Each transaction in SAP system is saved as document and it remains as complete unit until archived. Every company will be having a different set of transactions like customer/sales transactions, vendor transactions, etc. And this brings the need to define different set of unique document types for each transaction so that they can be picked up easily by the internal auditors to authorise and plan the expenses. Also, the uniqueness is needed between documents as various transaction require different set of data to be entered in the document like vendor transactions and sales transactions are completely different type and also there might be changes in tax for each transaction. Some data might be optional in a transaction while in other transaction the same data will be required and mandatory. All these reasons will ask for different document types.

Unique fields on document are

- Document number (Which will be in a Number Range)

- Company code

- Fiscal year

Each document will contain

- Document Header: Info which segregates the data in entire document

- Line items which specify what is being transferred between the accounts. First, posting is done using Accounting(AC) interface which represent the applications like sales order mgmt, purchasing mgmt etc. So, when a document is posted then system generates an accounting document(invoice, receipt, memo etc) which will have some fields(mostly identical) and more importantly items.

The document is controlled by

- Document type: which is internally a Document header

- Posting Key: needed for line items

As discussed above, at least one document will be generated for every business transaction along with a document number. Normally, this number is assigned by the system (if Internal) or user(if external setting are used).

If goods arrive from a vendor, then material document will be generated as part of inventory management and then financial document will be generated to give financial relevant data in GL account and amounts. So, for every transaction atleast one document will be generated. In this way, every transaction in any part of SAP system will be reflected financially by a Financial-document in each transaction.

Use RFBELJ00 to create a document journal in system. Most important data can be saved as a table for selected documents by using document headers and line items. Use reports RFBUEB00 and RFBUEB01 to find document in system

As discussed above, the different types of document types are

- S - GL document

- A - Fixed Asset

- M - Material

- D - Customer

- K - Vendor

Document types will define the

- set of number ranges that must be used externally(or will be used internally) for each document and

- The Account types the posting is done into, like in a customer transaction, vendor accounts will not be touched unless required.

There are couple of fields in Document-Header called as 'Document Header Text' and 'Reference Number' which can be made optional/required for each type of document. Document type will also define how the net procedure is calculated as every transaction is not same, there might be some difference in taxation, foreign exchange, business deals, how to store the document etc..

Storage of documents is a tough issue after having a long list of transactions in the company. Normally document type controls the storage issue. Always documents are recommended to store under the number of system document. Sometimes by using external document number( manually entered numbers) for documents the original document in the system(so that system can understand the posting) itself will become external document after a fiscal year. Then external number of original document will be used as 'Reference number' field of system document. As we know 'Reference number' is a part of 'Document header'. And then we will note the number of system document in original document. So, what we do in other words is we will bridge the System document using original document number by linking their numbers.

Every business transaction posted is a document generated at company code level. So, what are the document types in account level??

- KA - Internal transaction of Vendor A/c

- DA - Internal transaction of Customer A/C

- AF - Depreciation of Fixed Assets

- AA - Asset sale, purchase and transfer

- ZP - Automatic postings(payments)

- Z - payments

- R - Invoices

- AB - All-purpose documents(allows posting to all account types)

- DG - posting to Customer(D) and GL accounts(S) only..

- RV - Sales order mgmt billing document(customer invoice) which is used to transfer billing

- RE - Material mgmt (Vendor invoice) which is also used to transfer billing

- DR & KR is used when invoice is directly posted in FI module(extra-service transactions etc).

- And many more depending type of transaction and situation…

When internal numbering is used, system assigns new number to each document in FI, while in external number assignment, system transfers the billing document number to accounting document(provided this billing document number is not used before) to connect the invoice/receipt and document.

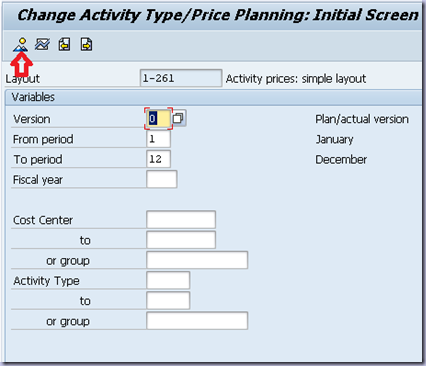

Now, lets go deep into Document Number ranges..

Document Number range: It’s the range of numbers that can be used for each document type in account level and must not overlap in any situation. If Internal Numbering is used, then automatically system takes the last document number from Current number field and assigns the next document number in number range.

If External Numbering is used, User must enter the number or number can be transferred from other system. Here, there might not be any continuous sequence while extra-facility provided for external numbering is that they can be alpha-numeric. Which is why many companies follow external numbering.

How long the document number range can be used?

There are 2 features regarding the time-usage of number range

- TO A FISCAL YEAR IN THE FUTURE : Here, number range will not stop even though new fiscal year arrives. Which means, in that particular number range, numbering goes on continuously into next fiscal year too.

- FOR EVERY FISCAL YEAR: Here, at beginning of every new fiscal year the numbering shifts to the first number of the range. This helps to ensure that number range is sufficient.

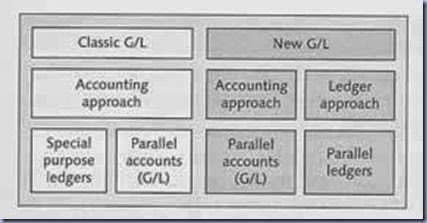

In New GL Accounting, Different ledgers can use different fiscal year variants in some rare cases and then special settings must be used during customization.

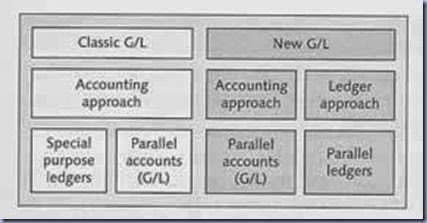

Ledger Solution is an important concept after New GL is being released as part of EHP4.7. With new GL, different accounting practices can be achieved in a single shot rather than going through hard task of other methods. Lets say You have one Company which reports its statements using US GAAP accounting principles and now to make a financial report according to IFRS accounting principles, it will be difficult. And normally, in SAP dual reporting is achieved by using dual accounts(or parallel account approach) before new GL came out. After, new GL came out things became easy.

A ledger group can be assigned to a company code as part of 'Ledger approach' shown above, and in this ledger group multiple ledger can be assigned. Ledgers are divided in to a Leading Ledger and Non-leading ledger. In any ledger group there will be one leading ledger and many non-leading ledgers. Company code when assigned to a ledger group will have leading ledger as its GL. Like,

SAP has defined two types of ledgers

| Leading Ledger | Denoted as 0L in the standard system, all company codes in a client are to be assigned to this ledger, it is used to portray the group-valuation view. You can also assign one or two additional local currencies that can serve as the parallel currencies apart from the first local currency or global-company currency. You have to assign the book depreciation area (01) of asset accounting to the leading ledger, besides integrating the Controlling (CO) as well (only the values from the leading ledger are sent to CO). |

| Non-Leading Ledger | These are additional ledgers that you can define in addition to the leading ledger. Defined for each company code, you can assign different characteristics values and fiscal-year definitions to these ledgers and use them for different purposes, such as parallel accounting and management reporting. You can use one or more currencies of the leading ledger as the currency of the additional ledgers. For example lets say you used USD for the first currency and Euro, INR as the second and third currencies you would not be allowed to use GBP for your non-leading ledgers, basically the currency for a non-leading ledger must be defined in the leading ledger. |

If any ledger is not represented as leading ledger in ledger group then, a non-leading ledger will be automatically selected by the system as shown in above picture. Now, If you assigned a Ledger group to a company the daily postings are posted to all the Ledgers in ledger group. If Different Fiscal year variants are used by Ledgers in a ledger group, then only Fiscal year variant of Leading ledger is verified during postings.

Why Ledger group is needed?

Lets go back to the requirements, For a company which is generating financial reports in US GAAP accounting structure, could be very tough and head ache to give out reports in IFRS accounting standard too. This can be achieved using the non-leading ledgers in the ledger group. First assign the ledger group consisting of a leading ledger which follows US gaap and also a non-leading ledger which follows IFRS to a company code. Daily postings and transactions will be updated in all the ledgers of Ledger group when assigned to a company code. leading ledger which follows US GAAP accounting policies will generate Accounting report as per GAAP. As company code is assigned to ledger group which contains non-leading ledger, if this non-leading ledger follows other accounting practice like IFRS or IAS then it will generate the report in IFRS or IAS accounting format. This was the main advantage of using Parallel Accounting feature in New GL. Need of re-posting the transaction into other account as part of parallel accounts approach/process to generate reporting in other standard(s) is not preferred after NEW GL is released, which was hefty work.

So, What are the advantages of New GL?

All the advantages are shown in the below pic, and it is recommended to google all of them to understand more.

![clip_image003_thumb[1] clip_image003_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiVwfRsHCwMJFWKQmNK0-oNQUl7YffPsd0rnasR6IYw7a9-PFLEukuavks_54UPn5lfgtA4JAhkZqjHcWTfLnFK9dbTuoBCyVKh_eEgIoC8b0BKUkevchPHcyjvrUsPuPbzEVNrODneEBs/?imgmax=800)

As we understood, in parallel ledger approach daily postings are done in all ledgers of ledger group. But, the problem is with the view. Yes, when viewing all the postings it will be difficult to find out which posting is done to which ledger.

