In this Unit, we need to understand and work on one of the basic financial equation

NET INCOME = REVNEUES - EXPENSES

And sometimes most companies will find it difficult to determine the time period of a transaction as some transactions will go on and on and some transactions will not happen at right time. This gives nightmare to value the transaction and at what time period to report the transaction. Due to this type of transactions, accountants must adjust some of important things like postings, trial balance etc. while preparing financial statements

WHAT ARE TIMING ISSUES?

Once, all the transactions are finished then it will be easy to prepare financial statements. But, in real scenario, transaction will not end and sometimes management wants monthly financial statements and also to file tax returns interim financial statements are required. For this complexity, accountants divide the economic life of business into artificial time periods. This is called as time period assumption.

For example, the airplanes purchased by Southwest Airlines five years ago are still in use today. We must determine the relevance of each business transaction to specific accounting periods. (How much of the cost of an airplane contributed to operations this year?)

HOW TIME PERIOD IS DIVIDED AND USED?

Both small and large companies prepare financial statements periodically in order to assess their financial condition and results of operations. Accounting time periods are generally a month, a quarter, or a year. Monthly and quarterly time periods are called interim periods. Most large companies must prepare both quarterly and annual financial statements. An accounting time period that is one year in length is a fiscal year. A fiscal year usually begins with the first day of a month and ends twelve months later on the last day of a month. Most businesses use the calendar year (January 1 to December 31) as their accounting period, some do not. In India, April to March is commonly followed along with many other countries.

WHAT IS DIFFERENCE IN ACCRUAL VS CASH BASIS ACCOUNTING?

Under the accrual basis, companies record transactions that change a company’s financial statements in the periods in which the events occur. For example, using the accrual basis to determine net income means companies recognize revenues when earned (rather than when they receive cash). It also means recognizing expenses when incurred (rather than when paid). So, in Accrual basis accounting companies update the transactions when they recognise expenses or revenues before when they receive or pay the actual cash.

An alternative to the accrual basis is the cash basis. Under cash-basis accounting, companies record revenue when they receive cash. They record an expense when they pay out cash. The cash basis seems appealing due to its simplicity, but it often produces misleading financial statements. It fails to record revenue that a company has earned but for which it has not received the cash. Also, it does not match expenses with earned revenues. Cash-basis accounting is not in accordance with generally accepted accounting principles (GAAP). It is mostly used in small enterprises.

HOW DO COMPANIES RECOGNISE THE VALUE OF SUCH REVENUES AND EXPENSES?

It can be difficult to determine the amount of revenues and expenses to report in a given accounting period when the transaction is not yet finalised. Two principles help in this task: the revenue recognition principle and the expense recognition principle.

REVENUE RECOGNITION PRINCIPLE

The revenue recognition principle requires that companies recognize revenue in the accounting period in which it is earned. In a service enterprise, revenue is considered to be earned at the time the service is performed. To illustrate, assume that Dave’s Dry Cleaning cleans clothing on June 30 but customers do not claim and pay for their clothes until the first week of July. Under the revenue recognition principle, Dave’s earns revenue in June when it performed the service, rather than in July when it received the cash. At June 30, Dave’s would report a receivable on its balance sheet and revenue in its income statement for the service performed.

EXPENSE RECOGNITION PRINCIPLE

Accountants follow a simple rule in recognizing expenses: “Let the expenses follow the revenues.” Thus, expense recognition is tied to revenue recognition. In the dry cleaning example let us consider salaries are paid daily, this means that Dave’s should report the salary expense incurred in performing the June 30 cleaning service in the same period in which it recognizes the service revenue. The critical issue in expense recognition is when the expense makes its contribution to revenue. This may or may not be the same period in which the expense is paid. If Dave’s does not pay the salary incurred on June 30 until July, it would report salaries payable on its June 30 balance sheet.

WHY IS THE NEED FOR ADJUSTING ENTRIES?

The need for adjusting entries is high and depends on the way expense or revenue is being recognised. To make trial balance up to date, adjusting entries must be done for various reasons like below,

- Some events are not recorded daily because it is not efficient to do so. Examples are the use of supplies and the earning of wages by employees.

- Some costs are not recorded during the accounting period because these costs expire with the passage of time rather than as a result of recurring daily transactions. Examples are charges related to the use of buildings and equipment, rent, and insurance.

