Accounting is the most popular activity in any business scenario.. It spans all around risk, future value and basic functionality of organisation!

Accounting has 3 activities basically,

- Identification

- Recording

- Communication

Identification is where a company finds out the economic activities related to its business like sale of a telephonic services by AT&T to its customers. In this way, they can review where the market is heading to.

Recording holds the financial activities as a record. This activity is needed to know how the problems identified in economy is affecting the financial activity in the company. This recording activity summarizes and whole financial activities of company in a systematic and chronological order as the activities happened daily.

Communication is now being considered as highest priority in Financial activity because of the frauds and other money laundering activities being done by Big corporates. So, as part of communication all the companies who are trading in any stock exchange must give annual financial reports compulsorily, in some stock exchanges the reporting must be done quarterly too. For, this reporting the recording activity gets importance and Recording activity simplifies in generating financial reports in a meaningful way.

Financial Reports are more than what we had discussed here, any Financial Analyst or MBA grad or CFA person must be able to completely breakdown the report in to a sense. This gives a challenging task for any company's Accountant to make such an understandable report for everyone. Report must be able to specify the limitations, while explaining the data.

In Accounting, there is some other important activity called as Bookkeeping which usually holds only the recording of economic activities.

WHO USES ACCOUNTING DATA?

In first glance as per our discussion above, there are two types of users

- Internal Users

- External Users

Internal User are the users who belong to the organisation the report came from. They might be managers/ Finance team members or anyone belong to the company and want to use the report.

Here, for managers there is other type of accounting called as Managerial Accounting which is a part of SAP CO module. This Managerial Accounting is considered as best example utilisation of forecasting to analyse the sales projections or forecasting cash availability etc.

External users are the people or organisations outside a company but work on the company's financial reports and information being provided. Most of the External Users are Investors and Creditors. Investors are people who hold share(s) in the company as their ownership. Creditors are the people who lend money to the company as a loan and they don't want to get company bust their loan.

So, they will also view/monitor the company reports to access the financial capability of the firm. Another type of external users are TAX AUTHORITIES, which rely on reports to levy correct amount of taxes as per their regulation.

In both the pictures above, there are very important questions which define the capability of the firm in different perspectives. Answering these questions is called as FINANCIAL ACCOUNTING in a structured and standard procedure. This structured and standard procedure is called as ACCOUNTING STANDARDS. Different companies in different countries follow different accounting standards, though there is no much difference between these standards there is a subtle differences between them. We will discuss all about ACCOUNTING STANDARD later.

WHAT ARE ETHICS IN FINANCIAL REPORTING AND GIVE ITS IMPORTNACE?

Ethics in Financial Reporting was given importance after every developed/ developing country paid a heavy price to the economic uncertainty which occurred almost once for every 10 years, but particularly 2008 Economic downfall was the biggest fiasco. Along with these economic downturns, big corporates tried to manipulate their reports to reduce the tax burden and inflate their company's stock prices by showing good amount of Equity in their reports. ( WE will Know What is Equity very soon in this chapter). Today, every company is connected to the stock market and any sort of bad news can completely pull the stock market down and any good news can bring down another competitor. Stock Markets are supposed to make this a fair competition without pulling each other down using any malpractice. This gives confidence to investors in the stock market to continue investing in the stocks of companies listed in a stock exchange. A well-functioning economy depends a lot on accurate and dependable financial reporting.

There had been lot of companies who tumbled down after doing heavy money laundering and malpractice of inflating numbers in their financial reports. So, almost every government in a developed country amended their corporate laws to bring down such unethical corporates. In India, SATYAM fiasco is considered the biggest corporate fraud of malpractice while in whole world, ENRON is considered the most unethical corporate of modern financial accounting.

What is GAAP and other accounting standards?

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP) is the most famous accounting standard universally preferred. This accounting standard is developed by USA Authorities like FASB( Financial Accounting Standards Board) and SEC( Securities and Exchange Commission). While almost all the companies in USA use GAAP, the companies outside USA use IFRS(International Financial Reporting Standards). IFRS is developed by International Accounting Standards Board (IASB).

