Chart of Accounts: ??

Chart of Accounts is the only way of organizing the whole accounts in our company. Chart of Accounts (COA) is the main and basic content in master data of General Ledger(GL) Accounts. COA is a variant which can be used for any company once defined and as it’s a variant obvi there will be lot of COAs defined in SAP system to workout with or user can define a new COA for his/her company.

For defining a COA u need

- COA key, Description

- Length of GL account number(1 to 10 digits)

- About cost elements

- Group COA

COST ELEMENT: and COST CENTRE??

All these cost elements or cost centres are the way of organizing the costs/expenses for the company. Cost element is individualised costs of a particular part of organization work. Ex, we will make cost elements like salary, rent, energy costs, etc.. So, its basic form of costs in organization and they play . There are 2 types of cost elements, Primary, Secondary & Revenue..

- Primary cost elements are cost objects which sit only in FI module of corresponding GL account either salary account or materials account etc.. Primary Cost elements distribute Expenses

- Secondary Cost elements are used extensively in CO module where internal cost flows are recorded and identified with cost elements but without cost elements in CO. Wen creating secondary cost elements, they should be valid from the first day of current fiscal year through the default 'valid to' date. Secondary Cost elements assess the expenses.

- Revenue Elements are used to analyse the revenues in cost controlling (CO) and they are actually part of primary cost elements. But SAP system categorizes them as revenue elements.

Cost Centre It is used for showing the expense on the whole department level like marketing, production, inventory, administration expenses etc..

Cost Center is Center in which costs are incurred. eg. department or plant or region, project etc

Cost Element. It represents expense a/c and revenue accounts. In controlling you call p&L items as cost element (because, these elements defines the basic costs company is going through)

What Chart of Accounts hold is first COA segregates the whole business operations into accounts which directly reflect in P&L statement and Balance Sheet. Cost elements can be maintained manually or automatically when a new GL is saved. SO, that gives a basic structure to divide costs or expenses and then revenues and other financial accounts can also be separated easily. For each cost element, you must define its category to make SAP system understand what sort of costs are being recorded in any particular cost element like administrative expenses or production expenses or inventory costs etc..

The biggest confusing stuff is in Controlling(CO) module GL accounts cannot be accessed and so financial reporting is done just by cost centres, profit centres and financial areas etc.. and this gives a huge stress to create a seamless and errorless implementation of SAP for any client as per their business process. Because CO module is what can be in today's world called as Business operations/ Operation team/Senior Management reporting.

Group COA can also be used but just for reporting purposes in cross-company way(for a Group of Companies). A directory containing GL accounts in our COA can be obtained by report RFSKPL00.(Know how to open a report, table, forms and how to change/edit them ?)

If company codes intend to use cross-company code controlling then both the company codes must have same COA.

HERE, Clearly SAP distributes information in 2 segments

- COA segment

- Company Code Segment

COA segments consists of

- Account umber

- Account (A/C) group( this is another important concept which is described in Customer/vendor accounts)

- Name of Account

- Control fields(to know account is of what type? is it a P&L A/c or B/S A/C)

- Consolidation fields(group A/C)

Once a company starts using COA assigned to it and If you change some characteristics of COA, things might get little confusing and so, COA must be studied first. In report RFSKTH00 all the COA account segments are managed. An Account is formed when Company code segment is added to COA segment.

Company code segment describes the needed and adds some more specifications to GL Account like an additional tax which is just for this company and might not be used in other companies which are using same COA. So, in Company Code Segment info is all about company related information like,

- Currency

- Taxes

- Reconciliation account

- Line item display

- Sort key

- Field status group

- House bank

- Interest calculation info

All the above points Can be specified to company's perspective for daily transactions.

Balance Sheet , P&L Accounts: SAP treats both the Balance sheet accounts and P&L Accounts separately when a new fiscal year starts.

- When SAP creates a Balance Sheet, it contains

- Assets(Cash, stock, assets, machinery, land etc)

- Liabilities(Short-term debt, long term debt)

- Equity

What does SAP do to these accounts in coming new fiscal year? What will it do to the balances? Answer is the present balance in these accounts gets carried into same account or we can say forwarded into same account or simple in general terms we can say the balances in these accounts won't change and SAP will post last year balances into this year into same accounts when year shifts.

- Coming to P&L accounts its different. The profit or balance is carry forwarded to retained earnings account and P&L statement account is set to zero. So that new Fiscal year revenues, costs and all P&L statement issues start new. Retained earnings is another name for Reserves& surplus in normal accounting.

COA contains many accounts and so they are grouped like cash accounts, material accounts, asset accounts etc.. And then we assign a non-overlapping number range for each account group. So, by using this way we can ensure that accounts are segregated and wont clash in daily operations as we number then separately. (Ex: Assets accounts will be in 100,000 series while profit & Loss accounts will be in 200,000 series .. By seeing the starting number we can figure out what sort of transaction is this) SAP gives us pre-defined Account groups.

We specify what sort of company specific changes are needed in the company code segment and the Account group in GL is responsible for its appearance. That means, we specify what we want to look or see from company code segment using field status group on the screen for display.

Each field in company code(cocode) segment has its own properties to hide/ display/ this entry is required / whether this entry is optional during line entry. When you are posting a customer invoice we need basic details of this transaction like customer ID or name, Customer account number in our GL, number of products, products categories if needed, date to ship etc.. But we don’t need these customer account fields in salary transactions. So, we need to figure out what are the needed fields to be displayed and must be filled(required field, optional field etc..) when creating a document for different types of transactions and this can be done in field status. Fields can be grouped and they are called as Field Status Groups.