- Some items may be unrecorded. An example is a utility service bill that will not be received until the next accounting period.

WHAT ARE THE TYPES OF ADJUSTING ENTRIES?

Adjusting entries are classified as either deferrals or accruals. each of these classes has two subcategories.

Deferrals:

- Prepaid expenses: Expenses paid in cash and recorded as assets before they are used or consumed.

- Unearned revenues: Cash received and recorded as liabilities before revenue is earned.

Accruals:

- Accrued revenues: Revenues earned but not yet received in cash or recorded.

- Accrued expenses: Expenses incurred but not yet paid in cash or recorded.

HOW ADJUSTING IS DOINE FOR DEFERRALS?

To defer means to postpone or delay. Deferrals are costs or revenues that are recognized at a date later than the point when cash was originally exchanged. Companies make adjusting entries for deferrals to record the portion of the deferred item that was incurred as an expense or earned as revenue during the current accounting period. The two types of deferrals are prepaid expenses and unearned revenues.

Before going into any more inner details let us consider we are using company named PIONEER ADVERTISING COMPANY (PAA) for now.

PREPAID EXPENSES:

Companies record payments of expenses that will benefit more than one accounting period as assets called prepaid expenses or prepayments. When expenses are prepaid, an asset account is increased (debited) to show the service or benefit that the company will receive in the future. Examples of common prepayments are insurance, supplies, advertising, and rent. In addition, companies make prepayments when they purchase buildings and equipment. But as time goes on, the prepaid amount will expire just like monthly rent where at start of each month the previous rent expires. There is no need to write down the expiry of the prepaid amount as an entry unless required.

The Basic rule for adjusting an entry for prepaid expenses results in an increase (a debit) to an expense account and a decrease (a credit) to an asset account.

SUPPLIES::

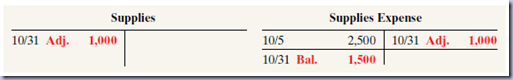

The purchase of supplies, such as paper and envelopes, results in an increase (a debit) to an asset account. During the accounting period, the company uses supplies. Rather than record supplies expense as the supplies are used, companies recognize supplies expense at the end of the accounting period. At the end of the accounting period, the company counts the remaining supplies. The difference between the unadjusted balance in the Supplies (asset) account and the actual cost of supplies on hand represents the supplies used (an expense) for that period.

On our Example of PAA company, We can see that company purchased supplies costing $2,500 on October 5. Pioneer recorded the purchase by increasing (debiting) the asset Supplies. This account shows a balance of $2,500 in the October 31 trial balance. An inventory account at the close of business on October 31 reveals that $1,000 of supplies are still on hand. Thus, the cost of supplies used is $1,500 ($2,500 - $1,000). This use of supplies decreases an asset, Supplies. It also decreases owner’s equity by increasing an expense account, Supplies Expense. This is shown below,

After the adjustment posting the asset account Supplies shows a balance of $1,000, which is equal to the cost of supplies on hand at the statement date. In addition, Supplies Expense shows a balance of $1,500, which equals the cost of supplies used in October. If Pioneer does not make the adjusting entry, October expenses will be understated and net income overstated by $1,500. Moreover, both assets and owner’s equity will be overstated by $1,500 on the October 31 balance sheet.

INSURANCE:

Companies purchase insurance to protect themselves from losses due to fire, theft, and unforeseen events. Insurance must be paid in advance, often for more than one year. The cost of insurance (premiums) paid in advance is recorded as an increase (debit) in the asset account prepaid insurance. At the financial statement date, companies increase (debit) Insurance expense and decrease (credit) Prepaid insurance for the cost of insurance that has expired during the period.

In our Example of PAA as per the main trial balance shown, Company paid insurance of $600 for an year, if calculated for each month its $50 ($600/12). By the end of each month prepaid insurance decreases by $50 and Insurance expense increases by $50. By the end of year, Insurance Expense covers full amount $600.

DEPRECIATION:

There will be lot of assets in the company and every asset will depreciate. When any tangible object like building, computers, cars, etc are acquired, they are recorded as assets on the acquiring date. Being assets, they will be used until their useful life. By the end of asset's useful life, the value of asset must become zero. This reduction of asset's value periodically is called DEPRECIATION.

