of looking at internal costs pointedly after it was launched in ECC4.7.

FLOW OF VALUES WITHIN MANAGEMENT ACCOUNTING:

Before, going into details let us look at the individual components and understand what is the purpose and then lets combine and get what the flow is all about!

Cost center is a organizational unit which u will classify your expenses to. cost center can be department or product etc. cost centre can be decided when ur creating PO(Purchase Order). every expenses in the organization will be attached to some or the other Cost Centre.

Profit center is an organizational unit in controlling to recognise ur profit.

Profit center is attached to material master record in costing view

Each cost centre should have profit centre but it is not other way round.

Internal Order is an instrument used to monitor costs and, in some instances, the revenues of an organization.

Internal orders can be used for the following purposes:

- Monitoring the costs of short-term/long-term jobs

- Monitoring the costs and revenues of a specific service

- Ongoing cost control

Internal orders are of 4 different types till now in SAP:

- Overhead orders - For short-term monitoring of the indirect costs arising from jobs. They can also be used for continuous monitoring of subareas of indirect costs. Overhead orders can collect plan and actual costs independently of organizational cost center structures and business processes, enabling continous cost control in the enterprise.

- Investment orders - Monitor investment costs that can be capitalized and settled to fixed assets.

- Accrual orders - Monitor period-based accrual between expenses posted in Financial Accounting and accrual costs in Controlling.

- Orders with revenues - Monitor the costs and revenues arising from activities for partners outside the organization, or from activities not belonging to the core business of the organization.

Now coming back to the flow of values, we must look deeply into the diagram given above. In each type of Accounting, different set of organizational units are used and it’s the duty of the SAP consultant to bridge them and find the optimum level of information availability to the Client as per his/her business needs and usage of client's operations.

Integration with other ERP Applications:

In Oracle Apps, most of the focus is given to the processes like

- Purchase to pay

- Plan to product

- Order to cash

Which is slightly different and though most of the companies use these processes in their daily operations SAP is designed to make use of even these operations so that a Client will not miss his touché while running his company under SAP. Touche, I mean his/her easiness with such process even after using SAP.

As I said above and shown in the pic Above , the data from other applications will be automatically updated in CO. Like FI where most of the transactions/posting being done will have an impact in CO module too when the logic of transaction asks for it. As shown in figure, any transactions in Expense accounts will have a corresponding update in CO module too as it gets updated in Cost centres, internal orders etc. Even the postings in HR module like costs for training will be updated to CO by the relevant cost centre. When Assets are bought, the transaction in FI will get updated in CO by the relevant Cost Centre or else CO might not be able to trace the costs and there might be error(changes in Finance values) in final reports of FI and CO modules. And if there is a huge difference in CO report and FI report then, its like a huge difference between Senior Managers and Finance Department. Obviously, a head ache. IN same way, Production orders in production planning, purchase orders in Materials Management, etcc will have their own method of updating the CO by relevant Cost objects like Cost centres or other cost objects assigned/used during configuration. Even in Sales Order Management, When revenue accounts have any transaction it gets updated as per the revenue types configured and track the revenue being generated. All this happens at the moment where transactions happen and 'no work gets stuck for tomorrow' in SAP. As shown in the pic, all the cost centres will have a profit centre and this can completely give out the profitability analysis to analyse the costs and profit-centre accounting to get individual process/product/project financial report, revenues and profits in CO module. Thus, CO module justifies its name Controlling!.

So What impacts CONTROLLING??

CO-PA is used for market and segment reporting. Controlling area which contains units like CO-OM(Cost-Controlling), CO-PC(Product Cost planning), EC-PCA(profit centre accounting) is used for "controlling area reporting" to calculate costs. Company codes are independent units which where accounting is done as FI module. In company code there may be many number of sales organisation, material organisation and other departmental organisations like logistics, procurement etcc which generate a self-auditing and accounting reports if needed.

So, every organisational unit impact the CO module, it must be looked carefully on how the information flow is being designed.

In an single controlling area, there can be many company codes and they can report in different currencies as per their need. All the company codes in a single controlling area must use same operative chart of accounts.

COST-CENTRE ACCOUNTING:

It must be looked on how to segregate costs as per the company needs and as per the SAP elements.