What are the types of View?

Entry View :

You can display the line items for one or more G/L accounts. G/L account line items are line items that have been posted to a specific G/L account. Unlike other line items, a G/L account line item only contains the information that is relevant from the account view.

You can display the following G/L account line items:

● Open items

● Cleared items

● All items

● Noted items

● Parked items

From

http://help.sap.com/saphelp_erp60_sp/helpdata/EN/42/fd9d7728985158e10000000a1553f7/content.htm

GL View:

In the general ledger view, you can display the line items together with the general ledger account assignments (General Ledger Line Items) and G/L account line items or document data for one or more G/L accounts.

You can display the following line items in the general ledger view:

· Open items

· Cleared items

· All items

In the general ledger view, you cannot display any documents that are noted or parked because there are no general ledger line items for these documents.

In addition to the general functions for displaying line items (see Line Item Display), the general ledger view also offers the following functions:

· You can specify the ledger for which you want to display the line items. The line items displayed are combined from the documents in the entry view and the general ledger view.

· With the custom selections, you can also make selections using general ledger account assignments (General Ledger Line Items).

From http://help.sap.com/saphelp_erp60_sp/helpdata/EN/42/fd9e6c28985158e10000000a1553f7/content.htm

Coming back to Number ranges, one number range can be assigned to several document types or copy the number range from one company code to another. And also number range can be copied from one fiscal year to another too.

Use report RFBNUM00 to find gaps in document number assignments.

Posting Keys:

Each line item in document will say what is being transferred but to make it clear whether item is going outside or coming inside, posting keys are used. This clearly says, whether line item is a Debit or Credit. And, it clearly gives out where the line item is going into and from where.

Posting Keys can identify if a line item is connected to payment transaction. This info can give out payment history so we can analyze them and create payment notices.

Sometimes, in sales-relevant postings the sales figure of the account must be updated by the transaction and this can be done by specifying the posting keys.

Some of the posting keys are,

- For GL Account posting, 'Debit' is posting key 40, 'credit' is posting key 50

- For customer invoices, 'Debit' is posting key 01, 'credit' is posting key 50

- For vendor invoices, 'Debit' is posting key 40, 'Credit' is posting key 31

- For Customer receipts, 'Debit' is posting key 40, 'Credit' is posting key 15

- For Vendor payments, 'Debit' is posting key 25, 'Credit' is posting key 50

- For fixed assets, 'Debit' in posting key 70, 'Credit' is posting key 75

DOCUMENT ENTRY FIELDS:

Up to now We have Account group field status, transaction specific field status and Company code specific field status.

Ex: When expenses are being posted, tax data and costs centre must be specified in document while cost centre data might not be needed when posting cash. So, what information is displayed and needed is controlled by field status.

THE MOST GENERAL RULE IS, ACCOUNT-DEPENDANT FIELD STAUS IS DEFINED FOR GL ACCOUNTS IN CUSTOMIZING. FOR CUSTOMER AND VENDOR DATA, POSTING-KEY DEPENDANT FIELD STATUS IN CUSTOMIZATION IS DEFINED.

For fields in GL accounts, Fields with highest priority is shown in document entry unless there is exceptions like

- When business areas are used, Business area field must be used as input and this business areas must be activated in company code. But, Business area field will not check whether Business areas are defined and activated in company code or not. Its just a field to define a status of required / optional entry.

- Tax field entries are only possible if the relevant account of GL which is being used in Document is relevant to tax.

Hide field cannot be combined with required entry which causes error.

Field Status Groups:

General Ledger Accounts must behave in the way they are supposed to be used/define. You cannot use expense accounts without deciding what fields in this account must appear in document entry. You cannot use Cash accounts unless you decide what fields of this account must mandatory/optional in document entry. When a document is posted to a GL Account, should cost centre field is required? Or should it be hidden??

This info is given using

Field status Groups(FSG) of each GL Accounts. For each GL Account ,FSG gives critical info on account's usage. This Fiscal Status Groups are summarized into

Field Status Variants(FSV). FSV must be defined and assigned to company code(s) or else posting cannot be made. Normally same FSV is assigned to all of company codes to keep information similar across company codes.

It's better to copy the standard FSG and modify as necessary. When a document is posted to a sub-ledger account then FSG must be defined for its reconciliation account.

Standard posting keys can be used and defined to create new posting keys. But if new posting keys are defined, then tables containing the reference of the keys must be updated. Posting keys of Assets and Materials can be used in transaction unless these components are installed. By changing the definitions of posting keys and FSG, FS of transaction-specific and Account-dependant can be changed. So FSG, posting keys, Account-dependant and transaction-dependant fields are completely interlinked.

Sub-ledgers do not have FSG, this gives heavy emphasis on different posting keys defined to meet all the requirements of sub-ledger. This is why sub-ledger have many posting keys.

While, posting in GL accounts is mostly differentiated using different FSGs. Therefore only 2 posting keys (40 and 50) are used for GL account posting.

There are some 'Document-splitting' objects which are mandatory for some objects like 'Segments' and 'Profit Centre'. This will be discussed in detail later in 'Document Splitting' chapter.

Practise:

Task -1: Customer's Accounting Manage wants:

Practise:

Task -1: Customer's Accounting Manage wants:

- Document types to be used for grouping document into categories in the system

- Internal number assignment to be used

- Document number ranges lie in the number ranges given below

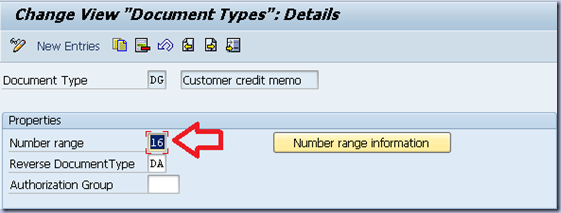

| DOC | Type | No | Range |

| SA | GL AC Document | 01 | 0100000000 - 0199999999 |

| DG | Customer Credit Memo | 16 | 1600000000 - 1699999999 |

| FG | Vendor Credit Memo | 17 | 1700000000 - 1799999999 |

| DR | Customer Invoice | 18 | 1800000000 - 1899999999 |

| KR | Vendor Invoice | 19 | 1900000000 - 1999999999 |

Check that they are created and assigned to corresponding document types..

Goto

IMG - FA (NEW) - FA Global Setting(NEW) - Document - Document number range - Documents in Entry View - Define Document Number ranges for entry view

| Field name | Value |

| CO-code | GEM |

Interval -> Change

Now check whether the number ranges are same as define above.

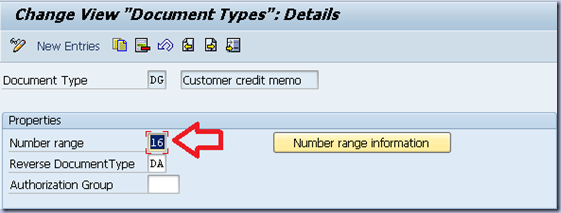

Here, in Document number ranges screen, I found that there are lot of number ranges which had been copied fro yeas and years.. I will show you a screen shot of 'Customer Credit Memo whose no = 16 in above table

And now we, must check that in Document types screen, 16 must be assigned to 'DG' Document type

So goto,

IMG - FA(NEW) - FA GLOBAL SETINGS (NEW) - Document - Document types - Define document types for entry view

Here, as we are just checking for DG = Document type, I double clicked on DG and I can see 16 assigned to it as shown in pic below

In the similar way its better to check that correct number is assigned to document types given above in table or else things might get confusing later.

Task -2 :)

Create document type ## for authorized expenses, reverse document type is AB. It should be possible to make posting to vendor master records and GL Accounts

Assign document number range 85 (85000000000 - 8599999999) to this document type with internal number assignment for currecnt fiscal year. Reference field in the document must be a required entry field.

Sol) To create a number range got

IMG - FA(NEW) - FA GLOBAL SETINGS (NEW) - Documents - document number ranges - documents in entyr view - define document number ranges for entry view

| Field name | Value |

| Cocode | GEM |

Internval -> change then

EDIT -> Insert Interval

| Field name | Values |

| No | 85 |

| Year | 2014/current year |

| From number | 8500000000 |

| To Number | 8599999999 |

| Current number | 0 |

| Ext | Blank |

Press Enter and then save..

Confirm the dialog box

'Transport number range intervals' with pressing Enter

Now goto

IMG - FA(NEW) _ FA GLOBAL SETTINGS(NEW) - Documents - Document types - Define Document types for Entry view

Here click on 'New entries' and enter the following info

| Field names | Values |

| Document type | ## |

| Number rage | 85 |

| Reverse document type | AB |

| Account types allowed: | - |

| Assets | Do not select |

| Customer | DO no select |

| Vendor | Tick |

| Material | Donot select |

| GL Account | Tick |

| Required during Document Entry: | - |

| Reference number | Tick |

Choose save

Go back and give descriptions for '##' as

'Authorized expenses'

Save

![clip_image008_thumb[3] clip_image008_thumb[3]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjDt5bOhMlZy_TVenqTO_WcWL7dBFHAyoPD-tqR-JJVUqa3IMaWA5agBMp-sJ-iMZfQAPUyfWuJcy098JApWD5xuAsEixPve0rBntO1OKU3euEZYFFDVfqjm5zdPDZr76CWWRNsFHxXUNU/?imgmax=800) Task -3:

Task -3:

Now to make posting available for the new document type later on this tutorials, we must make one more critical settings in customization in new GL accounting. We must prepare this document type for document splitting.