The acquisition of long-lived assets is essentially a long-term prepayment for the use of an asset. An adjusting entry for depreciation is needed to recognize the cost that has been used (an expense) during the period and to report the unused cost (an asset) at the end of the period. One very important point to understand: Depreciation is an allocation concept, not a valuation concept. That is, depreciation allocates an asset’s cost to the periods in which it is used. Depreciation does not attempt to report the actual change in the value of the asset. So, an Asset's useful life is normally extended by re-investment and this changes its valuations again. This is why, there is a need for adjustment postings for every asset's depreciation and change in valuation. REMEMBER: CONTRA-ASSET ACCOUNTS ARE TYPE OF ASSET ACCOUNTS BUT IT MUST SHOW THE REDUCTION IN VALUE OF AN ASSET, THIS IS WHY THE ADJUSTMENTS ARE POSTED ON CREDIT SIDE.

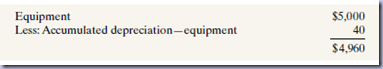

For Pioneer Advertising, assume that depreciation on the equipment is $480 a year, or $40 per month. As shown in Illustration 3-7 below, rather than decrease (credit) the asset account directly, Pioneer instead credits Accumulated Depreciation— Equipment. Accumulated Depreciation is called a contra asset account. Such an account is offset against an asset account on the balance sheet. Thus, the Accumulated Depreciation—Equipment account offsets the asset Equipment. This account keeps track of the total amount of depreciation expense taken over the life of the asset. To keep the accounting equation in balance, Pioneer decreases owner’s equity by increasing an expense account, Depreciation Expense.

There are different type of contra asset accounts for each type of asset as shown below are some examples:

- For Asset: Plant and equipment

- Contra-asset: Accumulated depreciation (depreciation expense goes to income statement)

- Contra-asset: Accumulated impairment losses (impairment losses go to income statement)

- For Asset: Accounts receivables

- Contra-asset: Allowance for doubtful accounts (bad debts expense goes to income statement)

- For Asset: Inventory

- Contra-asset: Allowance for obsolescence (obsolescence expense goes to income statement directly or via COGS)

- For Asset: Intangible assets (e.g. patents)

- Contra-asset: Accumulated amortisation (amortisation expense goes to income statement)

Accumulated Depreciation—Equipment is a contra asset account. It is offset against Equipment on the balance sheet. The normal balance of a contra asset account is a credit. A theoretical alternative to using a contra asset account would be to decrease (credit) the asset account by the amount of depreciation each period. But using the contra account is preferable for a simple reason: It discloses both the original cost of the equipment and the total cost that has expired to date. Thus, in the balance sheet, Pioneer deducts Accumulated Depreciation—Equipment from the related asset account, as shown below

In the above illustration $4,960 is called Book Value which is giving the value still left on the asset as per our books. Coming to Valuations, there are 2 types Book Value and Fair Value. We will discuss them later.

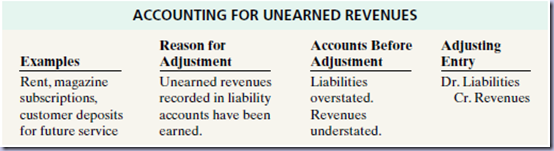

UNEARNED REVENUES:

Companies record cash received before revenue is earned by increasing (crediting) a liability account called unearned revenues. Items like rent, magazine subscriptions, and customer deposits for future service may result in unearned revenues. Airlines such as United, American, and Delta, for instance, treat receipts from the sale of tickets as unearned revenue until the flight service is provided. Unearned revenues are the opposite of prepaid expenses. Indeed, unearned revenue on the books of one company is likely to be a prepaid expense on the books of the company that has made the advance payment. For example, if identical accounting periods are assumed, a landlord will have unearned rent revenue when a tenant has prepaid rent. When a company receives payment for services to be provided in a future accounting period, it increases (credits) an unearned revenue (a liability) account to recognize the liability that exists. But, subsequently the company earns revenue by providing the service.