The fields 'Accounts Currency' and 'Field Status Group' are under required entry fields and their status cannot be changed. As per above explanation Account group controls the fields to be displayed in the GL master record, but it also can be changed by the transaction-specific control. During transaction if consultant doesn't want to allow transaction-specific data to modify the master- data but just want to display some field(s), he/she can specify a particular field is not modifiable in 'change Master data' .

Now the issue is with end-users, and what they want?. Fields displayed in GL account master record can be edited by transaction-specific master data(Document entry). So, how much SAP consultant should allow client to change this master data is dependent on many factors.

Reconciliation accounts are GL accounts assigned to business partner/Head quarters master record to record all the transaction of subledger (SL). Subledger are like internal division of GL like Accounts payable (AP), Accounts Receivables (AR), Asset Accounting (AA) etc.. So, All the posting in subledger will be automatically posted to reconciliation accounts.

Types of Account types:

S - GL Accounts

A - Fixed Asset Accounts

M - Material Accounts

D - Customer Accounts

K - Vendor Accounts

Line Item Display:

- For Accounts without 'Line Item Display', only figures in the transaction are updated when document is posted. When user wants to see the account online, he can see only balance

- For Accounts with 'Line Item Display', the important data from the posted line items is stored in special index table, which obvi consumes a little more data but when user checks account online, He/she will be able to see both the balance and individual line items

Report RFSEPA01 can be used to activate line item display. Line items display must be used when there is no other way to see line items and it must be activated for

- Reconciliation Accounts ( Subledgers will manage line items)

- Revenue Accounts (Sales order management application will maintain line items)

- Material Stock Accounts ( Purchasing management application maintains the line items)

- Tax Accounts ( ac items are only useful in connection with document; tax amounts are already checked when document is being posted)

A transaction is open(open item management) when the money flow is incomplete or goods for a transaction is incomplete. And when the flow finishes fully as per the invoice, then the transaction is cleared until then it's called as open transaction. In SAP, open and cleared items can be displayed separately and this gives a easy way to close/clear the transaction.

Normally open item management is used for

- Bank clearing accounts

- Clearing accounts for goods receipt/invoice receipt

- Salary clearing accounts

There are some 'ledger-specific clearing settings' and which are not discussed now, but can give more depth

Sometimes, In need user can see the transaction amounts in different currency other than local currency(currency specified in GL) and its easily possible by specifying the currency.

Indicator 'Only Balances in Local currency' can be selected in maser record if other currencies are not needed. This indicator field must be selected for clearing the transaction or else exchange rate differences might arise while clearing. Other indicator 'Without necessitating exchange rate difference postings' must be selected for international transaction between two currencies. These indicators are normally used for Cash Discount and GR/IR accounts.

'Without necessitating exchange rate differences' can be much more used for foreign assets as the exchange rate differences are not considered and its normally used for liquid finance investments which are considered for cash flows.

Creating GL Master data:

- Manual Creation:

- Two-step method(COA Segment & Company Code Segment): Here COA segment is created separately from Cocode segment. This will allow GL accounts only in COA segment or in multiple co-code segments

- One-step method: Here, GL account is created in specified cocode segment and then above step is repeated to create GL account in additional cocodes if needed.

- Creating By copying:

- An extension of existing account can be done by creating a new Account with reference to existing account. Ex: Another Cash Account can be made by referencing one at present being used.

- If all GL accounts in a company 1 are required in company 2, that can be done by copying the company code segment 1 to company code segment 2,Here entire cocode segment 1 is copied.

- A new COA can be created by copying an existing COA with account determination.

- DATA Transfer:

- Programs are used to reduce data entry like RFBISA00, Batch Input for GL account master data, which can be modified by ABAP skills to transfer new COA.

Group Chart of Accounts is normally used for cross-company reporting purposes.

- This Group COA must contain all the group accounts.

- Group COA must be assigned to operational COA and 'Group Account number' in COA segment of operational COA is required entry

- Different account in one operational COA can refer to same group account like Cash and Bank a/c pointing at same group a/c

- Disadvantage is the controlling part!! As different operational COA is used, inter-cocode controlling is not possible.

- TO overcome this disadvantage country COA can be used to navigate through cross-company code controlling easily.

PS: You must check how group of accounts effect the CO module and mainly Cost accounting and Profit-centre accounting.

Practice:

Task -1:

The accounting department requires additional GL accounts to handle authorized travel expenses and disbursements. An authorized travel expense is an expense over Rs 10,000 approved by accounting manager. The expense account numbers must fall with in the range of AE0000 to AE9999. The disbursement account numbers must fall in range of CD0000 to CD9999

Sol) When we copied company 1000 in previous exercise, we copied even COA and Company segment of cocode. All the account groups are also copied with COA. For GL a/cs mentioned in business scenario above, the accounting department needs additional account groups , one to expenses and one for disbursement.

Copy Account group 'ERG' within your COA (INT) to new account group AE# with description 'authorized expenses ##'. Change number range to AE0000-AE9999

Copy Account group 'SAKO' in your COA (INT) to new account group CD## with descriptoin 'cash expenses##' change number range to CD0000 - CD9999.