As most of the markets are being into a single global economy, there is a push to reduce the gap between the IFRS and U.S.GAAP. The process called as Convergence is being tossed since 2010 and almost every accounting body is trying to find the ways to merge the two accounting standards. It is a still in progress activity.

What are the measurement principles in GAAP?

There are 2 types of measurement principles

- COST PRINCIPLE

- FAIR VALUE PRINCIPLE

In Cost Principle, the companies must record their assets at the cost it is being bought. If a company buys a land for $300,000, initially in accounting records it is reported at $300,000. But what if by the end of next year, the fair value of land increased to $400,000? Under the COST PRINCIPLE, it continues to report at $300,000

In Fair Value Principle, the assets and liabilities must be reported at fair-value. Fair-Value is the price received to sell and asset or settle a liability. In most of the cases, market prices are readily available but it might not be sufficient to do any business.

So, the big question is when to use Cost Principle and Fair Value Principle?

In general, most of companies use Cost-Principle unless there is a situation to sell an asset. Fair-Value Principle Reporting is done when there is an asset like investment securities etc.. to be traded off.

Why is it important to have Accounting Standards?

For example, South Korea was the country which lagged behind due to low investor confidence on Korean Companies. In many cases, transactions involving shares of Korean Companies used to suffer a term called Korean Discount because, many investors found that Financial number are inflated and so, during transactions the investors were so unwilling to give full amount of the deal. This called for more control from regulators. In 2011, Korean Regulators passed law saying all companies must adhere to International Accounting standards giving out complete transparency and also Corporate laws were changed for fraudsters. This changed the transparency level in South Korea. Sooner, many stock exchanges in the world started investing in South Korea bringing good cash flows for companies like Samsung, Hynix, Hyundai, LG, Kia, Posco etc.,.

What is Monetary Unit Assumption and Economic Entity Assumption?

Assumption is the foundation of Accounting process. There are 2 types of assumptions,

Monetary Unit Assumption requires all the transaction data that can be shown as money. In simple terms, it is the assumption where all the economic events can be quantified as a measure of money.

Economic Entity Assumption is which divides all the activities as separate and distinct based on difference between the activities of owner and other organisation activities. This gives more clear distinction in understanding the wealth of the organisation along with any sort of malpractice from the owners. There are different methods of ownership too here,

- Proprietorship: Here, the Owner will also be the manager of the company. Proprietorship is normally common in small businesses. But, the accounting records of the business are kept separate from the personal records of the owner's activities.

- Partnership: When 2 or more person associated as partners then ownership is called as partnership. As similar to proprietorship, the business activities are kept separate from the personal activities of the partners.

- Corporation: Company as legal entity under the jurisdiction and state law, ownership is dependent on the person or association holding the percentage of shares of the company. Holders of shares(shareholders) will have a limited liability and stockholders can exchange the shares of organisation as asset transfers in any sort of transaction. This give corporation an unlimited life and interesting investments in stock markets.

THE BASIC ACCOUNTING EQUATION:

The Basic Accounting Equation is to find out what is Owner's Equity in their Business. Any business today will have

- ASSETS: Assets are something the corporation holds under its name like Cash in its accounts, Buildings, Lands, Machinery, inventories etc. which can be valued with money. There will be some intangible assets too which cannot be touched like a Software, brand name etc.. So, ASSETS are the things which are under the corporation and owned by the corporation.

- LIABILITIES: Liabilities are the loans which the corporation must pay out. Liabilities can be bank loans/debts and other obligations. If a company gets some raw-materials for its production purposes, it must pay for these raw-materials as ACCOUNTS PAYABLE. Along with such payables, there are SALARIES AND WAGES PAYABLE and SALES AND REAL ESTATE TAXES PAYABLE too. The entities which gets the money from the company are called as Creditors and they can legally force the company to pay their money by going to law in case things go bad.

- OWNER'S EQUITY: Once, ASSETS are finalized as particular amount of money and Liabilities are deduced from the assets, the remaining amount is left as part which belongs to owners(called as OWNER's EQUITY). Assets either belong to owners or creditors, to make it more objective let us remove creditor's claims(liabilities) from total assets. The remaining part of the company is called as owner's equity.

How to increase owner's equity?