Company will post this payment as Unearned Revenue(liability) in credit section to increase the liability. This liability is the obligation of service the company must give. Once the service is given, the expenses are calculated and remaining amount is transferred to Earned Revenue Account. But, posting daily revenues is not the professional way of Accounting as it will create a mess of account entries daily. In adjustment process, the present value of Liability will be calculated by dividing whole liability as per activity, stage-of-service or time-period. Once liability is calculated up to the present accounting period then posting is done. Posting is done at the end of present accounting period so that it makes easy to do a group of transactions rather than a single transaction daily.

So, directly even though the unearned revenue is turned to revenue in this accounting period, the posting is delayed to end of this accounting period. Typically, prior to adjustment, liabilities are overstated and revenues are understated. The adjusting entry for unearned revenues results in a decrease (a debit) to a liability account and an increase (a credit) to a revenue account.

Pioneer Advertising received $1,200 on October 2 from R. Knox for advertising services expected to be completed by December 31. Pioneer credited the payment to Unearned Service Revenue, and this liability account shows a balance of $1,200 in the October 31 trial balance. From an evaluation of the service Pioneer performed for Knox during October, the company determines that it has earned $400 in October. The liability (Unearned Service Revenue) is therefore decreased, and owner’s equity (Service Revenue) is increased.

At the same time, Service Revenue shows total revenue earned in October of $10,400. Without this adjustment, revenues and net income are understated by $400 in the income statement. Moreover, liabilities are overstated and owner’s equity is understated by $400 on the October 31 balance sheet.

ACCOUNTING ENTRIES FOR ACCRUALS:

The meaning of 'accrue' word is to sum up the money. The second category of adjusting entries is accruals. Prior to an accrual adjustment, the revenue account (and the related asset account) or the expense account (and the related liability account) are understated. Thus, the adjusting entry for accruals will increase both a balance sheet and an income statement account. Talking about Accruals there are Accrued Revenues and Accrued Expenses.

Accrued Revenues:

Revenues earned but not yet recorded at the statement date are accrued revenues. Accrued revenues may accumulate (accrue) with the passing of time, as similar to interest revenue. These are unrecorded because the earning of interest does not involve daily transactions. Companies do not record interest revenue on a daily basis because it is often impractical to do so. Accrued revenues also may result from services that have been performed but not yet billed nor collected, as in the case of commissions and fees. These may be unrecorded because only a portion of the total service has been provided and the clients won’t be billed until the service has been completed. An adjusting entry records the receivable that exists at the balance sheet date and the revenue earned during the period. Prior to adjustment, both assets and revenues are understated. An adjusting entry for accrued revenues results in an increase (a debit) to an asset account and an increase (a credit) to a revenue account.

In October, Pioneer Advertising earned $200 for advertising services that were not billed to clients on or before October 31. Because these services are not billed, they are not recorded. The accrual of unrecorded service revenue increases an asset account, Accounts Receivable. It also increases owner’s equity by increasing a revenue account, Service Revenue, as shown below

The asset Accounts Receivable shows that clients owe Pioneer $200 at the balance sheet date. The balance of $10,600 in Service Revenue represents the total revenue Pioneer earned during the month ($10,000 1 $400 1 $200). Without the adjusting entry, assets and owner’s equity on the balance sheet and revenues and net income on the income statement are understated.

On November 10, Pioneer receives cash of $200 for the services performed in October and makes the following entry.

The company records the collection of the receivables by a debit (increase) to Cash and a credit (decrease) to Accounts Receivable.

ACCRUED EXPENSES:

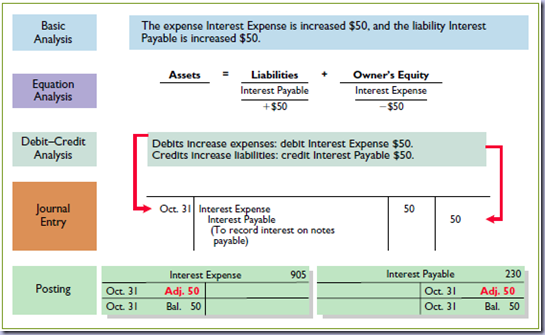

Expenses incurred but not yet paid or recorded at the statement date are called accrued expenses. Interest, taxes, and salaries are common examples of accrued expenses. Companies make adjustments for accrued expenses to record the obligations that exist at the balance sheet date and to recognize the expenses that apply to the current accounting period. Prior to adjustment, both liabilities and expenses are understated. Therefore, as Illustration 3-16 shows, an adjusting entry for accrued expenses results in an increase (a debit) to an expense account and an increase (a credit) to a liability account.