To know more about document splitting, I recommend you to just google it, we will discuss it in next UNIT more briefly and in detail.

To make document splitting available for the new document type ##, goto

IMG - FA(NEW) - GL Accounting(NEW) - Business transaction - Document splitting - Classify document type for document splitting.

Enter the following details for document type ##

| Field name | Value |

| Transaction | 0300(vendor invoice) |

| Variant | 0001 |

Save..

Task - 4:

We want to track the cars that are rented and so we want to make a required text field for line item sof Sports car rental expense account.. So create a new field status group FS## with descriptions Authorised expenses##

To create a new FSG with name FS## we must check the FSV assigned to our company code… FSG can be made by copying the FSG G001 in FSV 1000

Goto

IMG - FA(NEW) - FA Global Settings(NEW) - Global Parameters for company code - Enter Global Parameters

(or alternatively You can go to

IMG - FA(NEW) - FA Global Settings(NEW) - Ledgers - Fields - Assign Company code to FSV

Here, double click on company code and record the FSV assigned to our company code

For me its 1000 as shown in pic below

![clip_image009_thumb[3] clip_image009_thumb[3]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjCuqEJl0SamTFc4sgQL-HlVTBtCe_mwuHJUz1FJWRfl5ZNiLDZvHyzivlXeE7yJE8q7OAOYEwCuTDSr__iqvWaLCAI-xMSkZC12F3TaIyKd6EqKIzTt_uVGiJmShO1I4NiiXQf3PGZhWM/?imgmax=800)

Now, GOTO

IMG - FA(NEW) - FA Global Settings(NEW) - Ledgers - Fields - Define Field Status Variants

Here select the FSV assigned to your company code, in my case its

1000 and then double click on

'Field Status Groups'

Select

G001,

Click

'Copy as' and give the following details

| Field name | Values |

| FSG | FS## |

| Text | Authorised Expenses## |

Press Enter and save (FS## appears in FSG list as shown below)

![clip_image010_thumb[1] clip_image010_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhXVf1tM2XLNp9tE0m5jhbsUK7KHS44jFnvpZ3d66xrB9Hbvi8AR3ED-JQbZA6E6Z7Mxp29HhyphenhyphenB-LLbFmqZZWoZ16E3LxXq4-i1ZBGX4DoGAghYURcE1GAbaOleFTJgqH2BJCzkJeh81b4/?imgmax=800)

Now, without pressing back or exiting to any screen, let us think back on requirements

We want to make 'TEXT' a required entry and for that double click on

FS## in the list and double click on

'General Data'

And here, make

'Text' field a required entry as shown below

![clip_image011_thumb[1] clip_image011_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiPQQU7VDLHrDhTGFgZceHd4abKHXIXwaeG0a0nNSoHvoPFI1UiMR9QKMIFtElfyRZH0Pl5Raj3OBXi_rXSoa_K6hX26cuCzWGq_LbLUSiKZ5IkMIe4sla9g9A5sGFPh6XvrcuiTnplnnw/?imgmax=800)

Save…

Now we need to assign the FSD we had to create new GL Account

Sports Car rental Expense AE02##

For that goto

Easy access menu - Accounting - FA - GL - Master data - GL Accounts - Individual processing - in company code

Or just type

FS00 transaction code..

Enter the following fields

| Field name | Values |

| GL Account | AE02## |

| Cocode | GEM |

Press 'Change' and select

'Create/Bank/Interest' tab page

Enter

FS## in

FSG field as shown below

![clip_image012_thumb[1] clip_image012_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhdkLh25ZuKxAGZylmMYMcYH59ziTwDu9UnDDbU-7R6O39xy0qisslu9sK53Kktd9s4kbMAybk5J1UBA9_x9u5jAL7jsIh5sMF843wrcwBFF8Cdk8PjVq-A2-6AOOggsmrFpBeVV4f9JOY/?imgmax=800)

Save

So, upto now You had created a new FSG and assigned it to a GL Account

POSTING PERIODS:

What are closing periods?

In Sap system, you can't make transaction in every year before. In SAP system, a fiscal year must be defined so that SAP system can allow to post different types of documents to different accounts. In general terms Posting periods can be said as "Timing" limitation to posting so that previous year transaction cannot be changed for malpractice purposes. Most of the subledgers will be closed at end of closing periods by the accounting department but main ledger/GL Accounts will be opened for longer periods so that any miscalculations or reconciled transaction can be checked again as per real situations/values. I said situation as some transactions will not be closed with in a year and so sometimes, it must be closed as part of yearly transaction to be included in an year.

Every year will be divided in to periods and transactions will be recorded as part of Accounting periodically called as posting periods. It depends on What and how a company wants to do periodically. Normally in countries like India, US, UK etc.. A fiscal year is from April - Marc and at the start of April company must give their financial reports to Stocks controller like SEC in US and SEBI in India. It is a regulatory condition to do business in their stock markets. Consolidated companies whose parent/headquarters are in other country is allowed to report as per the headquarters' fiscal year decision. Like in Vodafone India, whose fiscal year is same as their headquarters in UK. So, Vodafone India give out annual reports as fiscal year from August - September. Here, one must look that actually fiscal year regulation in UK is also same as India i.e, from April- March but Vodafone gives out their Financial reports as fiscal year from August -September of each year. UK law allows that and Indian law also allows that but per a fiscal year accounting reports must be given as per needed. To segregate Accounting on fiscal year basis, company must record each type of transaction for each year to create a live balance sheet and P&L stmt. It reduces burden for internal reporting as decisions by top level management can be takes easily using the reports. So,

IN SAP SYSTEM one fiscal year is divided into 16 periods and in these 16 periods 12 are normal periods and 4 are special periods.

Lets take a look at how and what happens in Accounting department to make a final report.

Let us take a company following April-March fiscal year policy and they have internal auditor as part of Accounts department. In March, Accounting department will be busy in finalising transaction so that reports must be generated. First, Internal Auditor will finalise all the transaction that happened in past April - March fiscal year and try to bring out a conclusion in transaction which are open/troubled due to management decision/strategy. This can be considered as first special period in SAP. After Accountant finalises his report, he will be in touch with senior Management of the firm to get the real values in open/troubles transaction or for any errors. This can be considered as second special period in SAP. After senior management accepts the report, external auditor must check out the whole report from the internal auditor and unless external auditor accepts and signs the report it will not be accepted by the Financial regulator or controller like SEC/SEBI. This stage which includes work of external auditor can be said as 3rd special period in SAP system. After, internal and external auditor finalises and accepts a report It will be submitted to stock market showing the financial condition and strategy of the company. Now, in last para, I said in

SAP SYStem fiscal year comprises of 12 normal periods and 4 special periods. I gave the utilisation of special periods just by an example. Here, Normal periods are normal months and so, 1 normal periods gives out 12 months but special periods are not months and they can be expanded.

SAP SYSTEM WILL normally close the transaction for a month/period if month ends but, it can be opened if transactions are still unfinished by end of a month. It is not possible to post transaction of last fiscal year in SAP unless there is an open transactions. OPEN transaction is nothing but a transaction which is not finalised or the order in of that transaction is still being manufactured. It might take couple of years to finalise transactions in Airplane Manufacturing and Delivery. Sometimes, to prevent any malfunctioning while storing a transaction periods will be closed wontedly. For Ex, Accountant might decide that some people in his Accounts department are actually making some transaction which are not really happening and to prevent this, he might close some transactions belonging to Assets and just open transactions belonging to customer for this period/month. This prevents documents being posted to incorrect posting periods and to incorrect accounts.

As we know a fiscal year = 12 months = 12 periods. Special Period comes only in last period so in 12th-period/12th-month there will be 4 special periods. But big difference in special posing period is they don’t have any start/end dates just like normal periods have for each month. So, when posting a transaction in special period the date of posting must fall in last posting period and special period must be opened along with last posting period.

In customization, SAP provided enormous variety of setting needed for different types of companies. Some companies might not have a 12 month fiscal year, they might just operate for 6 months. Some companies might not follow yearly dependant period policy, I mean when I said above 1 period = 1 month then

normally we assume that each period starts at 1st date of each month but, some companies might have a very different period starting dates like from 15th of each month and SAP gives us a complete flexibility even on the start & end dates of each period. So, all the settings like yearly dependant/ independent, Half-yearly/shortened fiscal year or a complete yearly functional fiscal year etc.. Will be defined as a

fiscal year variant. As, we know Variant means something that can be used by any company as part of it. So, we will define the fiscal year settings and save them as a variant called as

Fiscal year Variant(FYV). Later, we assign this FYV to our company code.

Posting Period Variant(PPV) is nothing but variant of controlling the posting in periods so like controlling the type of transactions allowed to post in a period and the timing of the period!

AGAIN GOING BACK TO QUESTION, WHAT ARE THE CLOSING PERIODS??

You define posting periods in your fiscal year variants. You can open and close these posting periods for posting. As many periods as you require can be open for posting simultaneously.

Usually, only the current posting period is open for posting, all other posting periods are closed. At the end of this posting period, the period is closed, and the next posting period is opened.