Owner's Equity can be increased by various methods like,

- Investments by Owner: If new cash flows in by the owner in to business, then his share in the company also grows unless liabilities increase to eat his investments.

- Revenues: Revenues increase the owner's equity as business generates income for the company. Once, all the payables are paid then the remaining will be called as PROFITS. These profits can be used for dividends to the share of owners or can be paid to managers as additional salary incentives etc.

How owner's equity decreases?

In some situations there can be decrease in Equity like

- Drawings: In proprietorship business, an owner can draw all his asset for his personal use resulting in reduction of total equity. DRAWGINS is the most common used term in financial accounting. But in Corporations, this doesn't happen as ownership can be transferred from person to person as a transaction.

- EXPENSES: If company is having too many expenses more than revenues, then the excess amount beyond revenue will be paid from equity. As Equity is being paid for expenses, the Equity gets reduced.

So, THE BASIC EQUIATION IS

ASSETS - LIABILITIES = OWNER'S EQUITY (or)

ASSETS = OWNER'S EQUITY + LIABILITIES

ASSETS = (OWNER'S CAPITAL - OWNER'S DRAWINGS + REVENUES - EXPENSES) + LIABILITIES

What is a Transaction?

A transaction is a internal or external business activity which affects the basic accounting equation. Company does many things daily like hiring, answering a telephone call etc.. If anything affects its assets, liabilities and Equity, then it is called as transaction. And as it is a transaction, it will be recorded appropriately.

Sometimes transactions will have dual-effects on the accounting equation, an increase in asset value might decease other asset value and also increases the liability. Under such specific circumstances, analysis must be done on exact change in accounting equation.

TRANSACTION ANALYSIS:

Let us take a look at 10 transactions as part of a company, Softbyte.

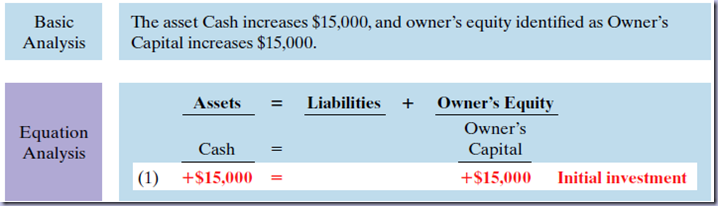

Transaction (1). Investment by Owner. Ray Neal decides to open a computer programming service which he names Softbyte. On September 1, 2012, he invests $15,000 cash in the business. This transaction results in an equal increase in assets and owner’s equity.

Observe that the equality of the accounting equation has been maintained. Note that the investments by the owner do not represent revenues, and they are excluded in determining net income. Therefore it is necessary to make clear that the increase is an investment (increasing Owner’s Capital) rather than revenue.

Transaction (2). Purchase of Equipment for Cash. Softbyte purchases computer equipment for $7,000 cash. This transaction results in an equal increase and decrease in total assets, though the composition of assets changes. Cash decreases $7,000, and the asset Equipment increases $7,000. The specific effect of this transaction and the cumulative effect of the first two transactions are:

Observe that total assets are still $15,000. Neal’s equity also remains at $15,000, the amount of his original investment.

Transaction (3). Purchase of Supplies on Credit. Softbyte purchases for $1,600 from Acme Supply Company computer paper and other supplies expected to last several months. Acme agrees to allow Softbyte to pay this bill in October. This transaction is a purchase on account (a credit purchase). Assets increase because of the expected future benefits of using the paper and supplies, and liabilities increase by the amount due Acme Company.

Total assets are now $16,600. This total is matched by a $1,600 creditor’s claim and a $15,000 ownership claim.

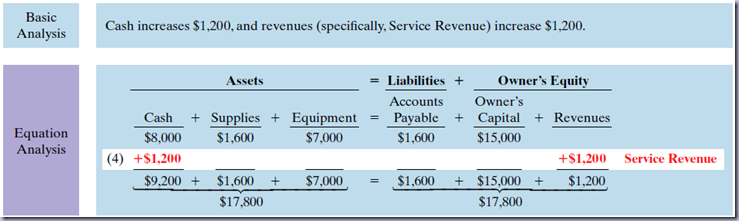

Transaction (4). Services Provided for Cash. Softbyte receives $1,200 cash from customers for programming services it has provided. This transaction represents Softbyte’s principal revenue-producing activity. Recall that revenue increases owner’s equity.