Goto SPRO - FA(NEW) - GL Accounting (NEW) - Master data - GL Accounts - Preparations - Define Account Group

Scroll down to see COA - INT

Select SAKO, General GL Account II and ERG, P& L stmt Account for your accounts

Press 'copy as'

Overwrite ERG with following ( In European Keyboard # in SAP is pound symbol)

Account Group AE# Name Authorized Expenses ## From Acount AE0000 To Account AE9999

Then Overwrite SAKO account group with following

| Account Group | CD## |

| Name | Cash Disbursements ## |

| From Account | CD0000 |

| To Account | CD9999 |

Save…You must see AE## and CD## in INT coa as shown in pic below…

Task - 2:

Create 3 GL accounts: Two for Authorised Expenses (Entertainment expenses, Sports car rental) and one for cash payments. As we did in previous step, use the new AE## and CD## for new accounts and look out COA of your Company code, look what must be created described below

Account number: AE01##, AE02##, CD03##

Reference account numbers: for AE01## and AE02## -> GL Account 400000

For account cd03## -> gl account 113100

PS: Pls delete the entry 'Alternative Account Number'

- Create GL Account (Expense Accounts)

Goto SAP Easy Access menu - Acounting - FA - GL - Master Data - GL Accounts - Individual Processing - Centrally

Or type FS00 tcode. Here, type

| GL Account | AE01## |

| Cocode | GEM |

- Choose GL Account - Choose with template

| Account number | 400000 |

| Cocode | GEM |

Now goto 'Control data' tab and de-select alternative account number and then Save after the whole data is entered and you must be able to save without error!

Similarly finish the above step for AE02## account too and in process de-select the 'alternative account number' before 'save'

- To create GL Account Cash payment CD03## go to same screen above, I mean FS00

| GL Account | CD03## |

| Cocode | GEM |

Now click 'Create with template'

| Account number | 113100 |

| Cocode | GEM |

Fill the following data

| Account Group | Cash disbursements## |

| Short text | Disbursements GEM## |

| GL Account long test | Cash disbursements GEM## |

| Group account number | 110100 |

In control data tab, de-select 'Alternative account number' and 'save'

- To view your Chart of Accounts

SAP EASY ACCESS MENU - ACCounting - FA - GL - IS - GL repots(NEW) - Master data - GL Accounts list

Give this info

| COA | INT |

| Cocode | GEM |

Then click execute..

As you see in the executed report - I created AE01#, AE02## and CD03## as pointed out.

Now go back and look at what are the conditions for cross-company code controlling, Foreign currency options while posting for a GL Account, line-item display, difference in local currency & foreign currency and reconciliation accounts above..

Profit centre & Segments (Very Important)

In a company tree, we keep some elements at nodes which track all the transaction going to various parts of the company by that nodal point. These elements yearly will be used to give out reporting (Bal sheet and P&L stmt) information as transactions are tracked by them. We assign the elements in company tree based on different criteria like Geography, products, markets etc.. We use such elements to give a detailed look of business activities happening across the criteria like geographical area, products etc. and track the developments/projects too. There is reporting methodology called as 'Segment reporting' to see the report of a particular element in a node in real-time.

SEGMENT REPORTING

Scenario Highlights

The purpose of segment reporting is to provide a breakdown of data in financial statements by individual enterprise areas such as divisions, or geographical areas..

Function List

The purpose of segment reporting is to make the profit and risk situation of individual enterprise areas (segments) transparent. segment reporting must be configured in accordance with specific customer requirements, report enabling a balance sheet and profit and loss account to be drawn up for each segment

The following functions are provided to support this building block:

- Posting a G/L account document with different segments

- Period end processing

- Balance sheets and P&L statements

- Cost of Sales Accounting – P&L statements

- Receivables and payables by segments

Key Points

- In accordance with special accounting principles such as IAS/ IFRS/ US GAAP, segment reporting is required for product–related enterprise areas.

- The results from individual segments of the company are present.

From <http://help.sap.com/bp_bl604/BBLibrary/HTML/166_EN_US.htm>

'Segment' is a field/character of new standard account assignment object which helps to create evaluations for elements/objects. So, what I mean is How can an nodal element track the transactions? It must have a character to understand the transaction and this character is 'segment' which is an account assignment object.

What is Account Assignment object?

An object to which costs or quantities are posted in Controlling. Account assignment objects can be objects such as cost centres, internal orders, projects, or business processes.

From <http://help.sap.com/saphelp_nwce71/helpdata/en/35/2aa41e88e65cd5e10000009b38f974/content.htm>

- Profit Centre

- Business area

- Profitability Segment of CO-PA

- User-define field

Are alternative account assignment objects which are commonly used.

When you create a profit centre for a master data, segment is enabled automatically by ER system. Postings in segment are done when postings in profit centre are done. But, there is no 'dummy segment posting' as in profit-centre logic and if profit centre doesn't have a segment, the segment account assignment is also not there. At standard level of customization, segment is derived from profit-centre.

Segments are defined in client-level while profit centres and cost centres are defined in controlling area level.

Now, profit-centres accounting being a part of controlling (CO) module , it give a headache to get segments officially in FI module. Looks at SAP NOTE 1035140 on this topic. We will deal with this later in CO module!!