Special periods can be open for closing postings(WHAT IS THIS?) during the period-end closing.

What is Closing posting?

Closing posting is nothing but closing the transactions by internal auditor to finalise the transactions values and make reports. So, Closing Periods are nothing but Special Periods.

From http://help.sap.com/saphelp_erp60_sp/helpdata/en/96/8b300943ce11d189ee0000e81ddfac/content.htm

What are the account types associated to FYV control?

As discussed above in this UNIT , the different types of document types are

- S - GL document

- A - Fixed Asset

- M - Material

- D - Customer

- K - Vendor

These are the account types which are controlled for posting by PPV. Now, another setting(denoted by '+') is also given by SAP so that you don’t need to specify each and every account. This '+' will post document to any type of account(i.e., ALL ACCOUNTS) as given above. So, for any posting period variant at least one line with entry '+' is mandatory.

What must be considered when posting to a special period?

When posting to special periods, you must take the following into consideration:

- The posting date must fall within the last regular posting period.

- You have to enter the special periods in the document header in the Period field, since the special periods cannot be determined automatically by the system.

From <http://help.sap.com/saphelp_470/helpdata/en/96/8b2fef43ce11d189ee0000e81ddfac/content.htm>

WHAT ARE INTERVALS?

In SAP System, let us assume that you are in 12th normal period and in 2nd special period. So, now you want to make some corrections for transaction belonging to normal period 4 and period 5. You can open them as an interval and make the corrections. At any instant, you can have 2 intervals though you can correct the transactions in any period of fiscal year. In the 2 intervals one must stick with special period at any instant.

Ex, If you want you can keep all the periods open at the same time or you can open only a specific period say period 03 to period 04 at a time (one interval)

Example 1,

you can have 2 period ranges (intervals) open at a time -

Range : 11/2008 to 12/2008 and 04/2009 to 05/2009

here you have totally 4 periods opened.

Example 2

Range: 01/2008 to 12/2008 and 02/2009 to 05/2009

No. of Periods open - 16 periods

From <https://scn.sap.com/thread/1343218>

IN New GL, third period interval is also allowed and much more customization is being allowed in new GL. Ex, It is possible to post to only one profit centre 1000 while the person who is in control of profit centre 2000 doesn't want to permit the postings any more.

SAP permits past/future dated transactions unless the concerned posting period remains open. While in document view, the posting date, posting period and fiscal year are displayed along with transaction figures.

Now, we talked too much about FYV lets do some practice.

Practise:

Task -1:

Create a Posting period variant 'PP##' with name 'posting periods GEM'. As per requirements of the accounting department, subledgers are opened for only curent month while GL is open for both current month and previous month. Assign this PPV to your company code

Sol)

Goto

IMG - FA(NEW) - FA Global Setings(NEW) - Ledgers - Fiscal year and posting periods - Posting periods - Define Variants for open posting periods

Click 'New Entries'

| Field name | Value |

| Variant | PP## |

| Name | Posting periods for GEM |

Save..

Now to define the periods in the PPV

Goto

IMG - FA(NEW) - FA Global Settins(NEW) - Ledgers - Fiscal year and posting periods - Posting periods - Open and close posting periods

Click 'New Entries'

| Fieldname | Values |

| 1st item | |

| Var | PP## |

| A/c types | + valid for all accounts |

| From Account | Blank |

| TO Account | Blank |

| From Period 1 | Previous Month |

| Year | Previous Month's year |

| To period 1 | Current month |

| Year | Current year |

| Field Name | Value |

| 2nd item | |

| Var | Pp## |

| A/c type | D |

| From Account | Empty |

| To Account | Zzzzzzzzzz |

| From period 1 | Current month |

| Year | Current year |

| To period 1 | Current month |

| Year | Current year |

| Field name | Values |

| 3rd item | |

| Var | Pp## |

| A/c type | K |

| From Account | Empty |

| To account | Zzzzzzzzzz |

| From period 1 | Current month |

| Year | Current fiscal year |

| To period 1 | Current month |

| Year | Current year |

Save

![clip_image013_thumb[1] clip_image013_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiDTREsj_wf_9mjrECq55_4WyJOMzPNWK1RqJsXjhAmwWJrjGdCGeTZBRkAyD7vHJYLj2lynj3_NMYxtjxtczzWMojFo36p9e07DTUgJEgTxEFcGik9sckNtNDubQJ3OenTQ8gZNw2t8Ao/?imgmax=800)

To copy an existing interval(Which we are not doing in this as we created a new one):

IMG - FA(NEW) - FA Global Setting(NEW) - Ledgers - Fiscal year and posting period - Posint periods - Open and close posting periods

Select account types for 0001 posting period and click

'copy as' and then overwrite the

'var' field with '

pp##' and save,…

Now assign

'pp##' to

GEM

Goto

IMG - FA(NEW) - FL Global Setting(NEW) - Ledgers - Fiscal year and posting periods - Posting periods - Assign Variants to company code

Here, for company code '

GEM' assign

'pp##' in its variant field.

![clip_image014_thumb[1] clip_image014_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjp-OfsJQSzhb77GcoeC5Pcd5IqYN8Xr9PuNbzp39-RHryKZAWx3_Q5Os4FmFOzwf2XTR63gsQpHh7yJ5bfa-7bhbN5Y5-BPu2EIqiP2dEbNVlq6FNMG2B-HyxpkevNRCuYRcxA8Y_YW9Y/?imgmax=800)

Save…

Remember: There is an authorization group which applies to first period interval. If an Accountant think that some changes must be made in transactions only by some people in Accounts department.

POSTING AUTHORIZATIONS:

Sometimes authorizations are needed even to post high amount transactions so that such transactions are double checked by correct authority and given approval. This maximum amounts can be defined as part of 'Tolerance group' which also controls the payment differences. Most of the times, money at the end of payment might not be the exact amount specified in the invoice, this differences can be checked and a error limit or payment differences limit can be specified so that transactions which exceed the this differences limit will be asked for authorization or can be rejected automatically.

What sort of upper limits can be specified in tolerance groups?

- Total amount per document

- Amount per customer/vendor item

- Cash discount offered or granted with a particular tolerance group for a user.

- You can also specify upper limit per payment differences

- Upper limit for open /closing item

- Limits can be specified even on different currencies.

Even though a blank is given in tolerance field for any customer, there will be default tolerance group assigned. But for any employee who have high and low limits, a special tolerance group must be created and assigned to user IDs.

There are 3 types of tolerance groups(TG) available in FI

- GL A/c TG which contains upper limit for transaction

- Customer/vendor TG which contains the payment differences for each customer/vendor

- Employee TG which contains upper limit for payment differences for posted amounts so that a high difference in payment differences can be

Ex, If a payment difference occurs when a user is entering a transaction of an employee then both the employee TG and customer TG will come into force automatically to check payment differences and the authority for user to enter the amount of transaction like if the amount is higher than the limit for that user or not.

Practise:

Task -1: I

nternal auditors have requested the following maximum authorizations for accounting department

- Account clerks:

- 500000 units of local currency per document

- 100000 units of local currency per open item

- 5% discount in cash

- Accounting manager

- 5000000 units of local currency per document

- 800000 units of local currency per open item

- 10% cash discount

Sol) Here as mentioned in the business scenario we will create 2 TGs one is 'blank' TG for accounting clersk and other 'SUPV' for accounting supervisor/manager

For 'Blank' TG goto

IMG - FA(NEW) - FA Global Settings (NEW) - Document - TGs - Define Tolerance groups for employees

Here double click on

'GEM' and give the following details

| Field name | Values |

| Amount per document | 500,000 |

| Amount per open item | 100,000 |

| Cash discount per line item | 5% |

Save.. And in same way create a new TG with 'SUPV' by copying the above done blank TG

Go back, select the 'blank' TG we created above and click

'copy as' and overwrite the below info as given

| Field | Value |

| Group | SUPV |

| Co code | GEM |

| Amount per document | 5000000 |

| Amount per open item in account item | 800000 |

| Cash discount per line item | 10% |

Save..

Task-2:

Now we need to give the new created TG to the accountant supervisor]

To assign this new TG SUPV goto

IMG _ FA(NEW) - FA Global setting (NEW) - Document - TG - Assign User/tolerances groups

Click 'New entries'

| Field name | Values |

| Username | Your username |

| TG | SUPV |

Save

![clip_image015_thumb[1] clip_image015_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg24UVmLnA5CrtTN3z8WeBP3JMQB-fT5WWYQpNUyWMIVgjBt5r9hgSzfCaBY6e1lupADBzEJmjY6jJMPwfQ64RDwPEotwIaVSJyLNLSOINEYq2d7qj2T31hiuKRCkp_MmxRepHlT43k1HA/?imgmax=800) SIMPLE DOCUMENTS IN FINANCIAL ACCOUNTING

SIMPLE DOCUMENTS IN FINANCIAL ACCOUNTING

Here let us look at ENJOY transaction. By this way a user can post simple documents.