IN Chart of Accounts, Expense accounts are created in class-4 while revenue accounts are created in class-8.

All the costs are posted in FI as primary cost elements as shown above, while the secondary postings are like assessment and analysis postings which are just used in CO module and they don’t have entry in FI. Secondary costs are part of Management controlling and decision making elements.

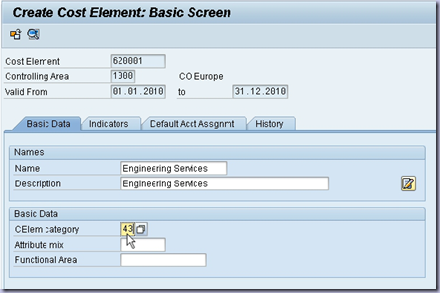

Before going into any depth let us make a secondary cost element, lets see the respective screens of "Cost Elements" to get intouch with CO Module:.

In SAP menu - Accounting - controlling - Cost centre accounting - master data - cost element - individual processing - create secondary cost element

In this screen as shown above enter the cost element you want to make and the validity of the cost element too. After entering the data, click on 'Master data' button above and then new screen appears as shown below

Don't think of entering the data as I showed in pics, Im just making you familiarize with the screens. In the above screen, 'Basic data' is where basic information is given and as you can see, there is a 'default account assignment' to each cost element. But, just try to find out what is 'CElem Category' field in the above pic?

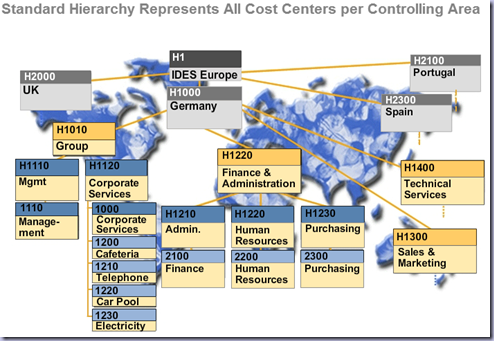

There is a hierarchy in any controlling area, which is a standard and default hierarchy. This is done to look at the costs in a complete tree structure of authority n the company.

In the above pic, You can see the way the cost centres are created as part of hierarchy with the numbers of each cost centre. A Cost centre can be assigned to any part/activity of the organisation.

You can also assign the manager responsible for this cost centre, for which cost centre this cost centre must be placed as part of hierarchy in the organisational setup, the department in the company for which this cost centre is assigned to, and also the profit centre field covers the purpose of the cost centre like production, services, sales or administration. There are 2 points which must be kept in mind during configuration..

- If a controlling area has more than one company code, then the linkage between the company code and its cost centres must be specified clearly to avoid any confusion in CO module.

- If Business areas are used in the company code, they must also be specified in the cost centre master record.

These days almost every consultant uses profit centres and business areas in their configuration.

Let us take a look at the cost centre and display it in standard hierarchy.

Goto SAP access menu - Accounting - Controlling - cost centre accounting - master data - standard hierarchy - display

Here, Enter '1000' in the controlling area field

Here you can see the whole Company codes assigned to this control area and all the cost centres in these company codes.

Every company will have many number of activities and the costs of each activity must be determined before allocation and this is why secondary cost elements come into picture.

Secondary cost elements will be updated by the management saying this is the costs/expenses we want to limit for this particular cost centre for which activity is being assigned. This costs allocation to cost centres can be either entered manually or automatically by predefined limits in configuration.

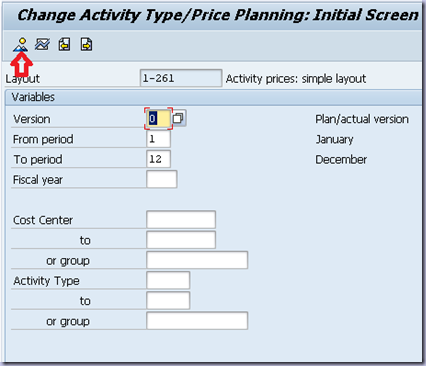

Let us see the way of allocating/planning a price to a cost centre..