Let's look at different types of Accrued Expenses

Accrued Interest:

Pioneer Advertising signed a three-month note payable in the amount of $5,000 on October 1. The note requires Pioneer to pay interest at an annual rate of 12%. The amount of the interest recorded is determined by three factors: (1) the face value of the note; (2) the interest rate, which is always expressed as an annual rate; and (3) the length of time the note is outstanding. For Pioneer, the total interest due on the $5,000 note at its maturity date three months in the future is $150 ($5,000 X 12% X 3/12—), or $50 for one month.

the accrual of interest at October 31 increases a liability account, Interest Payable. It also decreases owner’s equity by increasing an expense account, Interest Expense. Interest Expense shows the interest charges for the month of October. Interest Payable shows the amount of interest the company owes at the statement date. Pioneer will not pay the interest until the note comes due at the end of three months. Companies use the Interest Payable account, instead of crediting Notes Payable, to disclose the two different types of obligations—interest and principal—in the accounts and statements. Without this adjusting entry, liabilities and interest expense are understated, and net income and owner’s equity are overstated.

Accrued Salaries and Wage:

Companies pay for some types of expenses, such as employee salaries and wages, after the services have been performed. Pioneer paid salaries and wages on October 26 for its employees’ first two weeks of work; the next payment of salaries will not occur until November 9. As shown below,

three working days remain in October (October 29–31). At October 31, the salaries and wages for these three days represent an accrued expense and a related liability to Pioneer. The employees receive total salaries and wages of $2,000 for a five-day work week, or $400 per day. Thus, accrued salaries and wages at October 31 are $1,200 ($400 X 3). This accrual increases a liability, Salaries and Wages Payable. It also decreases owner’s equity by increasing an expense account, Salaries and Wages Expense, as shown below;

Pioneer Advertising pays salaries and wages every two weeks. Consequently, the next payday is November 9, when the company will again pay total salaries and wages of $4,000. The payment consists of $1,200 of salaries and wages payable at October 31 plus $2,800 of salaries and wages expense for November (7 working days, as shown in the November calendar X $400). Therefore, Pioneer makes the following entry on November 9.

This entry eliminates the liability for Salaries and Wages Payable that Pioneer recorded in the October 31 adjusting entry, and it records the proper amount of Salaries and Wages Expense for the period between November 1 and November 9.

WHAT IS THE USE OF ACCRUAL ACCOUNTING?

It gives a clear and simple picture to know/forecast the revenues and expenses before they are paid/received. The Chinese government, like most governments, uses cash accounting. It was therefore interesting when it was recently reported that for about $38 billion of expenditures in a recent budget projection, the Chinese government decided to use accrual accounting versus cash accounting. It decided to expense the amount in the year in which it was originally allocated rather than when the payments would be made. Why did it do this? It enabled the government to keep its projected budget deficit below a 3% threshold. While it was able to keep its projected shortfall below 3%, China did suffer some criticism for its inconsistent accounting. Critics charge that this inconsistent treatment reduces the transparency of China’s accounting information. That is, it is not easy for outsiders to accurately evaluate what is really going on. Budget Deficit is a macro-economic subject which connects all the money, markets, and regulations under a single boundary.

WHAT ARE THE RELATIONSHIPS IN ADJUSTING ENTRIES?

Each adjusting entry affects one balance sheet account and one income statement account.

WHAT ARE THE ADJUSTMENT ENTRIES MADE UP TO OCTOBER 31 IN PAA COMPANY?

Once, the trial balance is finalised after the adjustments then adjusted financial statements are produced using trial balance sheet. The Debit and Credit adjustments of the trial balance is shown below,

ARE THERE ANY ALTERNATIVE TREATMENT FOR UNEARNED REVENUES AND PREPAID EXPENSES??

In the case of prepaid expenses, the company debited the prepayment to an asset account. In the case of unearned revenue, the company credited a liability account to record the cash received. Some companies use an alternative treatment: (1) When a company prepays an expense, it debits that amount to an expense account. (2) When it receives payment for future services, it credits the amount to a revenue account.