In SAP System, Financial Accounting component uses one posting transaction for several different posting like

- GL Account postings

- Customer invoice postings

- Customer credit memo postings

- Vendor invoice postings

- Vendor credit memo postings

Normally in Enjoy posting screen, user must enter a Header and 1st line item. There is a general data section with in the document header where invoice and posting date, text and so on are entered. Normally to enter invoice and credit memos received, a type of document can be defined for each transaction which will after appears as default value for each of such type of transaction. This can be overwritten too for any purpose needed by the client company, this becomes default because the way of entering invoice or credit memo is commonly same in most of the companies. If a document type is not defined then the default type from the system is automatically selected like KR for Vendor invoices.

There are tab pages where important and non-important fields are given so that user who gets used to the data entering will slowly become aware of what is needed in what tab page for each type of transaction.

Sometimes we must clear open items(so that the present transaction will not be calculated to any open item of that particular vendor/customer etc.) and this to happen, system must know what are the open items available for each customer/vendor. So, when entering customer/vendor invoices the business partner data will be displayed along with account name, address and bank details. To get a display of open items , a button is provided which when pressed will open the open item list.

In transaction entry screen, along with header and line item data, there is also an information area which displays the balance.

Whenever a transaction is being entered, the date on the document(or document date) is taken from the supporting documents like a customer invoice or credit memo. This might be different from the date of posting(means the user entering the transaction into SAP) and so document will take the date from the supporting documents. But, if any of such documents are not provided then still transaction can be entered but the document date will be the posting date.

There are lot of customizations available to the document entry screen. You can change the orientation of the fields and columns by their size or sequence. You can see some settings like park, hold, or post, to complete the document entry once transaction balance reaches zero.

There will be some complex postings which require some experience. Complex posting transaction can be accessed via menu and this transaction is a series of screens. Once a user enters complex posting then he/she cannot return to initial screen.

Explanatory text field can be used for each line item and this gives some understanding. This line text can be used for external or internal purposes. For using externally for example for dunning notices, advice notes etc.. '*' is used in front of the text. This way a transaction can be understood outside the transaction data.

You can save line text as a key(four digit key template) and when a transaction is being posted a relevant key can be used directly in the text field rather than entering whole line item text.

Practice:

Task -1:

Post a

simple document to test the customization work.

- 5000 units of local currency cash is being withdrawn from the bank account to petty cash. Post this transaction(cash account: 100000; Account bank position: 113100 each with profit centre: 1000)

HINT: select 'TREE OFF' so that document entry screen fills the whole windows

Remember SUPV Tolerance group and it might come into effect s we post.

Accounting manager rented a car and went for a out of town conference. Post vendor invoice for 110,000 units of local currency to vendor account which ws created earlier(Vendor##). Choose to 'calculate tax' with 'tax code 11'(10% tax) Enter the authorization number A## that you receive from the accounting manager in reference. Then post the whole expense into 'Sports car rental expense' AE02## account which was created before along with profit centre PR##. Use document type ## and enter description 'Conference##' as required 'text' field in line item

During conference, accounting manager toolk clients to dinner and so post an additional invoice of 330,000 units of local currency to 'Entertainment Expense account' AE01## using the same criteria of previous exercise.

Post a customer invoice from 220,000 units of local currency to a customer account. Choose 'calculate tax' with 'tax code 10'(10% output tax) post to revenue account 800200

HINT: select 'TREE OFF'

Post a customer credit memo of 5500 units of local curency to customer account created earlier. Use 'tax code 10' and revenue account 800200

HINT: Select 'TREEOFF'

- Display the customer's or vendor's line items to check the postings which are done::..

(PHEW, I know it is a hell of practise now)

Sol 1) Simple document posting to GL account

Goto sap easy access menu - Accountng - Financial accounting - GL - Document entry - Enter GL Account document -

Choose GEM and press enter..

| Field name | Value |

| Basic data | |

| Document date | Current date |

| Posting date | Current date |

| First item | |

| GL account | 100000 |

| D/C | Debit |

| Amount in doc.curr | 5000 |

| Profit centre | 1000 |

| Second item | |

| GL Account | 113100 |

| D?C | Credit |

| Amount in document currency | 5000 |

| Profit centre | 1000 |

Document -> simulate

Here, check the document and double click on line item to display or change the data.

Choose

'POST' to save the document and not he document number.

HERE: I GOT AN ERROR MESSAGE F5275 saying in G1 Fiscal year variant, the present posting date doesn’t come in any period:

![clip_image016_thumb[1] clip_image016_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3icQhdL3untO77z0nOTmPc4PMYgtCT04ja4lbXX84NaKiyMuaDejFNuXwqMPxATuZgGotrFtOKAROnQN7AEkVJzkjrnYtZhzzM0noTIMQj86JIK1X_ITBxXuZH2bP05EiXP0UI-0FbZ0/?imgmax=800)

I overcame this error by going to ob29, selected the FYV which was given to our company 'GEM' which was 'G1' and then I double clicked on periods to see the periods specified in this FYV. If the table here is empty then it periods must be assigned as shown in the above figure. By assigning the periods we are specifying when does a period starts and when does it ends with exact date, To get more understanding on shifting-periods look in the periods of 'V3' FYV. Here, 3 periods will be shifted because V3 resembles April-march Fiscal year.

After doing the above step, the error disappeared and document overview appears to give details about the posting items and info regarding the document.

![clip_image017_thumb[1] clip_image017_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhWu8KXXyPQDZanvSLI7z3fppADgmVuRehFOVvDpQpg8hdvB9LywYlLQVsQqYMEjXQahd4fsFmpLXX-46jLAtoIB0zxDsRYdtlvAVf782w_VXnudwPmXyLVmNrygyM6DcOpFhb2kTKZVmk/?imgmax=800)

Now after you get the document overview screen you can change data if needed by double-clicking a line item . click

'POST' to post the document and note the document number.

After completing the whole inner processes(it takes time first time), the system will post the document and will give the document number (I was given

100000000 because We had specified the document number range with the starting number 100000000)

![clip_image018_thumb[1] clip_image018_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh906tWLJXFASKpYARvWbYB67RAU5GoIjziRmuT_58U3RJrwZYmSNda9lGjMgLx_I0r_MTfVwF16VkrpdMy_SCaNxifl7CNuAmthjguGof5WfHgbUyEkIOrH3qoQfgkj-q0VruTbt_FFGI/?imgmax=800) Task 2: a) VENDOR INVOICE:

Task 2: a) VENDOR INVOICE:

Post vendor invoice of 110,000 units of local currency to vendor account 'Vendor##' . Choose to 'calculate tax' and use tax code11. Enter authorization number A## in reference field which was received from the accounting manager. Post the expense to 'sport'scar rental expense' AE02## which was created and profit centre PR##.. Use document type ## and enter a description ('Conference ##') in required entry field 'TEXT' in the line item.

So, GOTO

SAP easy access menu - Accounting - FA - Account Payable - Document Entry- Invoice

Here:: Sometimes you may not be able to enter the document type and in that situation, click on 'Editing options' when entering a document and choose 'Entry with Short name' from the dropdown list ..

| Field name | Values |

| Basic data | |

| Vendor | Vendor## |

| Invoice date | Current Date |

| Reference | A## |

| Posting Date | Current Date |

| Document TYpe | Authorized Expenses## ( If you can't see the document type ready for input then click on 'Editing Options' and select 'Entry with Short Name' in the drodown list. |

| Amount | 110000 |

| Currency | Company Code Currency |

| Calculate Tax | Tick |

| Tac-code | 11(Input tax -10%) |

| ITEMS | |

| GL ACCOUNT | AE02## |

| D/C | Debit |

| Amount in Doc. Curr | 110000 |

| Taxcode | 11 |

| Text | Conference## |

| Profit Centre | PGEM (we created PGEM and CGEM in last UNIT) |

Document -> simulate

Click 'post' to save the document and note the document number.

Here, I faced hell of problem to find out the prescribed tax code-11 and tax code-10 as given in the configuration guide of SAP. But, to my problem I found out that in SAP TFIN50 nothing is given about any taxes and External Financial Accounting Basics must be covered to get to know how to integrate taxes, banking and other external accounting issues to our company. They can be configured but SAP TFIN will not give any sort of configuration and Here, I got stuck.. Well, its not completely stuck its more of a breakpoint to reach and study for completely new thing breaking the flow of the present topic.

Here, to create a new tax code with 10% input tax and also a tax code with 10% output tax GOTO FTXP and check the tax codes available for 'Great Britain' Country. In the description of all the codes available as shown in the pic below there are input tax codes and output tax codes(some with VAT).

![clip_image019_thumb[3] clip_image019_thumb[3]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiqh9_ofChK-mPhiqY4rMeZUQ7KK55VZrg4BlpQX0i0X3EQhlAb6N29qA3poaOLVz4zQRW4DXDGiTGSkx6MnQAm7drL7EjhczZOkh04e5tC4zyuodUy1K_0FeUAOrsxPLlG9QwEuApdUg0/?imgmax=800)

Coming to tax codes we have 3 things: direct input/output taxes, deduction in taxes like VAT or Service and levying them on the customer transactions and then we have withholding tax concept. For now we will stick with simple method of taxing: I.e, direct input/output tax. As in above pic there is no 10% input tax code and 10% output tax code, lets create both the tax codes in GB. TO know more about the types of tax processing available in SAP please goto OBCN to get the complete view of different types of taxes.