Goto sap easy access menu - accounting - controlling - cost centre accounting - master data - activity type - individual processing - create

Then we will create a planner profile in SAP Easy access menu - Accounting - Controlling - Cost centre accounting - planning - set planner profile

Remember this profile must be listed in TA50 table..(know how to view information in a table by google)

Now, to enter the limits for an activity

SAP easy access menu - Accounting - controlling - cost centre accounting - planning - activity output/prices - change

Here You can see the activity limits and when U click the 'Overview' as pointed in above picture after entering the details in this screen a table is displayed where every activities in this activity type is listed and in a column of the table displayed limit of costs can be entered directly and saved..(I am not showing it now as I want to show it clearly during configuration)

In CO, there are some figures/parameters which can be monitored every time when there is transaction which could affect the parameters.

As shown above, there are two types and TYPE -01 is fixed one and cannot be changed unless a new posting is done. Type -02 is a statistical figure which can be changed as per period and it remains same for that period.

All these organisational units of cost centres and profit centre is to control the costs and analyse the revenues being generated. As shown above, personnel costs are planned and entered to cost centre structure of the company along with other cost assessments like Asset depreciations etc.. The main aim of this planning is to create a value (/savings) by controlling the costs through value-chain analysis as per Management subjects and Profitability Analysis as per SAP subjects. IF in any case, there is a need to delimit the costs then planned calculatory costs can be used to delimit the cost in cost centre. There is no limit on activities being used as Activities cannot only be under CO module, they might be under production planning module (PP) and Sales (SD) module. Allocations can be manually entered or automatically derived using different methods. At last, all the costs will be monitored/assessed automatically in CO-PA.

So, What are the objectives of Cost Centre planning ??

- To plan the structure of Organization's future operations for a clear defined time period

- To control business method within current settlement period

- To monitor efficiently after completion of the settlement period using plan/actual or target/actual comparisons and

- To provide a basis for the valuation of organizational activities, independent of random fluctuations

Now lets go to some ground basics…

Whenever, there is a posting being done in FI module along with document number being generated in FI module, the same transaction is recorded in CO module called as management accounting object too with different document number. Being a management object, little more information will be available in the document to ease the understanding like cost element and posted amount.

As we discussed above about statistical objects, we need to find out what sort of objects are allowed for statistics.

Costs/expenses originate from various modules might use different objects to record the costs. IN management Accounting, postings for costs/expenses are recorded as true/real object and statistical objects as shown in the above picture. Look at the picture twice.. Statistical objects are just for information purposes. What is the real object, listed above as 'Network' in the pic above? It is WBS .. Know more about WBS which is a main topic in Project management .

The system has a priority for choosing which CO objects are posted as real or statistical transactions. The difference between real and statistical is quite simple. Real postings are those that form part of the transactional balance in the controlling module. For example, if the only item in a cost center was a real posting of $100, then the balance of that cost center will be $100. Statistical postings on the other hand are those that do not form part of the transactional balance in the controlling module. For example, if the only item in a cost center was a statistical posting of $100, them the balance of that cost center will be $0. However the statistical posting will appear in the cost center reports, but will be for informational purposes only.

Another major difference between real and statistical postings is that real postings can be allocated to other cost objects (for example, by using assessments, distributions or primary cost re-postings) since these values form part of the balance of the controlling object. Statistical postings however, cannot be reallocated. Also, you cannot specify only a statistical object in a posting when a cost element is used, as the system will require you to enter a real object.

When a posting is made to more than one cost object, the system has a priority which it uses to determine which of the objects is treated as real and which is treated as statistical. The below cost objects are listed in order of this priority:

- Profitability Segment

- Sales Order (for Make-to-Order postings)

- WBS Element

- Internal Order

- Cost Center

Note that the term statistical is also confused, because when used in the context of the Sales and Distribution module, it means something entirely different. I have heard people say that a statistical sales condition does not get posted to FI (and CO). However, in the SD sense, the term “statistical” means that the value does not roll into the price charged to the customer. The general ledger account linked to the statistical condition does get posted to the general ledger (and to controlling if there is a CO Object).

From <http://ovigele.com/understanding-real-versus-statistical-objects-in-controlling/>

So as per the above description, the way the system reacts to allocate costs is also dependant on the hierarchy. But, now-a-days SAP consultants wont normally create more than one cost centre for a particular cost/expense to avoid confusion and technical understanding limitability of the end-users.

