This Unit includes some important issues in recording a business transaction:

KEYWORDS :

| DEBITS | CREDITS | JOURNALS | LEDGER | POSTING | TRAIL BALANCE |

WHAT IS AN ACCOUNT?

Account is an individual record of increase or decrease in specific asset, liability or owner's equity. In previous example of softbyte which we discussed in previous post, there would be separate accounts for different set of transactions like cash, Accounts receivable, Accounts payable, service revenue, salaries and wages expense and so on.

In simple methods, accounts resembles a T format. Accounts has 3 parts in this T format: a Title, Debit side and Credit side.

WHAT IS DEBITS AND CREDITS?

When a transaction is done in an account, it will record whether money is going out or coming into the account. Debiting is when money comes in while Crediting is when money goes out. But, in Some type of Accounts Debit might be money going out and Credit will be Money coming in. WE will discuss these differences later.

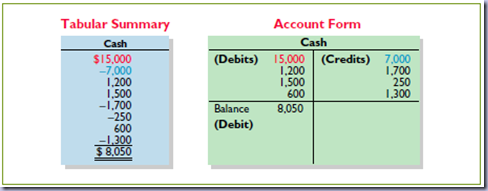

The other way of calculating the above Account is calculating the total debited amount and subtracting it with the total sum of Credited amount, i.e.,

Total Debited is : 15,000 + 1,200 + 1,500 + 600 = 18,300

Total Credited is : 7,000 + 1,700 + 250 + 1,300 = 10,250

Balance = 18,300 - 10,250 = 8,050

WHAT IS DEBIT AND CREDIT PROCEDURE?

In any transaction, two or more accounts will be affected as discussed in previous chapter. If you buy materials for cash, The value in Cash Account decreases while Material Account goes up as new materials add up. If you give a service, then the service revenue account goes up as the customer gives money as per time and support being provided for the service. Sometimes, in service also costs incur like installing a new part in machinery of customer, installing a new software etc. So, the point here is for each transaction 2 accounts will be affected at minimum. Though there are different accounts being affected for each transaction, the debit and credit balances will be equal.

WHY DEBIT AND CREDIT BALANCES WILL BE EQUAL?

As per the previous answer, when raw-materials are bought Cash value will be credited from Cash Account to Accounts Payable, while the Materials will be DEBITED in Materials Accounts with same value of cash which was debited. So, here, the cash value from Credit side shifted to Debit side in Material Account. But, in Accounts Payable the amount is credited as Accounts Payable is a Liability Account. This way Debits and Credits side are both equal again after the transaction.

Debit Credit Asset Increase Decrease Liability Decrease Increase Income (revenue) Decrease Increase Expense Increase Decrease Capital Decrease Increase

In Double Ledger Entry System, the above table is very important in understanding the transaction and making an entry. We also need to understand the effects of DEBIT and CREDITS on Asset, Liabilities and Owner's Equity.

So, now You got the expanded equation in Accounting covering all the scenarios in any business case.

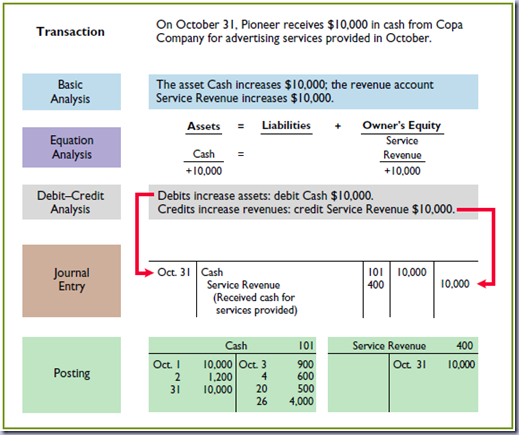

WHAT ARE THE STEPS IN RECORDING A TRANSACTION?

The recording process begins with the transaction. Business documents, such as a sales slip, a check, a bill, or a cash register tape, provide evidence of the transaction. The company analyzes this evidence to determine the transaction’s effects on specific accounts. The company then enters the transaction in the journal. Finally, it transfers the journal entry to the designated accounts in the ledger.

WHAT IS A JOURNAL??