Now, goto OBQ3 and select the tax procedure of the country respective to your company, as our company is 'GEM' in Britain, I selected 'TAXGB' and click on 'Control' Folder as shown in the below pic

![clip_image020_thumb[1] clip_image020_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg05mhSDYcp7hD83G89Qh3jFhbSiN_Ctv-s_LqBwXcKx8hzlBwI6rQ0_IwNIOHYfirF6WRdBJoIqA4YuJC3N8bs75gpN8o9KeK3PxOe7dj5wgOnQYFAHl5LxcUugCJj1SecOF-Spf9FFwg/?imgmax=800)

This is where things get little interesting!! And be patience..All I showed to you upto now is just the information about TAX procedure. To create a new tax code with 10% input tax and 10% output tax I decided to name them both as "tax code-11" and "tax code-10" respectively. Goto

FTXP

Here, If you see the questions in Exercises, above. They asked output tax rate of 10% as 'TAX CODE 10' while 10% input tax rate as 'TAX CODE 11'. So, lets make these tax codes by copying the standard tax codes and change their percentages and description.

In FTXP screen as shown below

![clip_image021_thumb[2] clip_image021_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiwcFu_7aQuhduWVW2nA4H-ZQwgC-uaxFbHp4GZc8jG2tmMh8wV3CTz3_m4pbhEr2xm8lUfnIu82LHEyWJk4JoDiCNO8Yeaee4-wOhpCWAoj0is3gjSx1666X9zbFxNMM6PuUkvUen2i8M/?imgmax=800)

Click

'COPY' button above after entering 'V6', Enter the details and then click 'tick' mark. In the next screen enter the details as shown in the pic..Change input tax to 10% by entering '10,000' in its field and then click 'Properties' and change the description to '10%' as shown below

![clip_image022_thumb[2] clip_image022_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgl2NGiEHRxcJ6vEK_JGaD3ORfztRyX0AA_hSvodiAStrcHAcFzeBTH3Geg8hYmlWq1zcaTuePprVqoavuO8JQvLF1ekqLt8Klx6C01WsPvkzIjd8qdb8xe_3k3NTw04HpLIde_rHwEQbc/?imgmax=800)

SAVE.. And similarly create an another 'Tax code -10' as output tax at 10% in same way as above from FTXP and copying output tax codes available…But, this time '10,000' will be entered in output tax field, change description in properties and SAVE… a status bar as shown below must appear saying that Tax code -10 is created.

![clip_image023_thumb[1] clip_image023_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiAIV4nVanh8bOknGLfFDXF9G3ocIvFtUc19oYls8-xUcrMNLTHhV_FHteI2TMIdW8BwLaEKYfNhG4pEs7D5yBk6OTU8ie-PwUZAqm5Vc49itPh4G_x3FGJfB02JnvCNOcIdTJzmZkG1as/?imgmax=800)

Now, we need to assign these tax codes to the tax accounts in the GL of our company. So, now we will make new tax accounts and then assign these tax codes so that whenever we use these tax codes again, no need to worry about the document issues related with taxes. I am creating new Tax accounts so that I don't wanna study all about the present GL for which my company is assigned to and it is much better way to know all transactions have gone to accounts you know.

Now, to make new tax accounts we need to find out what are the available accounts for input tax and output tax. In

FS00, I found input tax account and output tax accounts as in the list of all accounts available given in pic below.

![clip_image024_thumb[3] clip_image024_thumb[3]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiqWovkfZw96a6fxStiWWNUC1042yzcf34VXaej021weOQTeeQN4TjJxqY50KtRiH8k0S2s2mzRlH0LxjOpKo-cNFSUD2F5bx8BQliKvmyxQpPHCmSSDnedpKv20F_J3ju_8n-deKeFWkI/?imgmax=800)

On SAP Help Site, there is the following info about Tax configuration

Prerequisites

You have made all the relevant settings in IS-M/AM and FI.

IS-M/AM

| Prerequisite | Menu Path |

| Define tax indicators and account keys for conditions | Logistics → Advertising Management → Master Data → Conditions |

FI

| Prerequisite | Menu Path |

| Pricing procedure (tax determination procedure), condition types and access sequences | Financial Accounting → Financial Accounting Global Settings→ Tax on Sales/Purchases → Basic Settings→ Check calculation procedure |

| Assign calculation procedure to country | Financial Accounting → Financial Accounting Global Settings→ Tax on Sales/Purchases → Basic Settings→ Assign country to calculation procedure |

| Define transaction key/account key | Financial Accounting → Financial Accounting Global Settings→ Tax on Sales/Purchases → Basic Settings→ Check and change settings for tax processing |

| Define sales tax indicators | Financial Accounting → Financial Accounting Global Settings → Tax on Sales/Purchases → Calculation→ Define tax codes for sales and purchases |

| Assign tax accounts | Financial Accounting → Financial Accounting Global Settings → Tax on Sales/Purchases → Posting →Define tax accounts |

Revenue recognition for debit-side documents is a non-taxable transaction that is defined in Financial Accounting(FI) using the output tax Code for non-taxable transactions. You have defined this tax code for each company code in the Customizing settings for Financial Accounting under Financial Accounting Global Settings → Tax on Sales/Purchases → Posting → Assign Tax Codes for Non-Taxable Transactions.

Revenue recognition for the sales agent settlement credit-side transaction is an expense recognition, which is defined using the input tax code for non-taxable transactions. You have also defined this tax code for each company code in the Customizing settings for Financial Accounting under Financial Accounting Global Settings→ Tax on Sales/Purchases → Posting → Assign Tax Codes for Non-Taxable Transactions.

See also:

FI documentation → General Ledger Accounting → Cross Application Topics → Taxes → Calculation Procedure

FI documentation → General Ledger Accounting → Cross Application Topics → Taxes → Tax Indicators

From http://help.sap.com/saphelp_erp60_sp/helpdata/en/08/2e3165480611d396dd006094b92c6a/content.htm

In

FS00, click on the small help button next to specified GL Account and which is red-squared in the below pic as shown. This will open another screen/window which asks what u want to search in the GL(General Ledger).

![clip_image025_thumb[2] clip_image025_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEisKsbEOLTOHvP9tg4qX3qadng2kwNv03xyaYBeUbN3jymFZGQxtvsP37Zrv_OPUY1Ns9Nfy6k8uzxS9BYtu2AE4P1qz8WQVNKN-Rk1MbfTK0dhFhwMs3XN4QXd5L9uvpTVKhOCLYRVwnI/?imgmax=800)

In the search window, goto 2nd tab with title 'G/L account description in COA' and type "*input*"(without quotes) as shown above ..we are using this tab to get the list of accounts in GL which has description 'input' in or at as any word. Once we press tick mark or enter we will get the list of all accounts which has 'input' word in their description as given below.

![clip_image026_thumb[2] clip_image026_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi-Zt5f5BIcI6p8QLfV6_T4IjdT1JGxBOzVpO4eOa0cTLQ-OkjX-lAKSpbEaLoEGI3kS_llPANARaRVd87nsyleCYcjG6vPl5zJm-cY2QpmFo2AkyTzN45gV0KEIJwf0jQsEZnusgCkEk0/?imgmax=800)

Now select the GL Account with 'input tax' as its description as given above using red-arrow. We will use this account for our 10% input tax code. Select an input tax account and press enter

REMEMBER: AS WE ARE USING DIRECT GL ACCOUNTS AS TAX ACCOUNTS RATHER THAN A COPY, DON'T CHANGE THE ACCOUNT NAME BUT CHANGE ITS DESCRIPTION AS PER OUR NEED. BECAUSE CHANGING ACCOUNT NAME MIGHT RESULT IN SOME HEAVY CHANGES INSIDE AND NOT RECOMMENDED.

After, you press enter as directed in above para, U will see the below screen. Add '10%' in the description to know that this account is for 10% input tax click on '

Control data' tab and

![clip_image027_thumb[2] clip_image027_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhZpUWrfjQSgkstv60pkRuC2jCWFcpE-Cy1iODbQL_p_JjYvemIYaVPhyphenhyphenQCeKVPflYogTNNS7Ec882feBWsDc-22289TuR481unSvnlHzHGXvgMIJHpen-mi1-MKL2KKZ3MBP04kdlxLdY/?imgmax=800)

Make the changes as shown below. Select

'Posting without tax allowed' and enter the tax code '11' in the

'Tax Category' Field.

![clip_image028_thumb[1] clip_image028_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjiyh6lbAgeMJDFOUvgHP4UENmnJh2veH1YisemnbbRZ1xkJoUKbbxFZ0gzJFbrXQ6gQnKYMZioPN-2x3FY8wEDvK-If-Mg5odJYVktcyfbY-y3_6mL5En8ZLMXQfb-Bjd75cteVlc620/?imgmax=800)

Now save and see that there are no Errors. If there are no errors then GO

FS00 and make a same tax account for output tax of 10%. We know that in previous step we had created an output tax code -10 for 10% output tax. So, similarly assign the 10% output tax code to an output tax account in the GL. After you save the output tax account, it must look similar like below.