If segment is not possible to be derived from profit centre master record, then other methods must be found to assign a segment

- Manual entry

- BAdI implementation (FAGL_DERIVE_SEGMENT)

- Defining substitution rules

- Standard account assignment

REMEMBER: SAP ASAP methodology recommends to make the result: Behind your cost centre(CGEM) is your profit centre(PGEM) and behind it is your segment(SGEM). CGEM, PGEM and SGEM are part of our company tree structure of SAP configuration in this tutorial.

PRACTICE:(Create segment, Profit centre and cost centre)

TASK -1 : Create segment SGEM (main business field in your company) with name 'services'

SPRO - ES - Definition - FA - Define Segment

| Fieldname | Value |

| SGEM | Service group ## |

Then you must have 'SGEM' as shown below

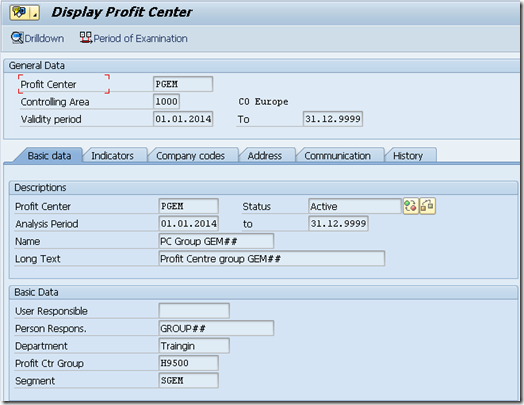

TASK-2: Create Profit Centre and activate it

SAP easy access - Accounting - FA - GL - Master records - Profit centre - Individual processing - Create ( KE51)… here choose, 1000: Create profit centre

Create and new entry using template profit centre, as given below

| Field name/data type | Value |

| Analysis Time frame | 01/01/1999 to 12/3/9999 |

| Name | PC Group GEM## |

| Long text | Profit centre group gem## |

| Responsible user | Leave empty |

| Person Responsible | Group## |

| Department | Training |

| Profit group centre | H9500(Training) |

| Segment | SGEM |

Save by clicking ctrl+s or floppy disk icon above

Activate using magic-wand symbol, then go back and click on 'display' in same access menu used above to 'create' and check out

Task -3 : Create Cost Centre (CGEM) with template cost centre-1000 in controlling are-1000

SAP Easy access - Accounting - Controlling - Cost centre Accounting - Master data - Cost centre – Individual processing – Create

| Field Name/Data type | Values |

| Cost Centre | CGEM (With template 1000) |

| Analysts time frame | 1/1/1999 to 12/3/9999 |

| Name | CGEM |

| Description | Cost Centre group GEM London |

| Responsible user | Empty |

| Person responsible | Group ## |

| Department | Training |

| Category of cost centre | Administration |

| Hierarchy Are | H1120 - Internal Services |

| Company code | GEM |

| Business area | 9900 |

| Functional area | 400 Admin |

| Profit Centre | PGEM |

Segments can be assigned to any structure and to any cross-company codes along with to many profit centres if needed. They don’t have time-frame functionality so, they can't be viewed or activated or changed…

Customer / Vendor Accounts:(Subledger Accounts)

Similar to GL , customer and Vendor accounts have 2 segments

- General Data: which can be accessed by whole organization and this segment is at client level

- Company-code specific data: which is a segment in company code level. Any company that wishes to do business with any specific customer or vendor must create a company code segment for this customer or vendor and this also creates customer/vendor account .

Reports RFBIDE10/RFBIKR10 (remember, DE - customer, KI- vendor in german) are used to transfer customer/vendor master data which is in source company code into another company code. Now, what is the purpose of customer if we are unable to process sales to any customer. That's why ‘sales area segment’ can be created to keep contact between sales and distribution department and customer.

In the same way, to connect Vendor and MM department, purchasing organisation segment is formed in MM module so that purchasing department can do business directly.

So, Customer Account consists of 3 segments:

- General data at client level

- Company code segment

- Sales area segment( it is a .org unit defined in SD module)

Account number to make transaction with customer will be given at client-level/production system and it won't be added in development system. Becoz we don't know how many sales areas are assigned to the customer company codes in client's business.

In same way of sales area, vendor account consists of 3 segments

- General data at client level

- Company code segment

- Purchasing organization segment( .org unit in MM module)

Here also, Account numbers for vendors will be assigned in client-level becoz we cant know how many vendors are there with same company codes and If assigned in development system , that might confuse the client.

The big part of fight between SD guy and FICO guy is the control on maser data. FICO and SD consultant must discuss who should control the master data of customer/vendors. This depends on the requirements of the client. But, for this course purpose we will assume customer/vendor master records will be maintained in Financial Accounting. (In this case, Accounts receivables people will be very red on FICO guys) But as you are being trained its better to learn completely.

In the same way, it’s a hurdle with vendor master records. They can also be either maintained centrally in the system to be accessed by all areas or separately for Financial Accounting and Material management department. For this course we will assume, Vendor master records will be maintained in Financial accounting.. (Accounts payables team should work together with FICO guys in such case and they might be pissed off if transaction are not happening).

Is much easier to keep customer/vendor master records centrally as any error will force everyone to look out for solution. But, in other cases if purchasing management/sales order management creates their own segments of master records while accounting departments creates its own segment of master record then there might be a risk of creating incomplete or duplicate master records. In such cases RFDKAG00 is run to compare customer master data and report RFKKAG00 is run to compare vendor master data.

To avoid duplication

- Use matchcode to check before creating new accounts

- Activate automatic duplication checks

What will be there in customer/vendor account?