The journal is referred to as the book of original entry. For each transaction the journal shows the debit and credit effects on specific accounts. Though some companies use different journals for different transaction, we will use general journal in our understanding.

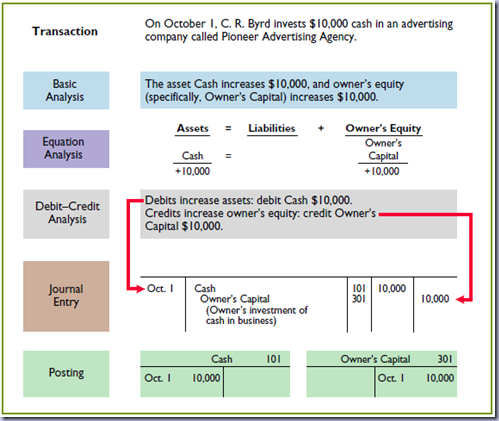

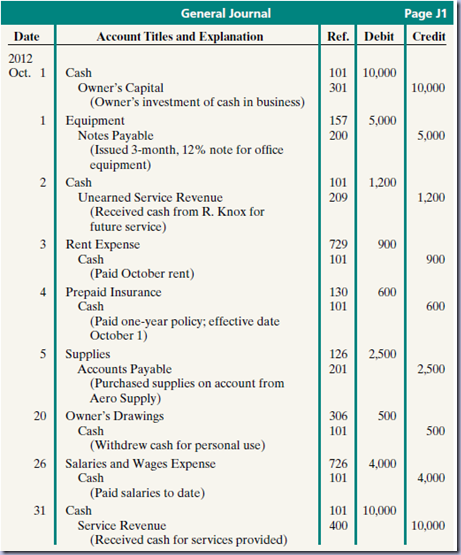

Example of Journal Entry:

Transactions of Softbyte. On September 1, Ray Neal invested $15,000 cash in the business, and Softbyte purchased computer equipment for $7,000 cash. The number J1 indicates that these two entries are recorded on the first page of the journal. Below pic shows the standard form of journal entries for these two transactions.

- The date of the transaction is entered in the Date column.

- The debit account title (that is, the account to be debited) is entered first at the extreme left margin of the column headed “Account Titles and Explanation,” and the amount of the debit is recorded in the Debit column.

- The credit account title (that is, the account to be credited) is indented and entered on the next line in the column headed “Account Titles and Explanation,” and the amount of the credit is recorded in the Credit column.

- A brief explanation of the transaction appears on the line below the credit account title. A space is left between journal entries. The blank space separates individual journal entries and makes the entire journal easier to read.

- The column titled Ref. (which stands for Reference) is left blank when the journal entry is made. This column is used later when the journal entries are transferred to the ledger accounts.

An entry that requires three or more accounts is a compound entry. To illustrate, assume that on July 1, Butler Company purchases a delivery truck costing $14,000. It pays $8,000 cash now and agrees to pay the remaining $6,000 on account (to be paid later). The compound entry is as follows.

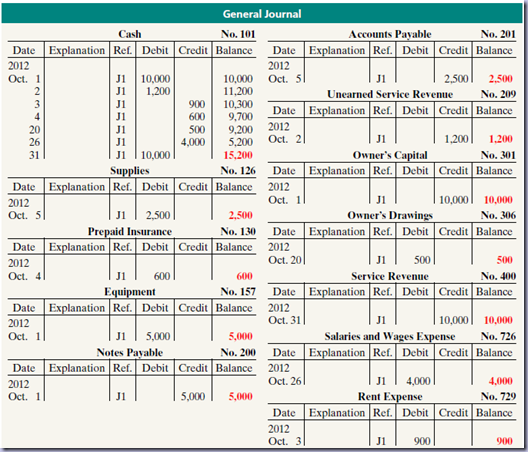

WHAT IS A LEDGER?