![clip_image029_thumb[3] clip_image029_thumb[3]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEig2-mU6pTWY8Y0sbZlJQWMc3XLnmJIILbl0VIMQ81uNYsMlsUY5aZ4de7Mx-h5zP0NVVGnippYokFqh95EbwkoIcQXbllkxaXDSAHr5c-r00mCQxfc_yoYAkB0sSVYM-XAkWD7rvU1qh4/?imgmax=800)

(If you see the above pic clearly, I didn't select

'Posting without tax allowed'.. And I wontedly did that for output tax account to see what could happen, will there be an error? Or whether the tax amount will change and how this effects? TO learn that I didn't select it)

Now, as we had tax accounts assigned to the needed 10% tax codes(input and output) lets create the vendor invoice where we left off in practise. Goto

SAP easy Access menu - Accounting - Financial Accounting - Accounts Payable - Document entry - Invoice

Enter the following info

| Field name | Values |

| Basic data | |

| Vendor | Vendor## |

| Invoice date | Current date |

| Reference | A## |

| Posting date | Current date |

| Document type | Authorized expenses##(If you can't see the document type ready for input then click on 'editing options' and select 'Entry with short name' in the dropdown list |

| Amount | 110000 |

| Currency | Company code currency |

| Caluclate tax | Tick |

| Tax code | 11(input tax - 10%) |

| In Items | |

| GL Account | AE02## |

| D/C | Debit |

| Amount in doc. Curr | 110000 |

| Tax code | 11 |

| Text | Conference ## |

| Profit centre | PR## ( in our configuration Profit centre is PGEM as practised in the previous chapter and not PR##) |

![clip_image030_thumb[2] clip_image030_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhZUoWgKudU2QLHZ80xFVv2QfU9YARyAzkir_Qe4Dlm1w0HEpkXHj7OMjNhYj7DEaQzoDMW3_aXtRUiHL9_SX1zm5Y6E0mSVXBx9xznXg2oVtwvO_30-MZaMr1O4Z8drG1PPgDKfhllUPs/?imgmax=800) Document -> simulate

Document -> simulate

![clip_image031_thumb[2] clip_image031_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjnZRRgIpDf-jxZynIDDtW8LSKQCWsFR2QW16GvXGrZ_guzpCGHiCHaQaywVNCWrWl1aDVDcpV7G2Cz8HT_1p-y_rUYh0T0lQ4WdGxZN6gRjvh6Vep1NDy7WOxIzsBXaPE9NT6tbC-UTPI/?imgmax=800)

YAHoooOOOO!! We did Something which is not there in SAP Configuration guide. And tax issues are normally dealt in real-time issues but we made IT!!

Now, lets finish the invoice posting!!To finish the posting there from the above screen, click on 'Complete' button(4th from left) and then u must see that document is saved status as shown below.

![clip_image032_thumb[1] clip_image032_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgCaUxsJbc86x2CoY8ihNbfLAKsVYCMJAR01bsF2QdzDJyihEEcvDfdR-tYbUlX55-HkqvmR-WvVcIvBHWptdrWKRIYod5Ey51qAK3D7-Sc1KaQI1hppHJrMYydEa6tZEGzrumIzid-KTw/?imgmax=800)

Oh-shit!! I parked it(status is saying I parked it), now we must retrieve it and post it. OK, double-work !!

Goto

FBV0 and a screen appears asking the parked document details as shown below

![clip_image033_thumb[3] clip_image033_thumb[3]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhpP7F4SU5d70GWiyblsVCFn-sIhBo3-YOVWnwMIihRgf0jismD0GsrBrFSXMnhkGsqX6DIzl7rI4ZfawX8gtdg9K9vLPKsiBwZeGPStK0psKMoN-os9TGPzEC1ap20vdsqjS5Z3uNZlNk/?imgmax=800)

We, know what document number is as it was there in the status when document got parked. Press Enter and You will land in a normal invoice-entry screen to make any more changes to the parked document. Like amount, tax code etc.. But here we won't do any of such changes and it will be similar to screen showed below

![clip_image034_thumb[2] clip_image034_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiof3Rnpehihl0gvaCMIpWtgHcgmghJOEHwwt73jHDmHnsmrx-QwS9rH0dJrB0hJvSv1m8K4eMuWGNABtLPXjAt59ZoRnfKDoIISMKQa8u-xjdLDALGxiRDCBQOzHOB9suDGjdA2HPamk4/?imgmax=800)

And here, click shift + F11 or click

'POST' button 2nd from left as shown in screen above. It will take small amount of time and document number will be generated as shown in the pic below.

![clip_image035_thumb[2] clip_image035_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhEB7OnVbCoU8JPVm5NAqjCwW6hyphenhyphenXQE06vOT4FJeHjX6GLt98puTNEZeoHhHIl2_9gxM-lAI7CH2j_MBYlt1-YuhMS-3PfJ-HWlf1bg6kS7lwRIFCVBfsiBn2RJoU3QlHqAnHHSM4E7i00/?imgmax=800)

Congratz for posting first vendor Invoice !!!!

Please note that PARKED DOCUMENT WILL NOT BE POSTED, if:

1. Debit and Credit totals are not tallied.

2. Your Controlling is activated, but you have not given real CO Object for expenses accounts. (where you have created cost elements)

3. Not filled some of the mandatory fields.

From http://scn.sap.com/thread/1217180>

Know the Difference of FBV0, FV60 and FV70 transaction codes..

--____--____--____-ϦΓƸẪĶ-____--____--____

Configuration for Tax Code steps are

1. Maintain the Tax Procedure OBQ1

2. Maintain the Tax Processing in Accounting OBCN

3.Change View of procedure & go to control OBQ3

4. Maintain the Tax Code FTXP

5. Changing in GL Master for assign TAX Code FS00

6. GL assign to Maintain Configuration for automatic posting OB40

7. Make your posting with Tax Code.

So, TASK -1 (B) finished .

TASK- 2(b) Another Vendor Invoice

While at a conference, the Accounting Manager took clients out to dinner. Post an additional invoice for 330,000 units of local currency to the 'Entertainment Expense Account' AE01##, using the same criteria as in the previous task.

Record the new document number by repeating the same steps to post this new transaction. Let us look at the entries we made previously and change the input as per the specs in this task.

| Field name | Values |

| Basic data | |

| Vendor | Vendor## |

| Invoice date | Current date |

| Reference | A## |

| Posting date | Current date |

| Document type | Authorized expenses##(If you can't see the document type ready for input then click on 'editing options' and select Entertainment Expense Account AE01##' in the dropdown list |

| Amount | 330000 |

| Currency | Company code currency |

| Caluclate tax | Tick |

| Tax code | 11(input tax - 10%) |

| Line Items | |

| GL Account | AE01## |

| D/C | Debit |

| Amount in doc. Curr | 330000 |

| Tax code | 11 |

| Text | Conference- Dinner## |

| Profit centre | PR## ( in our configuration Profit centre is PGEM as practised in the previous chapter and not PR##) |

So again goto

SAP easy Access menu - Accounting - Financial Accounting - Accounts Payable - Document entry - Invoice

Fill the details as given in below pic!!

![clip_image036_thumb[2] clip_image036_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgpizszowFM9x1tFntlPc1U8K_CAwNVWVFpxpm1lWp9_MVrY8uPRvR7ycZ9ykd2tQmi3QM0tAg1qFAQMM_z7vMpccnP5FEvFquxh2IHGjUGYNOMDSeU4uhX1bVHscWbpROVB6Gap9zOL74/?imgmax=800)

After

clicking Document -> Simulate

Check the data and then save(ctrl + S) to get the document number.

![clip_image037_thumb[1] clip_image037_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgiB0lYEA7iskcDyyAgVfcD7sAjQxCchNjiQEmuXXOf2ES6todUhXuoRGMhvIGDEl3l5urTh6n7Nj4S1VcgVdPXdoKVZPckdhdL78idHMUCsZfEAJaevrtxANJyrqsN_rVK7VV8CXaudfo/?imgmax=800) Task -3(a) Customer Invoice:

Task -3(a) Customer Invoice:

Post Customer invoice for 220,000 units of local currency to you customer account. Choose the 'Calculate tax' options and use the tax code - 10% output tax. Post to the revenue account 800200. Make note of the document number.

Goto

SAP easy Access menu - Accounting - Financial Accounting - Accounts payable - Document Entry - Invoice

If prompted to enter a company code - Choose

'GEM' and then press 'Enter'

I was unable to get to know the customers defined for GEM so I looked all the available customers for GEM and found RUBY ITALY which we had created in previous chapter. And so we will be using Ruby Italy.

![clip_image038_thumb[2] clip_image038_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjgyYcpHSo-Ij13PgERhg5uA-iJmd1u1Ros6Ogon9Iykm4UyMvbTrmEbbIqwUHC5lP7ZmLNf7Go01XduKAs_UDua0tsHeQYhP6qAU7VI7Rm08iNoI72QBr4ODIygMBfXBgGJMoUcvkkzmY/?imgmax=800)

| Field name | Values |

| Basic data | |

| Customer | Ruby Italy |

| Invoice date | Current date |

| Reference | There is no reference for this customer |

| Posting date | Current date |

| Document type | **It will select automatically** |

| Amount | 220000 |

| Currency | Company code currency |

| Caluclate tax | Tick |

| Tax code | 10(output tax - 10%) |

| In Items | |

| GL Account | 800200 |

| D/C | Credit |

| Amount in doc. Curr | 220000 |

| Tax code | 10 |

| Text | First Order by Ruby Italy |

| Profit centre | PR## ( in our configuration Profit centre is PGEM as practised in the previous chapter and not PR##) |

![clip_image039_thumb[2] clip_image039_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEia5LVlazVVgjHwNOjN-rDrAr69KDNEDZG2xgV7obCTwuzHabvptQNycQCtg7_8wumk374u3V39Y9LuAWaSuck2GaI9Gt8WgKrCJOPNtRRdvm_7Vi9RhbDbrCojmhTnYup4c7qdPp7rpHo/?imgmax=800)

When I pressed Document -> Simulate , I got an error (Message-F5118) as shown below!!