There will be many fields in their accounts(general data segment) and important fields are

- Search terms: Abbreviation for customer/vendor name is normally used in this field

- Group: Sometimes, customer and vendors belonging to same corporate group can be bundled as user-defined group key. This key can be used to run reports, transaction processing or for matchcodes.

- Clerk/accounting: The name of accounting person/team must be saved as ID. This ID can be used in customer/vendor master records in such a way that clerk will be responsible and concerned with this maser records. This ID can be used for dunning and payment proposal lists. (What are they?? Google it first:

You can use dunning notices or payment reminders to remind customers about amounts due (outstanding receivables).You can use a dunning run to determine on a regular basis all the invoices and down payment requests for which payment is overdue or due shortly. The run generates a dunning proposal list, which you can review and edit before the dunning notices or payment reminders are created. The dunning run bases its proposals on the dunning strategy defined in configuration.

Line item display and open-item management for customer/vendor account will be configured in standard way. What is one-time account/ reference account?

One-Time Accounts :

For customers whom you only supply once or rarely, you can create a special customer master record, the master record for "one-time accounts". In contrast to other master records, no data specific to a single customer is stored in the one-time master record, since this account is used for more than one common/normal customers practically. The customer-specific entries such as address and bank details are not entered until the document for the transaction is entered into the system.

IF You invoice a customer who purchased goods from you because his main vendor could not supply them. In this case, you post the invoice to a one-time customer account instead of creating a separate master record.

Features:

When you post to a one-time account, the system automatically goes to a master data screen. On this screen, you enter the specific master data for the customer, which is stored separately in the document. This includes name, address, and bank data, for example.

You process the master record for a one-time account in the same way as you process all other customer master records. You can do open items from it with the dunning program or pay items using the payment program. The functions for one-time customers are only different in a few aspects. For example, you cannot clear amounts with a vendor.

Account Group

Customer master records for one-time accounts are created with their own account groups. Via this account group the customer-specific fields (such as Name, Address and Bank details) are hidden from display when you enter the customer master record. You enter this data when you enter the document.

Reference Account Group

You can specify a reference account group in the Control group in the general data area. This account group determines the status of fields when posting to the one-time account, that is, what fields are displayed and which ones require an entry. The fields are controlled in the same manner when you display or change a one-time document, although the document change rules also determine whether a field can be changed or not.

If you do not specify a reference account group, every field on the one-time account screen is ready for input during document entry.

You can use an existing account group as your reference account group or you can create an account group especially for this purpose. For more information on this, see the Define Account Groups with Screen Layout (Customers) activity in the Implementation Guide (IMG) for Accounts Receivable and Accounts Payable.

Reconciliation Accounts

To create one-time master records, you have to specify a reconciliation account. If you differentiate between reconciliation accounts in your company, you will need to take this into account when creating one-time master records. You may, for instance, have different reconciliation accounts for domestic and foreign receivables. You would then have to create two one-time master records.

Line Item Display

For line item display, you should enter a key for sorting line items in the Sort key field. Keys 022 and 023 are provided in the standard system. You may define other keys that are specific to your company. Keys 022 and 023 have the following meanings:

Enter 022 to have the system sort and display line items by name and city.

Enter 023 to have the system sort and display line items by city and name. The line items of customers in the same city are displayed together.

Sort criteria can also be specified when entering a document. These criteria will override the sort keys specified in the master record.

Activities

When creating a one-time account, use the appropriate account group (such as "one-time account" in the standard system).

So, While posting a transaction for customer/vendor If some info is not given reference account/one-time account will be used. For every account group a reference account is recommended to be created.

In Financial Accounting, once Account groups are created, no longer they can be changed. However, If accounting/clerk roles are shared with Sales and distributions guy then some information can be changed in certain circumstances. We will delve in to that later.

In COA topic, we didn't discuss more about Account groups: This is best time to discuss it

ACCOUNT GROUPS:

Account group is group of accounts used for a particular purpose in Balance sheet or P&L stmt. Account group effects the way master data is created for that account (ex: Customer/vendor, AP, AR etc)

Account group controls the following:

- Number ranges of accounts

- Status of fields in master record for all three segments

- If account is one-time, customer or vendor!!

There are external number assignment and internal number assignment used by specifying a number range interval in each account group. This number ranges for customer accounts and vendor accounts must be separate and must not overlap. But in GL Account groups number ranges can overlap if needed. Number range of GL Accounts is always external while number ranges for customer/vendor a/cs can be external or internal. External means manually entered while internal means system creates the number automatically. Once a number range is assigned to an account group other number range cannot be assigned.

As part of one-time account, a special customer and special vendor master record is created. These records will contain receivables and payables for one-time customers/vendors. Being the nature of its usage, one-time account is used for more than one customer/vendor and so specific info is normally hidden.

As Account group controls the fields in master record, We must be careful in the status of fields being used as per HDRO ( Hide- Display - Required - Optional ) Hierarchy for both the fields like

- Transaction specific field status: Field status can be dependent on transaction master data like transactions to reconciliation accounts or one-time accounts which asks for a change in field status (create, change or display) like only 'Display' option selected for reconciliation account field so it cannot be changed.

- Account-group specific field status: As we all know Account group controls the field status and which means all accounts in an account group will contain same screen layout and fields for posting.

- Company-code specific field status: Now as explained below customer/vendor master record will have fields which are by company-code specific layout. We could have a specific privileges to some customers for whom transactions might be less taxed or discounted more than normal transaction or stop dunning process for a specific company-code etc..