Prepaid Expenses

Prepaid expenses become expired costs either through the passage of time (e.g., insurance) or through consumption (e.g., advertising supplies). If, at the time of purchase, the company expects to consume the supplies before the next financial statement date, it may choose to debit (increase) an expense account rather than an asset account. This alternative treatment is simply more convenient.

Assume that Pioneer Advertising expects that it will use before the end of the month all of the supplies purchased on October 5. A debit of $2,500 to Supplies Expense (rather than to the asset account Supplies) on October 5 will eliminate the need for an adjusting entry on October 31. At October 31, the Supplies Expense account will show a balance of $2,500, which is the cost of supplies used between October 5 and October 31. But what if the company does not use all the supplies? For example, what if an inventory of $1,000 of advertising supplies remains on October 31? Obviously, the company would need to make an adjusting entry. Prior to adjustment, the expense account Supplies Expense is overstated $1,000, and the asset account Supplies is understated $1,000. Thus, Pioneer makes the following adjusting entry.

After adjustment, the asset account Supplies shows a balance of $1,000, which is equal to the cost of supplies on hand at October 31. In addition, Supplies Expense shows a balance of $1,500. This is equal to the cost of supplies used between October 5 and October 31.

UNEARNED REVENUE:

Unearned revenues become earned either through the passage of time (e.g., unearned rent revenue) or through providing the service (e.g., unearned service revenue). Similar to the case for prepaid expenses, companies may credit (increase) a revenue account when they receive cash for future services. To illustrate, assume that Pioneer Advertising received $1,200 for future services on October 2. Pioneer expects to perform the services before October 31.1 In such a case, the company credits Service Revenue. If it in fact earns the revenue before October 31, no adjustment is needed.

However, if at the statement date Pioneer has not performed $800 of the services, it would make an adjusting entry. Without the entry, the revenue account Service Revenue is overstated $800, and the liability account Unearned Service Revenue is understated $800. Thus, Pioneer makes the following adjusting entry.

And After posting the entry, the accounts looks like,

So, the complete way of entering Adjustment entries are

I am reading your post from the beginning, it was so interesting to read & I feel thanks to you for posting such a good blog, keep updates regularly.

ReplyDeleteAccounting Company in Dubai | Accounting Companies in Dubai

Great post, the information that is given about accounting companies and accounting services in Dubai is very worthwhile and interesting too. Keep sharing like this post.

ReplyDeleteaccounting services in Dubai

In this JD Edwards Accounts Receivable training you will learn to Manage customer information, Process accounts receivable invoices, Process sales order invoices, Process manual receipts, Process automatic receipts and drafts, Process credit reimbursement, Process accounts receivable and payable netting transactions, Process tax information, Set up the system for credit and collections, Manage customer deductions, Process delinquency notices and fees for overdue accounts and Analyze statistical information for customers. JD Edwards Accounts Receivable Training

ReplyDeleteThanks for sharing about this necessary information. Great to know about this necessary information about best account management service. Keep it up for sharing.

ReplyDeleteFinance And Accounting Outsourcing

Debt Recovery Agency

Debt Recovery Services

cash basis accounting is a simple method suitable for businesses with straightforward financial transactions and reporting needs. However, it may not provide a comprehensive view of a company's financial performance and is not always compliant with accounting standards. Businesses should carefully consider their specific requirements and, if necessary, consult with accounting professionals to determine the most appropriate accounting method for their situation. Accounting Services Outsourcing Australia

ReplyDeleteThe LEAD Enquiry is a one-stop outsourcing marketplace that can assist you in locating the best provider to assist you in developing a resilient business and lead generation campaign.

For those who are pursuing their CA or related professional certifications, it's essential to stay organized and have a well-planned approach like the one you've outlined. On a related note, for individuals or businesses seeking professional accounting services, Spectrum Accounts offers top-notch support as one of the leading Accounting Firms in Dubai. They cater to a variety of needs including company formation, audit, and financial management. If you need help in setting up your business or managing your accounts, their expertise in the Dubai market makes them an excellent choice for anyone looking for Accounting Companies in Dubai.

ReplyDeleteSpectrum Services:

Audit Firms in Dubai

Company Formation in Dubai

Accounting Company in Dubai

Corporate Tax Consultants in Dubai

Tax Consultants in Dubai

Vat Deregistration in Dubai

Vat Registrations in Dubai