![clip_image040_thumb[1] clip_image040_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgV6gYwjss-i2d2JZ8X-HGznGD_J8z_-qyebewnjQpF2k7qL6W_9-j2cf50cTyWxsJ1zyafs0rWoyedlKOiWYK96Ez7iUoBFJR-UtHA24lTpnCs9ysNVdApSg29We8Iewpl2ubmTptknDI/?imgmax=800)

And so, I should look back at this output tax-10% tax code and look at the account under this tax-code!!

GOTO

FS00 and when I checked the output tax account for 10% tax. I found no error in the whole account specifications. Its same as what I did in put tax code.

![clip_image041_thumb[2] clip_image041_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhKOhorWmKgsAEqBZ86TYZ7k6ia7VS3BTR6N8rIM8b3tQKua3vqi62a_UAY_WG0jW1s5CPw07MtisWNL3mj-9uNoPM_xkH9Dne3YBm1ytyl7WHeoutrfD2pKTItUkVImQm0X3kgsEtLScw/?imgmax=800)

So, I went back to

FTXP to look at tax-code-10 (output tax -10%) Properties and found that Tax-Account is not assigned before and so I added 175000 GL account in INT Chart of Account in Tax-Account tab as shown below

![clip_image042_thumb[1] clip_image042_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjDmraf7Jar9vVcMP59itPwpRoKx4qHUe2NkCRCjSbPyqL0AxHQW4AtNgpGvT2sW9mgaSZU0BU7Gr-MRKHEUQaSgwcir2wQhOegUaXlmhiAI0JsJppKbfjPGs543ih51_JafkeZ5zujCjw/?imgmax=800)

And when I came back and

simulated the Customer Invoice screen, VOILA!!

![clip_image043_thumb[2] clip_image043_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiiAgL5MnEmTg0P7ysaxoyedKCEfD1YfvJdNeFBjfENg8fD6wLfZtEa_J5UJhklTPy4ZzWTCGa_JoBOzVJxbac7FO_shASlmuycfDQtS2wEHcB4ysALo2JhINPbBWmou7zAMNAt88Qj8T4/?imgmax=800)

To post the document click 'SAVE' or 'Ctrl+s' to get document being saved confirmation as shown below at bottom of screen.

![clip_image044_thumb[1] clip_image044_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEibQE1MUDFrBWjjxHN9HTwOG8PN1jZVngCEaX-fC2C7Sm933EhdP69Hw7WXaWFd2b7AdwR4z8rcq8MVMgRbAiTxLy26tuLj43HTrYN31Wiv43ZHtP0tw1dXaXom6wCFvbT0trLvc7Tq07k/?imgmax=800) TASK -3(b) Customer Credit Memo

TASK -3(b) Customer Credit Memo

Post a customer credit memo for 5,500 units of local currency o the customer account we created earlier. Use tax code-10(output tax 10%) and revenue account 800200

Goto

SAP Easy Access Menu -> Accounting -> Financial Accounting -> Accounts Receivable -> Document Entry -> Credit Memo

Here, Enter the following details

| Field name | Values |

| Basic data | |

| Customer | Ruby Italy |

| Invoice date | Current date |

| Reference | No reference for this customer |

| Posting date | Current date |

| Document type | ** It creates automatically** |

| Amount | 5500 |

| Currency | Company code currency |

| Caluclate tax | Tick |

| Tax code | 10(output tax - 10%) |

| In Items | |

| GL Account | 800200 |

| D/C | Debit |

| Amount in doc. Curr | 5500 |

| Tax code | 10 |

| Text | First credit memo to ruby italy |

| Profit centre | PR## ( in our configuration Profit centre is PGEM as practised in the previous chapter and not PR##) |

As shown below

![clip_image045_thumb[2] clip_image045_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh_4OehRdQce3zLXKf6_QGpZ9sCeH1hj287KQWzp4aRi56l1mxLL-oU65XyedHfIo8iJCLqKtlaCCWcS4nKVXQtf5uJ5z1n3eg_ZCZdzNdHmMNaYkP5pH6q9n2msJGU5FcMjjlqx5wUkBg/?imgmax=800)

Now click

Document -> Simulate

![clip_image046_thumb[2] clip_image046_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhi88-99srCCTSKAlHEWQJdceur0oNl_YadDEzRx5JKa1jUI3lnIt4ACC81Ayh6BvVXDnVLfDHBSIswEXYuYdfMADmZniuG7vbeNHmd13h2KA-zyAlMJP-b5U_srpYHY3A3vucbVCx5BNI/?imgmax=800)

And then to save click 'Ctrl + s' to get document number after being saved at bottom of screen as below

![clip_image047_thumb[1] clip_image047_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhzgzjUzVjpEQ7VYSUn6gdcAj2ukGs8cfygsdMCwuN1fr_mx6gJ_HuVtReQ2pfTGBweM7YjN9hmAR-1NLwSULMSwX0yKKN55MwgLH9jmGg75SnkFkEAWxkVL1-Y5_bY0b_NzukR3RGwT18/?imgmax=800) TASK -4: List of postings made

TASK -4: List of postings made

Now lets get the display of customer's and Vendor's line items to check the postings we have made till now

Goto

SAP EASY Access Menu -> Accounting - Financial Accounting - Accounts receivables (or) Accounts Payables -> Account - Display/Change Line items

| Field name | Values |

| Customer (or) Vendor Account | Enter Customer (or) Vendor Number |

| Company code | GEM |

In

Display/Change Line Items in

Accounts Payable, it will ask the vendor and so I entered

VENDOR## as shown below and then click

EXECUTE

![clip_image048_thumb[1] clip_image048_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgMFIrwfy-J70kJxrUo9Cs6WOvXqKl1GJNwdHckOsREujsQAODetKaCGuZA5L-NCdViWMFTogJ6NjWFsWgy-9r-P_vt5yU74Nv3HIaxE1k62itkhZxhev2eyTnKw-KHwkr6WbsfrG0QOAo/?imgmax=800)

Then the complete transaction list for this vendor will be displayed as below

![clip_image049_thumb[2] clip_image049_thumb[2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhtqGJMfu7p4PN4gkJxq7dy1kpQLsrT2n3kOEcOmbeegDCGW20n1GNYO0j0WR8nAqBhaFZQZrTCASgWMKhy1yLyo3fiYDmH75tXgubg5nSjmpySyXIPT0Qtuz0-wNFYJRr51YNy_aFh-Ws/?imgmax=800)

Here, it is clear that we made 2 transactions for amounts

110,000 EUR and 330,000 EUR respectively along with total balance below.

Now, let us check the Customer side

Display/Change Line Items in

Accounts Receivables of

Easy Access menu

![clip_image050_thumb[1] clip_image050_thumb[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhF2UmO1_U75MQpj9gmB2eZcLmkeEui_oGDRhv8r8A9hW4W0ZzcoZ5nn4gES9w9o4_4pM2U-bTBwdKBqUvL_RiM1ego4N6FqzIXLEg4RdUjSneJnvaXzeASMjEzfsVt9wwRfUDVLJU4HhI/?imgmax=800)

Here, 2 line items are displayed as per the transactions we did before. As we had done a credit memo of 550 EUR in one transaction, the outstanding amount is subtraction of the two transactions as shown above.

By This UNIT, you must know

- Classifying and displaying accounting Documents

- Open and Closing Posting Periods

- Open and close posting periods for different account types

- Limitation on the amounts that can be posted and 'not posted' with and without allowance of Accounting clerks

- Assigning users to higher amount tolerance groups

- Post simple documents

As We completed introduction to posting, SAP CONSULTANT must

know two things

- What is all this for in CO? so, I will give out a brief

introduction in CO module and its internal components in next chapter to give complete perspective on why CO

is important and how can it create a smooth Business Management???How FI module

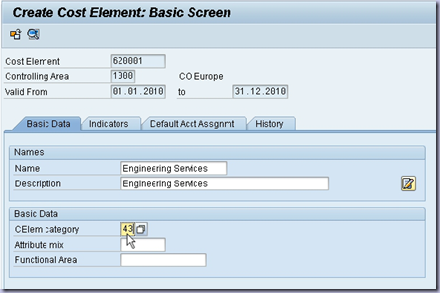

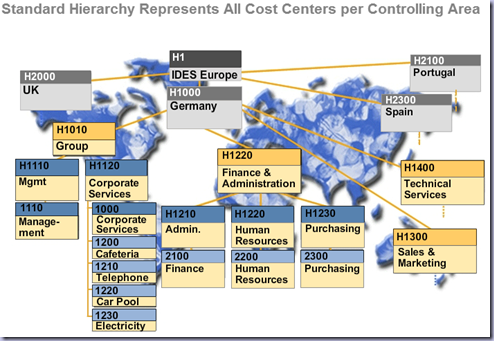

aids on functioning of CO module??.