So, How an FI document becomes a CO document?

FI document cannot become a CO document unless certain settings in configuration is done. First a primary cost element must be created in CO and must be assigned to the corresponding Expense account which is used in FI journal entry also along with this a valid cost centre must be referenced in FI line item during document entry. Line item is the item which is used as exchange in a transaction, it can be money, product, service anything belonging to the company. So, when creating a document for an expense/cost corresponding cost-centre must be referenced in a line item to show that it’s a cost and CO module will save this document by its own document number(which is different from FI document number). So, 2 separate documents will be created which is a FI document and CO document, each one having its own unique number.

So, how to get CO document by FI document??

COBK-REFBN being mindful of the document year and controlling area.

In COBK (header for CO documents) you have REFBN field, which in case that CO document was created from FI, will represent FI document. To know more about this issue see my post 'Transferring documents from FI to CO'

How to post and view an expense of a cost centre??

Here, let us consider that we had assigned a cost account(which is a GL Account) to a cost centre so that all the transactions in this account will be considered as costs of particular branch/unit. So, whenever costs incur we post document to as expenses to this cost-account.

Goto SAP easy access menu - Accounting - Financial Accounting - General Ledger - Document Entry - Enter GL Account Document

If prompted to give a company code give pre-defined company code like 1000 or any company pre-defined one. And then enter the data as shown below

If you see the Above pic clearly and understand the line items, there is a Debit Item and Credit Item. And for the Debit Line item from GL Account 403000, it had asked assignment of CO object as this account was actually assigned to Cost-centre. Tax Jurisdiction code can be used if your company expenses are tracked from many countries but this cost-centre just takes care of costs in a particular jurisdiction. In that case, we had to use tax jurisdiction code for 403000 line item, and enter that tax jurisdiction code in appropriate field which is beside the cost-centre field in above screen. When saved this document will be generated.

To see the costs incurred in a cost centre, goto

SAP easy Access menu - Accounting - Controlling - Cost Centre Accounting - Information system- Reports for cost centre accounting - Plan/Actual Comparisons - Cost Centre: Actual or Plan or Variance

In this screen enter the details as given above and click execute to get the transaction happened in this cost centre upto now

If you double-click on the Debit Account 400300 you will know the actual line items and Amounts being used.

Here, each transaction in cost-centre is listed by Account to Account from where money was being transaction is debited from. If you double-click again on the account number in this transaction then u will get the document of this particular transaction which shows info in more detailed manner.

Posting of Material Management to a cost centre:

The issues here, is How a FI document will be created from MM during expenses transactions, If a FI document is not created then that is a faulty implementation of SAP. ? Transactions such as Goods issued in Material Management Module can be recognised as costs when a cost-centre is assigned. This transaction will create a FI document between accounts Material Consumption to Material Inventory. So Goods are Debited in Material Consumptions and Credited in Material Inventory Account. And MATERIAL CONSUMPTION account(in GL) will be assigned to a cost-centre while configuring SAP to that company . This cost-centre being a part of CO will give out the expense when viewed.

Don’t always Depend on Training Institute alone.Please aware of Best Trainers too..

ReplyDeleteIf You need a Best Trainer in SAP Success Factors??? Then be ready for a DEMO From the Trainer MR.Karthick

CONTACT:8122241286

http://thecreatingexperts.com/sap-training-in-chennai/

http://thecreatingexperts.com/sap-successfactors-training-in-chennai/

http://thecreatingexperts.com/sap-mm-training-in-chennai/

http://thecreatingexperts.com/sap-fico-training-in-chennai/

Don’t always Depend on Training Institute alone.Please aware of Best Trainers too..

ReplyDeleteIf You need a Best Trainer in SAP Success Factors??? Then be ready for a DEMO From the Trainer

CONTACT:8122241286

http://thecreatingexperts.com/sap-training-in-chennai/

http://thecreatingexperts.com/sap-successfactors-training-in-chennai/

http://thecreatingexperts.com/sap-mm-training-in-chennai/

http://thecreatingexperts.com/sap-fico-training-in-chennai/