The two sides of the equation balance at $17,800. Service Revenue is included in determining Softbyte’s net income.

Note that we do not have room to give details for each individual revenue and expense account in this illustration. Thus, revenues (and expenses when we get to them) are summarized under one column heading for Revenues and one for expenses. However, it is important to keep track of the category (account) titles affected (e.g., Service Revenue) as they will be needed when we prepare financial statements later in the chapter.

Transaction (5). Purchase of Advertising on Credit. Softbyte receives a bill for $250 from the Daily News for advertising but postpones payment until a later date. This transaction results in an increase in liabilities and a decrease in owner’s equity. The specific categories involved are Accounts Payable and expenses (specifically, Advertising Expense). The effect on the equation is:

The two sides of the equation still balance at $17,800. Owner’s equity decreases when Softbyte incurs the expense. Expenses are not always paid in cash at the time they are incurred. When Softbyte pays at a later date, the liability Accounts Payable will decrease, and the asset Cash will decrease [see Transaction (8)]. The cost of advertising is an expense (rather than an asset) because the company has used the benefits. Advertising Expense is included in determining net income.

Transaction (6). Services Provided for Cash and Credit. Softbyte provides $3,500 of programming services for customers. The company receives cash of $1,500 from customers, and it bills the balance of $2,000 on account. This transaction results in an equal increase in assets and owner’s equity.

Softbyte earns revenues when it provides the service, and therefore it recognizes $3,500 in revenue. In exchange for this service, it received $1,500 in Cash and Accounts Receivable of $2,000. This Accounts Receivable represents customers’ promise to pay $2,000 to Softbyte in the future. When it later receives collections on account, Softbyte will increase Cash and will decrease Accounts Receivable [see Transaction (9)].

Transaction (7). Payment of Expenses. Softbyte pays the following expenses in cash for September: store rent $600, salaries and wages of employees $900, and utilities $200. These payments result in an equal decrease in assets and expenses. Cash decreases $1,700, and the specifi c expense categories (Rent Expense, Salaries and Wages Expense, and Utilities Expense) decrease owner’s equity by the same amount. The effect of these payments on the equation is:

The two sides of the equation now balance at $19,600. Three lines in the analysis indicate the different types of expenses that have been incurred.

Transaction (8). Payment of Accounts Payable. Softbyte pays its $250 Daily News bill in cash. The company previously [in Transaction (5)] recorded the bill as an increase in Accounts Payable and a decrease in owner’s equity.

Observe that the payment of a liability related to an expense that has previously been recorded does not affect owner’s equity. The company recorded this expense in Transaction (5) and should not record it again.

Transaction (9). Receipt of Cash on Account. Softbyte receives $600 in cash from customers who had been billed for services [in Transaction (6)]. This does not change total assets, but it changes the composition of those assets.

Note that the collection of an account receivable for services previously billed and recorded does not affect owner’s equity. Softbyte already recorded this revenue in Transaction (6) and should not record it again.

Transaction (10). Withdrawal of Cash by Owner. Ray Neal withdraws $1,300 in cash from the business for his personal use. This transaction results in an equal decrease in assets and owner’s equity. Both Cash and Owner’s Drawings decrease $1,300, as shown on the next page.

Observe that the effect of a cash withdrawal by the owner is the opposite of the effect of an investment by the owner. Owner’s drawings are not expenses. Expenses are incurred for the purpose of earning revenue. Drawings do not generate revenue. They are a disinvestment. Like owner’s investment, the company excludes owner’s drawings in determining net income.

Summary of Transactions:

Illustration below summarizes the September transactions of Softbyte to show their cumulative effect on the basic accounting equation. It also indicates the transaction number and the specific effects of each transaction.

significant facts:

1. Each transaction is analyzed in terms of its effect on:

(a) the three components of the basic accounting equation.

(b) specifi c items within each component.

2. The two sides of the equation must always be equal.

Companies prepare four financial statements from the summarized accounting data:

- An income statement presents the revenues and expenses and resulting net income or net loss for a specific period of time.