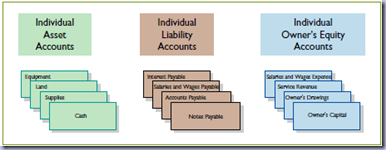

The entire group of accounts maintained by a company is the ledger. The ledger keeps in one place all the information about changes in specific account balances. Companies may use various kinds of ledgers, but every company has a general ledger. A general ledger contains all the asset, liability, and owner’s equity accounts, as shown below

The ledger provides the balance in each of the accounts. For example, the Cash account shows the amount of cash available to meet current obligations. The Accounts Receivable account shows amounts due from customers. Accounts Payable shows amounts owed to creditors.

WHAT IS STANDARD VIEW OF AN ACCOUNT?

Standard format is called the three-column form of account. It has three money columns—debit, credit, and balance. The balance in the account is determined after each transaction. Companies use the explanation space and reference columns to provide special information about the transaction.

WHAT IS POSTING IN RECORDING PROCESS?

Transferring journal entries to the ledger accounts is called posting. This phase of the recording process accumulates the effects of journalized transactions into the individual accounts. Posting involves the following steps.

- In the ledger, in the appropriate columns of the account(s) debited, enter the date, journal page, and debit amount shown in the journal.

- In the reference column of the journal, write the account number to which the debit amount was posted.

- In the ledger, in the appropriate columns of the account(s) credited, enter the date, journal page, and credit amount shown in the journal.

- In the reference column of the journal, write the account number to which the credit amount was posted.

WHAT IS CHART OF ACCOUNTS?

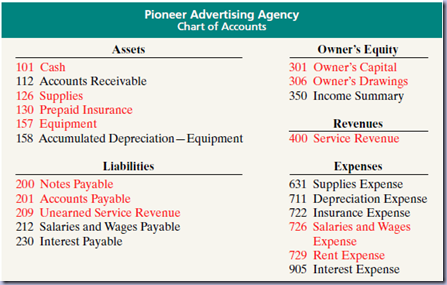

Most companies have a chart of accounts. This chart lists the accounts and the account numbers that identify their location in the ledger. The numbering system that identifies the accounts usually starts with the balance sheet accounts and follows with the income statement accounts.

You will notice that there are gaps in the numbering system of the chart of accounts for Pioneer Advertising. Companies leave gaps to permit the insertion of new accounts as needed during the life of the business. Chart of Accounts can also be said as the method of separating one type of account with other by a number.

EXPLAIN THE WHOLE RECORDING PROCESS ON SERIES OF TRANSACTIONS?

Summary Illustration of Journalizing and Posting

Below is the complete journal Entry of all the transactions done in October month.

Now, before going into General Ledger we need to know Trail balance.

WHAT IS TRIAL BALANCE?

A trial balance is a list of accounts and their balances at a given time. Customarily, companies prepare a trial balance at the end of an accounting period. They list accounts in the order in which they appear in the ledger. Debit balances appear in the left column and credit balances in the right column.

So, the trail balance is,

WHAT ARE THE FEATURES OF TRIAL BALANCE?

A trial balance is useful in the preparation of financial statements, as we will explain in the next posts. The steps for preparing a trial balance are:

1. List the account titles and their balances in the appropriate debit or credit column.

2. Total the debit and credit columns.

3. Prove the equality of the two columns.

WHAT ARE THE LIMITATIONS OF TRAIL BALANCE?

A trial balance does not guarantee freedom from recording errors, however. Numerous errors may exist even though the trial balance columns agree. For example, the trial balance may balance even when:

1. a transaction is not journalized,

2. a correct journal entry is not posted,

3. a journal entry is posted twice,

4. incorrect accounts are used in journalizing or posting, or

5. offsetting errors are made in recording the amount of a transaction.

As long as equal debits and credits are posted, even to the wrong account or in the wrong amount, the total debits will equal the total credits. The trial balance does not prove that the company has recorded all transactions or that the ledger is correct.

Steigern Sie Ihren Bekanntheitsgrad und demonstrieren Sie Ihr Engagement für ökologische Nachhaltigkeit mit der grossen Auswahl an Giveaways und Bio Werbeartikel der Qualiprom AG. Unsere sorgfältig ausgewählte Kollektion bietet eine Vielzahl von Werbeartikeln, die die Umwelt so wenig wie möglich belasten und gleichzeitig einen bleibenden Eindruck bei Ihrem Publikum hinterlassen.

ReplyDelete