If in such a complex field status which one of the above is followed during transactions??

The answer is all the field status above are compared and fields with highest priority are used. If a field is 'displayed' in transaction level, then that field might be displayed or suppressed by the system as there is no way to make transaction with 'display'.

In any case, for not to use both the transaction-level and company- code level field status of all fields will be 'optional' and this will give account-group field status a priority in system control. Ex: TDS/ withholding tax related info can be suppressed in company codes of gulf countries. So, Tax related fields will be suppressed as part of this customer in account group.

SAP implementation is all about making client connecting with his company's customer/vendor to make business seamlessly and so, these customer/vendor master records are very important for any SAP consultant. There might be a situation where sensitivity of information could get conflicted like payment a/c number changed etc. In such cases dual control principle is used so that one person makes the necessary changes and other person confirms these critical customer/vendor changes. First, dual control must be defined in customer/vendor master records in IMG. And if a field in customer/vendor master record is given 'sensitive' then any entry change will block that corresponding customer/vendor. This block will be removed unless second person in authorization checks the change and confirms it or rejects it.

All the changes for confirmation might include a single customer/vendor or a whole list containing many and this list is restricted by,

- Particular Customer/vendor

- Particular Company code

- Accounts not yet confirmed

- Accounts rejected

- Accounts to be confirmed by me

- Changes in Customer/vendor master record for all accounts can be displayed using reports RFDABL00 or RFKABL00

In cases where, customer is also a vendor or vice versa.. Things get little complicated and should be looked in detail transaction process. The big hurdle comes from payment , dunning and open items. so vendor account number will be added in customer master to make the link between or vice versa customer account number in vendor master. Ex: Lets say we have steel company, and one of our vendor (vendor -Z) sells us a product which is a type of steel called as steel-z while our company changes steel-z in to steel-y(a costly process) and sells in market. Now, vendor-z wants to buy steel-y from us regularly becoming a customer. So, we create a customer field for vendor-z and make the transaction. Here some of our previous orders with this vendor are still open, then when vendor-z orders steel-y then in posting, dunning program will interpret that as vendor and customer are same, it will try to clear previous open item. But, this depends on the way our company and vendor-z wants to make the transactions. We might accept clearing or we might not!!. If clearing to be used then just selecting a field 'Clearing with vendor' in customer account (OR) field 'Clearing with Customer' in vendor account must be selected or else don’t select. One live question is, what if this vendor/customer is a part of our group/parent company? Try posting this question in scn.sap.com

(This SCN is SAP Community Network which is a huge knowledge database, For every question, answers will flow in matter of hours which shows the dedication of some of consultants in SAP community and its better to get in touch with them. Mainly I want everyone to look at this post by Ravi Shankar Venna

Alternative Payer: It is a customer paying bon behalf of another customer.

Alternative Payee: It is a vendor deceiving payment o behalf of another vendor.

Info about alternative payer/payee can be entered in client or cocode level. If alternative payee/payer is already an existing customer/vendor then respective customer/vendor account must be entered/permitted as payee/payer in master record.

Using 'Individual Specification indicator' while creating the invoice, information about alternative payee/payer details can be entered for a customer/vendor who is not been created in the present ERP system.

Sometimes, there will be a geographical difference in cash flow and goods flow. A customer might place order by a local branch and will pay invoice by head office or central office. This can be reflected in SAP system using a field 'head office and branch accounts'. So, items posted in branch account are automatically transferred to head office by dunning process. But if 'Decentralized processing' field is selected in head office master record, then dunning and payment programs use branch office account.

RFDKVZ00/RFKKVZ00 can be used to know the customers/vendors with head offices and their branches.

Practice:

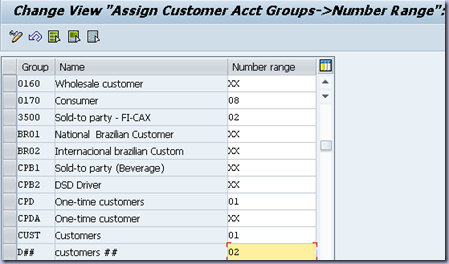

Task-1: Create Account group 'D##' with description 'customer ##' for regular customer accounts, DO this by copying KUNA and configuring D## as per the business scenario. Assign number range 02 to the account group::

SOL) Do not change the number ranges since they are valid for all company codes!

SPRO - FA(NEW) - Accounts receivables and accounts payables - customer accounts - master data - preparation for creation of customer master data - Define Account Groups with screen layout (customers)

Select 'Kuna General Customer'

Edit - copy As

Then overwrite with following

| Fieldname or data type | Values |

| Account Group | D## |

| Name | Customer ## |

To edit field status , double -click on 'company code data'

Double click on 'payment transactions' and make one change as given below

| Enter Terms of Payment | Required entry |

Save..

After saving you must be able to see D## in the list of KUNA as shown below

Assign number range for the new created customer account group 'D##' by going through.. Goto XDN1 to check the number ranges available

SPRO - FA (NEW) - AR and AP - Customer accounts - master data - Preparation for creating customer master data - assign number ranges to customer account groups

Here, search for 'D##' in group field and change the number range to '02' and save

Task -2:

Create a regular customer account with in new account group 'D##'

goto SAP EASY Access menu - Accounting - Financial Accounting - Accounts receivable - master data - create

Give the following details in the create screen and press - tick mark

Leave 'customer' field blank.. A warning error might pop up saying company '1000' is sold off to 0001 company but don’t worry.. Just press enter twice to overcome the waning!!