- An owner’s equity statement summarizes the changes in owner’s equity for a specific period of time.

- A balance sheet reports the assets, liabilities, and owner’s equity at a specific date.

- A statement of cash flows summarizes information about the cash inflows (receipts) and outflows (payments) for a specific period of time.

These statements provide relevant financial data for internal and external users.

Note that the statements shown in above pictures are interrelated:

1. Net income of $2,750 on the income statement is added to the beginning balance of owner’s capital in the owner’s equity statement.

2. Owner’s capital of $16,450 at the end of the reporting period shown in the owner’s equity statement is reported on the balance sheet.

3. Cash of $8,050 on the balance sheet is reported on the statement of cash flows.

ReplyDeleteQuickbooks PRO Support Number

Contact QuickBooks Support by certified Pro advisors and get 24*7 instant QuickBooks Pro Support on Call through Toll-Free number to solve issues.

Get the help from QuickBooks Enterprise support to handling all problems for accounting software, dial our tollfree number 1-866-666-0209 for Support.

ReplyDeleteQuickBooks Enterprise Support Number

Those guidelines additionally worked to become a good way to recognize that other people online have the identical fervor like mine to grasp great deal more around this condition.dubai audit firms

ReplyDeleteMy rather long internet look up has at the end of the day been compensated with pleasant insight to talkifrs 16 tax implications

ReplyDeleteBookkeeping that is accurate and up to date is the basic foundation of any successful small business. A small business bookkeeper Melbourne will aid to set up a framework for business, decide on a strategy, and keep track of specific details. Bookkeeping is an essential component of business finances and can have an impact on the growth and success of small businesses. It encompasses a wide range of responsibilities, from basic data entry in a software platform to collaborating with certified public accountants, and serves as the foundation of accounting and financial processes.

ReplyDeleteThanks for Sharing Such Beautiful Information with Us. I hope You Will Share Same More Information about Accounting. Please Keep Sharing Your Brilliant idea !

ReplyDeleteAccounting, Taxation & Auditing Firms in Dubai UAE

Thanks for sharing. Especia Associates LLP can conduct physical verification of stock on the company's behalf. We are a leading Stock Audit Services & Stock audit processes firm in Noida, Delhi, Gurgaon, Other regions in India. Stock Audit Services is a physical verification of stock and inventory and a very important tool for strengthening the internal control system. if you need stock Audit Services call 9310165114 or visit us Stock Audit services

ReplyDeleteNice blog,,,Thanks for sharing this blog

ReplyDeletetax compliance

Thanks for sharing the great information Auditing Company Dubai | ERP Consultancy Dubai

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThank you for share this blog. Discover best accounting services tailored for small businesses in Surat. Our expert financial professionals offer a range of solutions to help streamline your finances, ensure compliance, and optimize your business's financial health.

ReplyDeleteYour blog post on accounting in action provides a practical view of how accounting principles are applied in real-life scenarios. Thanks for sharing this insightful content.

ReplyDeleteBest Accounting Firm Toronto

Its very helpfull for my business Finance and Accounting Outsourcing Services

ReplyDeleteThnaks for sharing Information and its very helpful for us. custom software and Application development Services

ReplyDeleteUnderstanding Financial Planning & Analysis is crucial. Speaking of precision, just like in accounting, precision matters in embroidery placement too. Both require attention to detail for a polished outcome. It's fascinating how different disciplines demand similar focus. Mastering the language of business parallels the precision needed in embroidery placement both art forms in their own right.

ReplyDeleteUnderstanding financial accounting is pivotal in solid financial planning & analysis. It's like having a compass in the business world. By mastering this language, we decipher the story behind numbers, empowering better decisions. Focus on mastering the business perfectly aligns with the core of financial planning & analysis. It's about speaking the same financial language to navigate and strategize effectively.

ReplyDelete"Accounting in action" is a dynamic process that involves various tasks aimed at providing accurate financial information, supporting decision-makers, ensuring compliance, and contributing to the overall success and sustainability of the organization.