After you pressed tick mark it might take time and SAP system will ask more details regarding the customer and so give the following data in 'Address' tab

| Field name or data type | Value |

| Name | Your choice!! ( I'll say 'Sapphire Brazil' or 'Ruby Italy' etc. I'm taking ruby Italy so that currency can be Euro) |

| Search item | GEM |

| Street/house num | Your choice |

| Postal code/city | Your choice |

| Country/region | Course country |

Now select 'Control data' tab page

Just type '4711' in corporate group field and then press 'company code data' in top tab.

Choose 'Account management' and fill the reconciliation account with 140000-Trade receivables-Domestic

Choose 'Payment Transaction' tab page

Terms of payment - '0002'

Save…. And we will talk about tolerance group and there are some more important stuff which we will discuss later when its importance comes in our tutorial. For now just hover on…

Record your customer number:: 100211… This number might be different in your system and so after saving, you need to note down the whole number which appears just as shown below on the status bar of your screen.

I made something a bit beyond .. I actually added even the 'Automatic payments option' which is just below the 'Terms of payment' we changed as in previous step.. We will look at this issue in automatic payment concept but for now, its just a greek and latin for you so don’t worry but remember there is a way for automatic payment and lot of options are visible/available for a customer.

Task -3:

Create a vendor groups k##

Similar to above method of creating customer gothorugh

SPRO - FA (NEW) - AR and AP - Vendor accounts - Master data - Preparation for creating vendor accounts - define account groups with screen layout.

Choose 'KRED Vendors' and then click 'copy as' button above. And enter the following details

| Field name | Values |

| Account group | K## |

| Name | Vendors ## |

Double click on 'General data' to edit field status and double click on 'address'

- Change 'Search Term B' as required entry

Choose 'back' or press F3

Double click on 'Contact person'

- Change field name 'contact person' to 'Hide/suppress'

SAVE>>

But remember, in some systems I found something peculiar here.. After creating D## or K## and without assigning number ranges if you logout and login again, then D##/K## cannot be found in the list of account groups.. This might not be that important but I find it peculiar because, after saving ay data SAP system will keep it but that's not the case here..

Now number range assignment:::

Got IMG - FA(NEW) - AR and AP - Vendor accounts - master data - preparation for creating vendor master data - Assign number ranges to vendor account groups.

| Field name | Values |

| Group | k## |

| Number range | XX |

If it gives a warning that number range not in your group number! Just press enter twice to save..

PlS TRY TO KNOW WHAT IS THE ISSUE WITH NUMBER RANGE BY ANY PRO TO KNOW MORE OR SEARCH on it.. I will speak about the importance of number ranges later in Controlling (CO) but not now…

TASK-4 )

Create a normal vendor account Vendor in Vendor account group k## just created in above step

Use 1000 company code as template vendor

SAP easy access - Accounting - Financial Accounting - Accounts Payable - Master records - create

| Field name | Value |

| Vendor | Vendor## |

| Company code | GEM |

| Account group | K## |

| Refe | 1000 |

Enter..

Lets take some sort of mining company (DE BEERS) as our vendor so that we can buy some raw diamonds /precious metals directly and I want to select its location as UK country to this vendor to keep currency in Euro.. (no exchange rate needed for this vendor being in EURO)

In Address page..

| Field name | Values |

| Name | Here its your choice |

| Street | Ur choice |

| Search item 1 (A) | GEM |

| Search item (B) | Vendor last name(to make things easy) |

| Postal code | Ur choice |

| Country | Country |

Select 'EN' for english language

SAVE:::(optional)

There are some issues like you cannot enter a second search item in the table above because of some settings select every available automatic payment options and save if a n error is given out about automatic payment options. But I want to enter more data and so Press F8 or click next screen button…

- Enter '4711' in corporate group' field

- Press next screen until you will get 'payment transactions accounting' as title.. Here, enter '160000' as reconciliation account and 'A1 - Domestic' as cash management group

- Click 'next screen and type '0001' for 'payment term'

- Save it….

Cash management group as 'A1' is useful to make cash flow projections and so it gives information to management regarding cash flow.. You can see lot of fields here regarding interest, withholding tax etc.. We will deal with them during transactions but not now..

TASK-5:

Now, AS per our previous entries we found that one search item cannot be entered as there was no field as another search item in vendor master record entry or customer master record entry.. To make the new search item available we have to do some changes

Goto Sap easy access menu - Accounting - FA - AP - Master data – Change

| Field name | Values |

| Vendor | Vendor## |

| Company code | GEM |

| Address | tick |

Press 'Enter' Here if only one search item is available in fields then we need to check for field 'Search item B' priority in account group info.

To check a field status in account group :

IMG - FA (NEW) - AR and AP - Vendor Accounts - master data - preparation for creating vendor master data - define account groups with screen layout (vendors)

Here, select 'General data' and in that select 'address' .. Here, a list of fields will be displayed along with their priority… I saw that 'Search term B' is actually in same priority as 'search term 1/2' where both are in 'required entry' mode.

So then it must be something with transaction master data trying to stop 'search term B' as transaction master data also effects the fields display

Goto IMG - FA (NEW) - AR and AP - Vendor accounts - Master data - preparations for creating vendor master data - Define screen layout per activity (vendor)

Click on 'Create Vendor (Accounting)' and click on 'General data' to get a fields status list..

Here click on 'Address' and check out the field 'Search item B' in the list.. It will be suppressed as you came this far after checking account group data..

Change the priority of 'Search Item B' to 'Required entry' and save..

Now, go back to the screen where a list appears containing ;’Change Vendor(accounting)' below 'Create Vendor (Accounting)'.. Click 'Change vendor' and click on General Data then Address and then make Search Item B a required entry

Also, I made the same changes in Display vendor too..

Now, the data can be entered in field Search Item 2(B) in any vendor and any user. So, transaction dependant field status are not specific to a particular company code, rather like it’s a layer of settings on company code and account group settings..

Tocheck these changes goto SAP easy acces menu- FA - AP - Master records - Change.

Here, you can see another new search field after the first one.. Don’t enter anything now, as it is a required entry you can exit without entering any data.. So just click 'CANCEL' or F12 to cancel any info entry in this screen for now.

To know why SAP system listens to Transaction-dependant data .. Click on documentation or page icon just beside the IMG activity DEFINE SCREEN LAYOUT PER ACTIVITY (VENDORS) where u can find that even though in Account group says a field is Required Entry SYSTEM listens to transaction-record and if it says Hide then it hides the fields. Now, try to know What status all fields must be in transaction-specific to only be controlled by account group data??

TASK - 6:

Our client is a sensitive finance guy and wants a specific and is very particular way of interacting with the system. He wants to record the type of vendor by using first search field like, supplies, equipment, etc.. So, he wants the first search field to be a sensitive one with company code in second search field. So, indirectly he wants authority to confirm any changes made to this sensitive search field or first search field.

Sol)

You can define fields as “sensitive” in the customer and vendor master records. If you define a field in the customer/vendor master record as sensitive, the corresponding customer/vendor account is blocked for payment if the entry in this field is changed. To remove the block, a second person with authorization must check the change, and confirm or reject it.

From <http://help.sap.com/saphelp_erp60_sp/helpdata/en/ee/45c83843e49f63e10000000a114084/content.htm>

First, we need to define that Search Field 1(A) is a sensitive field and so goto

IMG - FA(NEW) - AR and AP - Vendor Accounts - Master Data - Preparation for creation of vendor master data - Define Sensitive fields for dual control (vendors)

Click New Entries ..click on input help in 'Field Name' and click on 'Search Item 1(A)(ADRC-SORT1)' so that it appears on the list as shown below

Save..But

Remember: Sensitivity changes are not company code specific and so, there are many chances that this field is already setup by another SAP person, If you are working in SAP multi-user environment.

Now, to change the properties of this field as per the needy usage of client we must change vendor master record… so goto

Sap easy access menu - accounting - FA - AP - Master data – change

| Field name | Values |

| Vendor | Vendor## |

| Company code | GEM |

| Address | Tick |

Press 'Enter'

| Field name | Values |

| Search term 1 | Supplies |

| Search term 2 | GEM |

Now press Enter and for any more changes and then 'SAVE' and as per dual control rules… Every change must be authorized by other person so..

To confirm the vendor master record change

SAP Easy access - Accounting - Financial Accounting - AP - Master data - Confirmation of change - single

Here, 'Vendor - Vendor##' and 'company code - GEM' press enter

Click 'changes to sensitive fields' to check the changes.. Double click several time on the field name to display detailed info about the changes…select green arrow to return to main screen and the choose 'Confirm' to confirm the changes made by the other person…

In the above task, to confirm vendor changes accounting clerk is required but in the sap FK08(confirmation of changes) screen, I am unable to confirm the changes as 'confirm' button is greyed out as shown below

And this was a problem to finish the task, I finished it by creating a new-user. Goto SU01 and create a new user by clicking 'create' and finish off the new-user settings with same profiles of the present-user so the new-user will and can have authority to confirm the changes and at last save the settings. After creating new user, I logged in as new user and confirmed the changes.

SAVE after confirming ..

NOTE:

- UNDERSTAND THE STRUCTURE OF CUSTOMER AND VENDOR ACCOUNTS

- FIND OUT THE DIFFERENCE IN GENEREL LEDGER, CUSTOMER ACCOUNTS AND VENDOR ACCOUNTS

- HOW TO MAINTAIN THE CUSTOMER AND VENDOR ACCOUNTS(MORE INFO WILL BE GIVEN IN LATER PART OF TUROTIAL)

- HOW TO MAINTAIN SOME EXCLUSIVE RELATIONS IN CUSTOMER AND VENDO ACCOUNTS.

Hello my dear,

ReplyDeleteI see your blog every day ... your blog is very useful for me and I love so much ...

You can see also ..

Learn our step by step method on how to become a SAP consultant with our Zero to Expert program

Visit Now - SAP FI/CO Training

I must thank you for the efforts you have put in penning this site. I am hoping to check out the same high-grade content by you later on as well. In truth, your creative writing abilities has inspired me to get my own, personal blog now..

ReplyDeleteSAP Training in Chennai | SAP FICO Training in Chennai | SAP ABAP Training in Chennai

Thanks for sharing this Informative content. Well explained. Got to learn new things from your Blog on SAP online access .Sap Success Factor Online Access

ReplyDeleteoracle rac online training

ReplyDeleteoffice 365 online training

business analyst online training