ReplyDeleteBest Cash Flow Forecasting Software | Financial Forecasting Tips | Moolamore Cash Flow Management

QuickBooks Error 15271 is a prevalent problem that users run into when they try to install or update QuickBooks Desktop payroll-related components. A notification reading, "Error 15271: The payroll update did not complete successfully," is frequently displayed in conjunction with this error. One cannot validate a file." Resolving this issue and guaranteeing seamless payroll processing within QuickBooks depend on comprehending the causes and putting the right remedies in place.

ReplyDeleteQuickBooks Error 1723

QuickBooks Error 15271

QuickBooks Error 15241

Outsource your accounts payable management to Outbooks in the UK to streamline your payments today. Reach out to Outbooks in the UK for customised AP solutions!

ReplyDeleteGet an accurate company valuation with Airmna's expert analysis. We assess key financial metrics, market position, and growth potential to determine a fair market value. Make informed decisions about acquisitions, investments, or your company's worth.

ReplyDelete

ReplyDeleteTheir moxie in fiscal operation is unmatched — perfect for businesses looking for strategic guidance.

financial management Firm

Great article on the basics of accounting! Understanding assets, liabilities, and equity is essential for managing finances. Keeping accurate records helps businesses grow and stay compliant. For expert tax advice and bookkeeping services, consider KPG Taxation, a trusted tax accountant Melbourne offering reliable solutions for all your tax and accounting needs.

ReplyDeleteNeed to outsource account tasks?We offers tailored solutions for UK firms, from daily bookkeeping to year-end reporting. Free up time, cut overheads, and scale efficiently with our certified accountants. Get a free consultation!

ReplyDeleteThank you for sharing valuable information

ReplyDeletecabinet comptable copropriété

QuickBooks Accounting in the USA and Canada is a prevalent software answer for businesses, delivering mechanisms to handle finances, track income and expenses, develop invoices, procedure payroll, and ready taxes. It assists users in simplifying accounting tasks, ensuring adherence to regulations, and keeping accurate financial records for more profitable decision-making.

ReplyDeleteQuickbooks Bookkeeping in the USA and Canada delivers businesses with an exhaustive solution to handle finances, track payments, generate invoices, and prepare taxes. With elements like real-time reporting, payroll processing, and seamless integration, it facilitates accounting tasks, providing accuracy, keeping with regulations, and efficient financial administration for businesses.

ReplyDeleteThey also provide support on VAT compliance necessities and accounts receivable services in UAE consisting of report-maintaining, invoicing, filling out VAT returns, etc.

ReplyDeleteThank you for sharing such valuable and helpful information and knowledge. This can give us more insights! Keep it up. I would love to see your next update.

ReplyDeleteAccounting Services in India

I’m glad to see your blogs these blogs usefully for all student who want grow future about Financial Accounting office management also helpfully college student who want submit his project really thanks full yours share this type of article on your blogs I never see other blogs information.

ReplyDeleteTop 10 office Management institute in Delhi NCR

Best Computer Institute in Delh

Graphic Designing Institute in Delhi NCR

Partnering with top accounts payable outsourcing companies ensures timely invoice processing, reduces errors, and improves cash flow management. Businesses can focus on strategic decisions while experts handle AP tasks.

ReplyDeleteLovely blog thanks for sharing online platform to everyone help read your blog for get information

ReplyDeleteData Analytics Course in Delhi

Best Computer Courses in Delhi

Really insightful post on SAP FICO and HANA—great to see accounting concepts explained alongside the technology that brings them to life. As systems become more advanced, it’s still vital to have human expertise guiding decisions. That’s where a UK VAT Specialist can add real value, ensuring compliance and clarity while businesses make the most of tools like SAP. A great blend of tech and professional knowledge here!

ReplyDeleteWhy Practical Learning Matters in Finance Education

ReplyDeleteAbsolutely agree! Practical exposure is the key to mastering accounting and taxation. At IICPA Institute, we integrate real-time GST, Tally, and Income Tax software training to ensure every student becomes job-ready. 💼

Accounting Course

Excel Certification Course

Tally Certification Course

HR Certification Course

Income Tax Certification Course

TDS Computation Course

Nice Post!!

ReplyDeletePlease look here at Corporate Tax Registration in Dubai

For multinational corporations, understanding both the headline rate and the exemptions is key. This level of detail is what high-quality accounting and tax preparation Stone Mountain should offer.

ReplyDelete